From blockchain to Robotic Process Automation, banks are trying to keep up with the fintech disruption, adopting in many cases their technologies and the way they approach their users. Let’s take a look at the future trends in banking and financial services industry.

Like many other service industries, it’s very important to understand how consumers behave. Data will likely be one of the biggest future banking trends. As consumers become more connected through the internet and consume content so quickly, they’re becoming less loyal to brands and harder to satisfy. According to an EMC study, there will be 20 times more useable data than today by 2020, meaning financial institutions will only gain more opportunity to fully understand their consumers. With financial institutions gaining more understanding for their consumers, technology in the banking sector will continue to grow as they meet the needs of the consumer.

It’s important to understand the future trends in banking technology as the industry is constantly shaped by it. Be sure to keep a look out for these emerging trends in banking as they continue to impact the industry.

Blockchain Integration

Blockchain technology, first used in the cryptocurrency Bitcoin, is a distributed database that can keep track of transactions in a verifiable and permanent way. The Harvard Business Review predicts that blockchain will disrupt banks the way the internet disrupted media. Blockchains are transparent, highly secure, and are relatively cheap to operate. As more financial institutions realize how blockchain can improve security, save money, and improve customer satisfaction, more will adopt the technology.

Furthermore, blockchain is undoubtedly going to be the spine of the sharing economy. It is one of the most prominent technologies that instill security and accountability in the product and service delivery landscape. The technology scrutinizes transactions in a cost-effective, decentralized, and verified manner. It reduces dependency and supports proper book-keeping. Blockchain is one of the financial services technology trends that will underpin the two most important pillars of the industry, i.e., transparency and trust.

Blockchain acts as a decentralized database and helps in protecting customers’ personal and financial data by storing all the information about real-time payments & profile details on multiple blockchain servers. This resolves issues like fraud detection and cyberattack prevention. The need for third parties will be removed in the loans and credit system using blockchain making it more secure to borrow money and reduce interest rates.

Blockchain is the leading headline for digital banking trends. In 2015, 13 blockchain & bitcoin companies obtained more than $365 million in funding. Last year, there was a tremendous demand for cryptocurrencies, reaching over $300 billion in total value. Analysts believe that banks may potentially treat cryptocurrencies and other digital assets similar to traditional fiat currencies, meaning the world may begin to see new banking technologies innovations arise.

Artificial Intelligence (AI)

Over the years, AI has become an integral part of banking services. AI along with Machine learning is vital for fraud detection. The software that banks use for fraud detection generates alerts whenever there’s a potential fraudulent transaction.

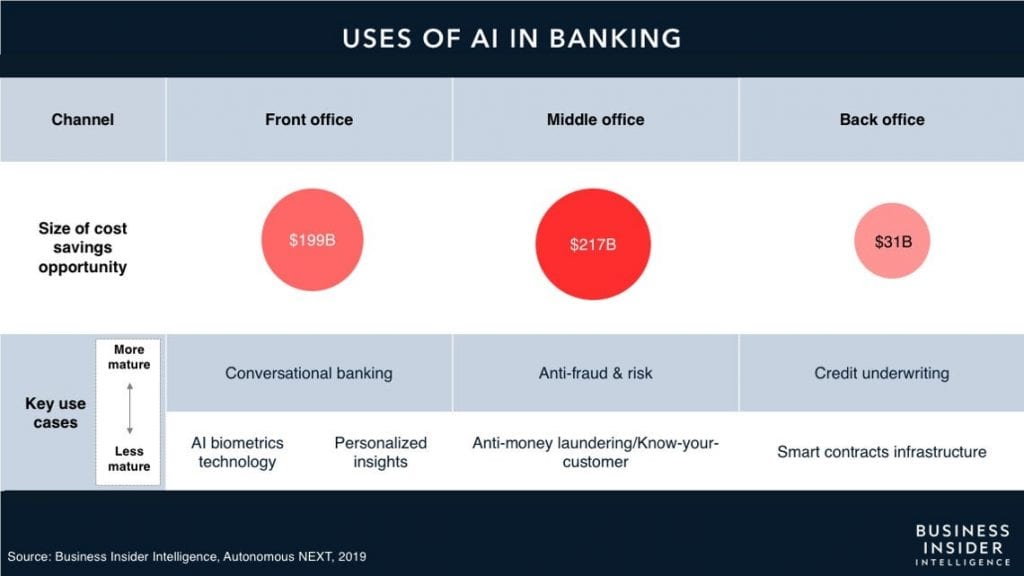

Banks have benefited enormously by adopting newer technologies like AI resulting in lower costs and more revenue through multiple channels. A report from Business Insider Intelligence says the average estimated cost savings for banks using AI will be $447 billion by 2023.

It is mainly used to streamline customer experiences with robots and chatbots. One common example is using AI to facilitate mobile banking enabling customers to get 24/7 access for any banking operations. Although banking and financial services tend to be slower to adopt new technologies, a PricewaterhouseCooper study confirms the majority of financial services decision-makers are investing in artificial intelligence (AI)—52 percent of executives confirmed they are making “substantial” investments in AI while 72 percent believe it will be a business advantage.

AI also helps financial institutions to make more effective lending decisions and better risk management. This technology work along with other trends like big data analytics, voice interfaces, RPA, etc.

AI is also instrumental in the way financial institutions enhance security and prevent and detect fraud. The technology helps financial institutions with risk management and lending decisions and is foundational in making other technology such as big data analytics, robotic process automation, and voice interfaces work.

Big Data

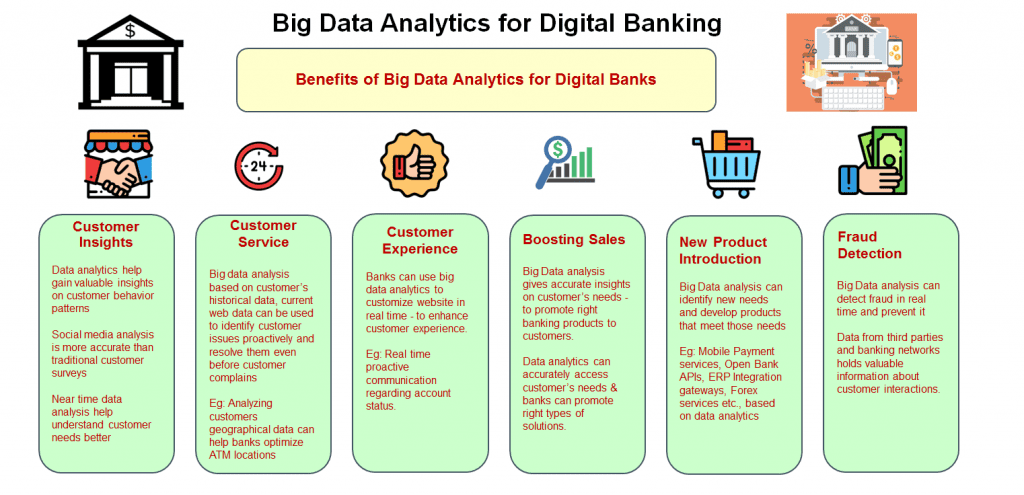

One of the ways to determine a technology’s influence on an industry is to look at how an industry is investing in it. The banking sector is currently one of the top investors by industry in big data and business analytics solutions according to the IDC Semiannual Big Data and Analytics Spending Guide.

The amount of data generated by the financial industry—credit card transactions, ATM withdrawals, credit scores—is mind-boggling. And being able to put that data to use to make business decisions and process it effectively to glean actionable insights will be critical to staying competitive in the future.With the increasing amount of data generated every day by the banking sector, it is becoming difficult to extract actionable insights that can help in growing more opportunities. This technology has undoubtedly put all the banking data i.e. debit/credit card transactions, ATM withdrawals, money transfer, etc. to make informed decisions and process it effectively to gain valuable information that is needed to stay competitive in the future.

Big Data helps in making banks learn about their customers in a better way enabling them to make real-time business decisions through analysis of customer’s purchase habits, sales management, etc. Other added benefits of big data are better marketing, product cross-selling, fraud detection, customer feedback analysis and many more. Additionally, it aids in identifying the latest market trends and streamlining internal processes to reduce risks.

Robotic Process Automation (RPA)

Using RPA, the bank can use customer service bots to deal with low-priority questions from customers like account balance check, payment queries, etc. and save the time of human agents to deal with high-priority concerns. This will not only improve productivity but reduce labor/operational costs and the error rate. With instant resolution through RPA, users can make a quick decision for their credit card application without getting any human agents involved in the process.

Though robotic innovations are still in the adolescent phase, banking organizations should be aware of all the benefits it offers to maintain long-term AI results. Leverage RPA technology to deliver the best possible customer experience in the banking world through robots and virtual assistants. Automate your repetitive tasks without human intervention and save costs efficiently.

Cloud banking

Cloud banking is the future technology that banks & Finance Institution would like to adopt. This is mainly because of the fact that banks want to reduce costs and offer better product & service offerings across the retail & corporate banking segments.

Faster-to-market with new product launches will be key differentiating factor in the cloud banking space, with the help of API’s integration, which can be easily integrated with another ecosystem or fintech company in quick time. Enterprise level support will be the key differentiating factor in cloud banking, as data across the group level can be integrated and offered as services to its customer.

According to the IT road map, banks can decide the products and data, which need to be on cloud and premise and deploy the solution accordingly. Moreover, banks can decide the storage of data in public, private cloud or hybrid cloud as per the business decision.

This can further help banks meet the regulatory and compliance framework levied by the central bank / regulatory authorities. Like GDPR in European countries or CCPA regulation in California State, US, banks need to adhere to specific regulations and store data accordingly in the respective geo locations.

Business Process as service (BPaas)

Bank & FIs would like to leverage technology and pay only for services offered by the product / software vendors. This will be the emerging trend in coming days. Going forward, banks will reap the following benefits with BPaas.

· Reduces software license and product cost

· Reduces cost of operation in maintenance of data center

· Pay for service offered by the product / software vendors, based on the transaction volume or user-based licenses as per the agreements

· Bank can go live to any geography with pre-configured products offered by the vendor to start with

· Meeting regulatory and compliance standards, based on central bank regulations.

Cyber Security

The banking and financial sector has been under tremendous pressure with financial data breaches / crimes in the course of many years. Cyber security plays a key role, as banks offer a majority of their services via Omnichannel platforms and transaction processing via different payment networks across the globe.

Banks expect to have an endpoint security solution to overcome data breaches over external networks / payment gateways. This will ensure that financial data is not tampered with malicious code / data breaches as part of transaction processing.

For commercial banks, there are innovative technologies developed on cyber security such as multi-factor authentication and virtual reality with the help of facial recognition. Apart from such measures, bank implement firewalls and anti-malware applications to prevent data breaches.

With help of AI / ML (Artificial Intelligence / Machine Learning) technology solutions banks can perform security and system audit to identify suspected / fraudulent transactions. AI / ML will help banks to analyze the weakness area in the existing application and build more security.

Instant Payments

Instant payment is the new emerging trend in the payment space for banks and FIs. This trend will help the customer to leverage technology and process the payment instantly without compromising on transaction security.

Banks and market participants will have a level playing field with more integration towards third party Fintech / Regtech companies to offer instant payment service and meet the regulatory standards of the central bank.

The Euro Retail Payments Board (ERPB) proposed that at least one common-European solution for instant payments in Euro should be available to all payment service providers in the EU. This decision was taken by ERPB in 2014.

Banking and financial institutions in the US operate the RTP (Real Time Payment) system, which is widely used for real time settlement among themselves. The US Clearing House is working with key payment service providers, banker’s banks, and corporate credit unions to ensure that every financial institution in the US will have the option to access the RTP network by 2020.

Hyper-Personalization

Processing, storing, and generating insights from consumer data will be even more critical banking trend in the near future. Thanks to artificial intelligence (AI) and big data, FinTech companies can rely on processed data to attract and retain new customers by personalizing their offerings.

According to a recent report, 94% of banking firms could not fulfill the “personalization promise” in 2018. Meanwhile, 64% of SMEs are interested in personalized money management advice for cash flow, invoicing, and financial planning that will allow them to improve their business decision-making process.

Whether it is insurance, wealth management, payments, or lending, banks can leverage AI and big data to generate customized financial services to fulfill otherwise unmet needs. AI-based workflows can discover new client groups, streamline risk management, and drastically cut down compliance costs.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.