“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change”

Charles Darwin

The 14 September 2018 marks the 10th anniversary of the collapse of Lehman Brothers, which triggered the worst global financial crisis since the 1930s. All over these 10 years, many were the facts that changed the world as we all know now. While some has been well disclosed and sorted, others, however, remain in obscurity and their consequences yet to be seen.

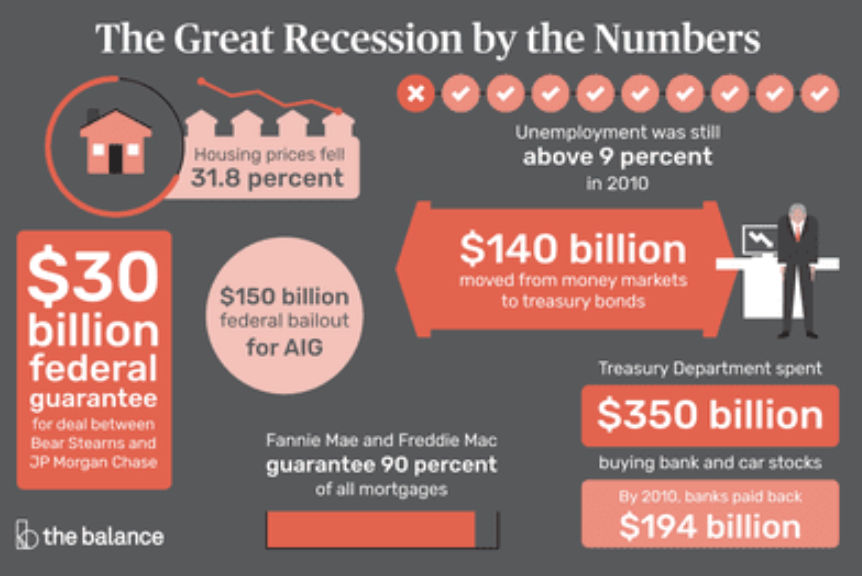

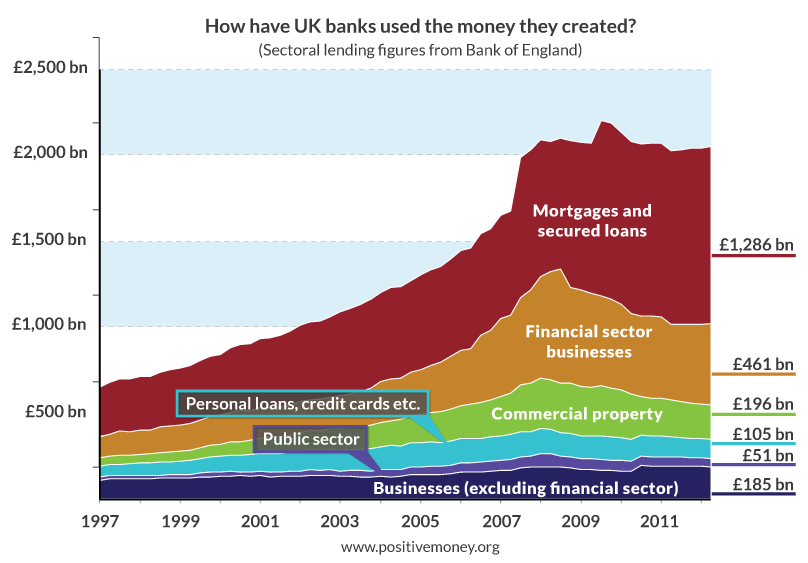

So what did the financial industry learned from this and how can it be avoided going forward something last this? From the issues with crashing the biggest banks in the world to destroying some country economies, the issues with deregulation, to the mortages crash the last 10 years have been of change and disruption.

The last 10 years offered the fintech emergent revolution that ironically is coming mostly outside of the financial world and slowly becoming as big as the financial world. Moreover the last 10 years saw also the emergence of bitcoin and crypto currencies, the so called tokenisation of the economy. But the challenge is how all these innovative new waves will play in new world where most of the world economy is still offline and where 3 billion people are still unbanked.

The keyword critical that came out of this financial crisis was trust, or the lack of it. Trust is the critical element of the issues with the financial industry. Any solution will have to be build with it.

I will try to look at what happened in the last 10 years and what is now coming. To start here is a summary of the story of the Financial Crisis that encompasses the last 10 years:

-

9 August 2007

It all started when BNP Paribas froze three of their funds. Than move indicated that they have no way of valuing the complex assets inside them, which were known as collateralised debt obligations (CDOs), or packages of sub-prime loans. It was the first major bank to acknowledge the risk of exposure to sub-prime mortgage markets. Adam Applegarth, Northern Rock’s chief executive, later said that it was “the day the world changed.”

Larry Elliott, economics editor, said about this that “as far as the financial markets are concerned, August 9 2007 has all the resonance of August 4 1914. It marks the cut-off point between ‘an Edwardian summer’ of prosperity and tranquillity and the trench warfare of the credit crunch – the failed banks, the petrified markets, the property markets blown to pieces by a shortage of credit.”

-

14 September 2007

British bank Northern Rock had already borrowed large sums of money to fund mortgages for customers, and needed to pay off its debt by reselling (or “securitising”) those mortgages in the international capital markets. But, by that time, that demand for securitised mortgages had fallen, and Northern Rock faced a liquidity crisis. Consequently, it ended up requiring a loan from the British government. This sparked fears that the bank would shortly go bankrupt – prompting customers to queue round the block to withdraw their savings. It was the first run on a British bank for 150 years.

-

24 January 2008

A group of analysts announced the largest single-year drop in US home sales in a quarter of a century.

-

17 February 2008

After the failure of two private takeover bids, Alistair Darling saw himself forced to nationalise Northern Rock in what he claimed it would be a temporary measure. It will pass nearly four years before it returns to the private sector.

-

14 March 2008

The investment bank Bear Stearns was bought out by JP Morgan. So far, it will become the biggest casualty of the crisis.

-

6 May 2008

Hank Paulson, US Treasury secretary from 2006 to 2009, in an interview with the Wall Street Journal, confessed: “I do believe that the worst is likely to be behind us.”

-

7 September 2008

The US government bailed out Fannie Mae and Freddie Mac – two huge firms that had guaranteed thousands of sub-prime mortgages.

Lehman Brothers took the stage: Artwork and Ephemera” sale at Christie’s of London in September 2010, on the second anniversary of the investment bank’s bankruptcy.

-

15 September 2008

Heavily exposed to the sub-prime mortgage market, the American bank Lehman Brothers files for bankruptcy, prompting worldwide financial panic.

Dick Fuld, the final chairman and CEO of the bank, was the focus of protesters’ anger when he testified before the US House of Representatives about the effects of the collapse of Lehman Brothers.

-

17 September 2008

The UK’s largest mortgage lenders, HBOS, was rescued by Lloyds TSB after a huge drop in its share price.

-

21 September 2008

US investment banks were pummelled on the stock markets and Goldman Sachs and JP Morgan Chase decided to change their status to banking holding companies, marking the end of the investment banking model dominant during the noughties.

-

25-29 September 2008

Two more American banks collapsed – Washington Mutual and Wachovia.

-

30 September 2008

Shortly after becoming the first European country to slide into recession, Ireland’s government promised to underwrite the entire Irish banking system – a pledge that they were ultimately unable to uphold.

At the same time, President Bush were shaking hands with Treasury Secretary Henry Paulson after Congress passed the $700bn financial bailout bill.

-

October 2008

After days of wrangling in Congress, Hank Paulson pushed through the Troubled Asset Relief Program (Tarp), which at that point bought or insured toxic sub-prime mortgage securities from the major banks.

David Buik, market strategist, and consultant at Cantor Index said: “We might have been critical of Hank Paulson. But with Tarp, he took a decision. And that has to be right. Markets cope very well with good news. They cope even better with bad news. They do not cope with uncertainty.”

-

7-8 October 2008

Iceland’s three biggest commercial banks – Glitnir, Kaupthing, and Landsbanki – collapse. To protect the deposits of their many British customers, Gordon Brown used anti-terror legislation to freeze the assets of the banks’ UK subsidiaries.

-

8 October 2008

Amid the worst ever week for the Dow Jones, eight central banks including the Bank of England, the European Central Bank, and the Federal Reserve cut their interest rates by 0.5% in a coordinated attempt to ease the pressure on borrowers.

-

13 October 2008

To avert the collapse of the UK banking sector, the British government bailed out several banks, including the Royal Bank of Scotland, Lloyds TSB, and HBOS. The deal is thrashed out over the weekend, and well into the small hours of Monday morning.

-

7 November 2008

Figures shown that 240,000 Americans lost their jobs in that last month.

-

12 November 2008

After criticism from high-profile economists, Hank Paulson announceds drastic changes to Tarp. He cancels the acquisition of toxic assets, and decides instead to give banks cash injections.

Charles Ferguson, director of Inside Job, an Oscar-winning documentary about the banking crisis mentioned: “It was totally clear nobody knew what they were doing. Hank Paulson would change his plans and his public statements on approximately a daily basis. It also became clear that they were not going to punish people or change the nature of the system.”

-

14 November 2008

The G20 met for the first time since Lehman’s went under, in a meeting that was compared in significance to the Bretton Woods summit in 1944.

-

10 December 2008

“We not only saved the world …” In a slip of the tongue at PMQs, Gordon Brown revealed how highly he rates his role during the financial crisis. 4 months after LB went down, governments around the world had drawn their plans to fight the crisis.

Retracing the mistakes of the past

Since the crisis, a litany of stakeholders, including governments, regulators and consumers have called for a restoration of trust in the sector. Ten years on, scepticism and doubt still prevails, with only 55 per cent of Britons claiming they trust their banks.

Many critics even argue the need for greater transparency is now more important than ever before. Experts claim innovations such as fintech and blockchain hold the key for improved openness. Thomas Coughlin, CEO of Kinesis Monetary System, a recently launched gold-based stable coin, believes technology holds the key to restoring trust in the financial services sector.

“Ten years on from the credit crisis of 2008, the financial services industry is in critical need of the restoration of trust to avoid the creation of another hype bubble, similar to the one which developed within the housing market in 2008. The crisis led to a chorus of calls from a range of important stakeholders such as governments, regulators and consumers asking for the industry to become more accountable and transparent. Today, innovations in technology are allowing greater levels of accountability than ever before. The advent of blockchain technology, for instance, allows for the creation of digitised, shared and trackable sets of data, allowing not only increased visibility but stored, downloadable ledgers for all stakeholders to see,” he said.

As we look ahead to the next ten years, the important is about trust and creating the stability of the financial and wealth creation industry. This with creating trust and financial technological trust and solutions are pivotal to the next level and sustainable growth of the leading world economies.

The financial industry is also now a fintech powered industry. With the emergence of Blockchain and crypto technology there is a new strong possibility that can provide the trust and transparency to the complex and disruptive financial services sector that needs to ensure complete new visibility of transactions, trustful systems to users and the myriad of stakeholders on a micro-level, broken down to each second of the day.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.