There is a list of global financial innovation spots around the world. And Gibraltar, the small, less than 7000 m2, rock between Spain, Europe and Africa, is one of them. With a population of just 32,000 people, this British Overseas Territory has been leading in some areas of financial regulation and innovation, especially when it comes to blockchain and e-commerce. The famous Rock of Gibraltar, a 426m-high limestone ridge has in fact been a financial and Fintech innovation hub for some time now. Gibraltar has taken a lead in the area of e-commerce and fintech innovation, including the areas of blockchain (see more about blockchain with Simon Pearson) and distributed ledger technology (DLT).

Gibraltar has been positioning as one of the world’s leading jurisdictions in welcoming, regulating and fostering fintech businesses. Having established a world-first in regulating the use of direct ledger technology for the transfer of value, Gibraltar has attracted expertise, entrepreneurs and world-leading businesses to its shores.

Chief Minister of Gibraltar Fabian Picardo said in March 2018 that “Gibraltar has positioned itself as an innovative and forward-looking jurisdiction,” while declaring that the British territory was “open for business” to the world of fintech. Indeed, the context is encouraging: a friendly Financial regulation, an open and active government in financial affairs and an attractive tax regime for individuals and businesses. All these factors have led this small headland “to take a lead in the area of fintech innovation” worldwide.

In fact, FinTech services are the major industry of Gibraltar. As a glimpse, e-commerce alone –there is a strong presence of cross-border financial services and e-gaming– employs thousands of people (in a population of only 35,000) and is estimated to constitute over 20% of the gross domestic product, with specific regulations in place since 1989.

On the other hand, there are many other types of financial entities in Gibraltar, including:

· Investment firms, including dealers and principal traders.

· Collective investment schemes.

· Professional fund directors.

· Fund managers.

· Stock exchanges.

· E-money firms.

· Payment services.

· Consumer credit firms.

· Credit institutions.

· Insurance and reinsurance companies.

· Insurance intermediaries (life and general).

· Company management firms.

· Accounting firms.

· Bank branches.

· Depositaries.

· Distributed ledger technology (DLT) firms, including cryptocurrency firms.

The government and its financial authorities have been working hard on passing laws and regulations to make all these services to feel safe while, at the same time, creating a healthy business environment.

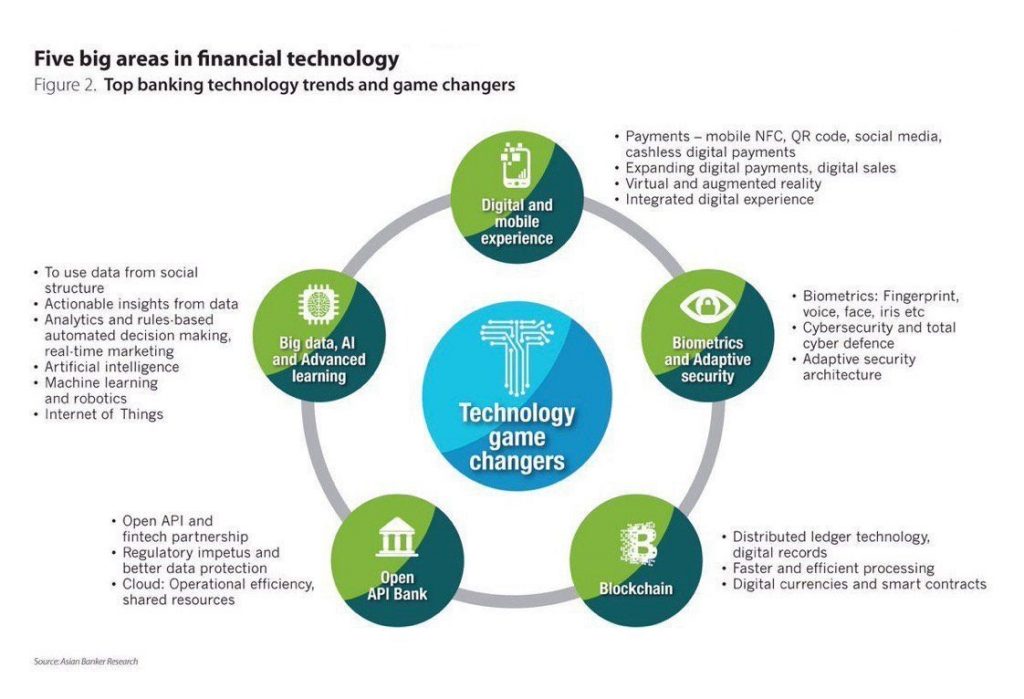

The importance of aligning regulation with the current pace of technology development in financial services is now as critical as it has never been. FinTech is having a major impact on various areas of the financial services sector, and mainly because of the new technological advances that are constantly being made.

This continuous progress is visible in almost every area. For example in the banking sector, where initiatives such as mobile banking are becoming more commonplace. Alternative lending platforms are also enjoying new solutions out of this tech development as well as FinTech is also revolutionising the way in which firms and start-ups can raise funds, for example, through initial coin offerings (ICOs) and token offerings. These are increasingly replacing the more traditional methods of fundraising. E-commerce is rapidly gaining ground against High Street retailers thanks to new digital payments solutions while trading and exchange platforms are scattered throughout the world and open 24/7. Blockchain technology is also impacting several different sectors generally (not just financial services), but its distributed ledger technology is extremely applicable and useful for financial services.

“The Gibraltarian government and the Gibraltar Financial Services Commission have taken a mindful approach to the various fintech sectors – they are supportive of innovation while recognising the need for suitable regulation in many key areas in order to: encourage good operators (that are looking for a suitable regulatory framework); deter bad operators and practices; protect consumers and clients of fintech firms; and mitigate the risks of money laundering and crime,” said FinTech expert Peter Howitt in a recent article.

Even more importantly, the British Oversea Territory is willing to tackle regulation at the cutting edge of technological developments. By doing this, it makes sure that it remains a leading fintech jurisdiction as witnessed by the DLT provider regime. It has also advanced proposals for a new regulatory regime for the promotion and sale of crypto-tokens.

Gibraltar The World’s First Blockchain Regulatory Framework

Gibraltar’s major achievement to date was to become the first territory to regulate blockchain and its uses within financial services, putting themselves one step ahead in the fintech innovation. The Financial Services (Distributed Ledger Technology) Regulations 2017 (DLT Regulations) were implemented in January 2018 in Gibraltar. These regulations amend the Financial Services (Investment and Fiduciary Services) Act to make the storing or transmitting of value belonging to others through DLT a controlled activity that requires authorisation from the GFSC. These are the first regulations of their kind, and they effectively created a new regulated sector.

Boosted by this regulatory framework, 2017 saw a surge in firms applying to the GFSC for DLT licences. These include the likes of trading platforms eToro, Coinfloor, or the oldest crypto trading platform in the U.K., Covesting, among many others. By the law, firms that had been providing distributed ledger technology services before the implementation of the DLT Regulations were required to apply for a DLT Provider’s Licence within three months of the implementation date. After submitting their application, they were allowed to continue providing such services until their case was determined (without breaching the DLT Regulations). “The general consensus among DLT firms was that they preferred to be regulated, as this would establish standards of best practice and add further legitimacy to their own operations (given the nascent stage that this technology is currently at and the scepticism with which it is still sometimes viewed),” was said in a recent Thomson Reuters’ report.

Gibraltar – Financial and DLT innovation – the ‘Token Sale’ Regime

Once DLT offerings were under a regulatory framework, the government of Gibraltar is trying to tie all the loose strings in this complex world. The latest comes with the financial authority currently drafting a new set of regulations (Token Regulations) to cater to the burgeoning ICO market.

The last few years have seen a marked increase in the number of firms raising funds via alternative methods, with ICOs more often being the preferred method of choice. As it stands right now, a token sale is a means by which an organisation can raise funds through crowd financing by issuing and selling tokens. At present, if the token is not a security offering and is essentially a utility token, it is unregulated under Gibraltarian and EU law as it poses a potential risk for the general public.

This risk comes from the very nature of an ICO funding round. When not a security, a token provides the holder or investor with access to a developed product or service. An ICO is a means of early-stage project funding, and as such, subscribers or investors are often investing in a product or service that is yet to be developed.

What the new token sale regime is trying to do is to bring into scope all token sales that fall outside existing financial services regimes so that there are minimum standards in place for the sale of so-called ‘utility tokens’ that are otherwise outside of the scope of the DLT Regulations and existing financial services and securities law. The new regime is likely to require that any token sale be conducted and promoted by a regulated sponsor firm.

“It is… desirable to establish a regulatory regime that mitigates such risks and provides appropriate and adequate safeguards by requiring full and accurate disclosure of information; imposing rules for the orderly and proper conduct of secondary market platforms; and requiring competent professional investment services,” said the government recently.

FinTech brings innovation, but also disruption, and governments need to keep up with those changes to be able to stay at the top of the league and not to lose competitiveness. The government of Gibraltar certainly is well aware of it and has been acting since 1989 to make the small British Oversea Territory become a FinTech superpower.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.