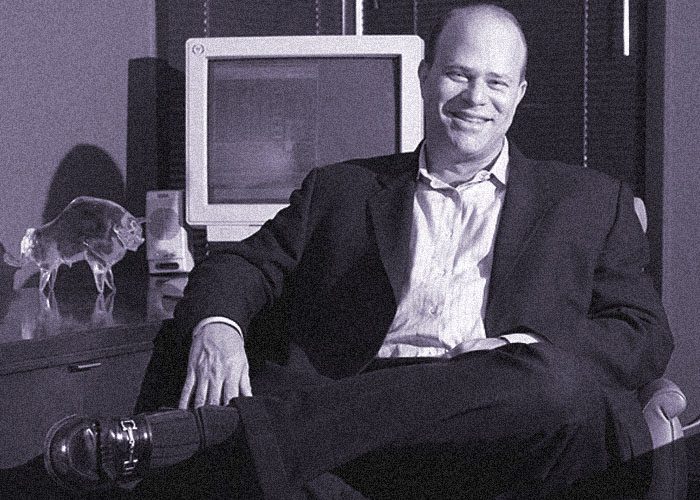

Although he isn’t quite a household name in the same way as George Soros or Ray Dalio might be, there can’t be a single person in the investment industry that doesn’t know who David Tepper is.

As the founder of Appaloosa Management, Tepper has made vast fortunes by investing in ‘distressed’ companies, and in 2012, he was (according to Institutional Investor magazine) the highest-earning hedge fund manager in the world with a $2.2 billion paycheck.

Born in 1957 into a middle-class Jewish family in Pittsburgh, Pennsylvania, Tepper was raised by his accountant father and schoolteacher mother along with his two siblings. After excelling at school, he paid his own way through a bachelor’s degree in economics at the University of Pittsburgh by working in the Frick Fine Arts Library, and graduated with honours.

It was while at university that Tepper made his first forays into trading the markets, with his father giving him his first two investments, which were in Pennsylvania Engineering Co. and Career Academies, the latter of which went bankrupt. Perhaps it was this early experience that led to his interest in making money out of companies that are in trouble – which was to be his hallmark as a trader, and would later make him a fortune.

Upon graduating from Pittsburgh, Tepper went straight off to work in the finance industry, landing a role as a credit analyst in the treasury department of Equibank. However, he soon grew unsatisfied with his position and his hopes of advancement, and left in 1980 to study for an MBA at Carnegie Mellon University. Two years later, with MBA in hand, Tepper went off to work in the treasury department of Republic Steel in Ohio.

From here on in, there was literally no stopping the upwards career trajectory of the talented young financier. In 1984 he landed a role with Keystone Mutual Funds in Boston, and just one year later he was recruited by investment banking giant Goldman Sachs in New York, which was in the process of forming its high yield group.

Starting out as a credit analyst, Tepper’s undoubted talent for dealing in distressed securities saw him promoted to head trader on the high-yield desk within just six months. He stayed there for eight years, racking up huge profits for the bank by focusing on bankruptcies and other special situations, and cementing his reputation as one of the shrewdest traders on Wall Street. By the time he left Goldman in 1992, he was considered to be one of the foremost authorities on the topic of distressed securities, and formed his own hedge fund management firm, Appaloosa Management, in early 1993.

Tepper’s uncanny knack of spotting profit opportunities in securities that the market is running scared from has since proved to be a huge asset to himself and the investors in his fund. Back in 2001, he made a staggering 61% annual profit by focusing on distressed bonds, although he changed tack in 2005 by deciding to focus on stocks in the S&P 500.

In his own words, he generates his remarkably consistent profits by investing in the diciest of companies, such as Mirant, MCI, Conseco and Marconi, keeping the market “on edge”.

While the financial crisis was to prove the undoing of many fund managers, it presented an unprecedented opportunity for a distressed investment vulture like Tepper. In 2009 alone, Tepper’s hedge-fund earned about $7 billion by buying distressed financial stocks in February and March (including Bank of America common stock at $3 per share), and selling them on at a massive profit when those stocks recovered later in the year. That year, Tepper was the highest-earning hedge fund manager according to the New York Times, and this was not to be the last of such accolades, being awarded Institutional Hedge Fund Firm of the Year in 2011 and the top hedge fund earner of 2012 by Forbes magazine.

Outside of the financial markets, Tepper has a keen interest in sport, and coaches his children’s baseball, softball, and soccer teams as well as owning a 5% stake in the Pittsburgh Steelers. He is also actively involved in charity work in the New York and New Jersey area, and donated $55 million to his old alma mater, Carnegie Mellon University, who renamed their business school as the Tepper School of Business in recognition. He later donated a further $67 million to develop the Tepper Quadrangle on the north campus, which will include a new Tepper School of Business facility and a welcome center.

He has also dabbled in politics, forming the political action group “Better Education For Kids” in 2012. The aim of this organisation is to push for more charter schools, the end of teacher ‘tenure’ which is thought by some to be crippling the public school system, and legislation that will allow private companies to take over failing public schools. To this end, he also contributed to the 2013 Jersey City Mayoral campaign of Steve Fulop, who chimes with his views on educational reform.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.