Image: Wikimedia Commons

Top hedge fund managers come in all shapes and forms, but the arrival of quant traders – mathematical geniuses wielding highly advanced computer algorithms to analyse and trade the markets – brought a new, eccentric breed to the party. And the “Quant King” – as Forbes magazine dubbed him – was Jim Simons. In 2006 he was hailed as being the “World’s Smartest Billionaire” by the Financial Times, and is listed, along with his wife Marilyn, as the top billionaire donor in New York. Yet, the secretive nature of Wall Street’s most generous man means that although he is well-known, he remains something of an enigma.

Unlike traders who worked their way through the investment banking system, the quants were coming from an academic background. And, according to Scott Patterson’s book about the group, The Quants, they were a pretty eccentric bunch who all seemed to know one another. Using highly advanced mathematics, they built models of the markets, and developed tools to exploit many previously undreamt-of opportunities.

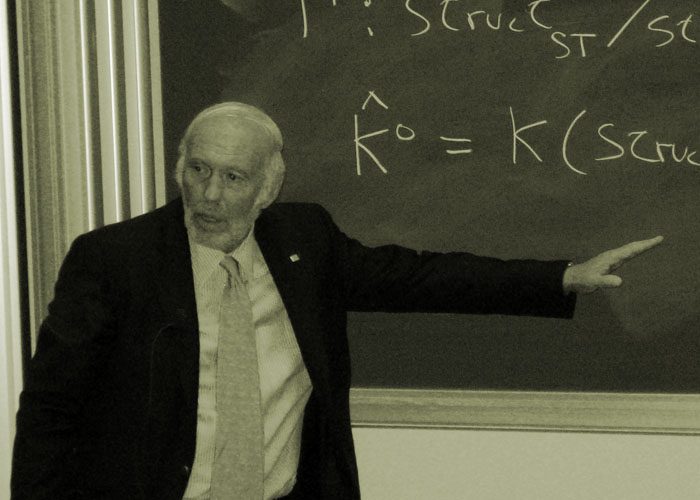

A Mathematical Genius

Jim Simons was one of the leaders of this pack, and like many of his fellow quants, Jim Simons is a mathematician first, and a trader second. Having worked as a codebreaker for the US Defence department in the 1970s, Simon’s genius for pattern recognition was to prove useful indeed when he put it to use on the markets.

Widely considered the father of Financial Signal Processing, Simons founded a “black box” hedge fund, Renaissance Technologies, in New York in 1982. Today, it has over $20 billion under management, and Simons himself is reported to be worth a cool $12.5 billion. He retired as CEO of Renaissance in 2009, although he still has some involvement in it.

Born to a Jewish family in Massachusetts, Simons was a mathematical prodigy who attained a degree in maths from MIT and a Ph.D. in Philosphy and Mathematics from Berkeley. After leaving university, he began to work for the military as a codebreaker, and teach mathematics at MIT and Harvard. Then, in 1968, he became chairman of Stony Brook University’s math department, and did some work for IBM in 1973 on data encryption technology.

He made a major mathematical breakthrough in 1976, winning the American Mathematical Society’s Oswald Veblen Prize in Geometry. His work resulted a revolutionary new geometric form known as Chern-Simons theory, part of the basis of string theory.

His move from academia into the business world came in 1978, which led him to establish a hedge fund management firm trading in commodities and financial instruments. His firm, Renaissance Technologies, used highly computer-based mathematical models to predict price changes in easily-traded financial instruments. These techniques require a huge amount of data to be gathered, and using algorithms to seek out non-random movements from which predictions could be made.

Unlike most hedge fund firms at the time, Renaissance employed people from a range of non-financial backgrounds, including statisticians, mathematicians, physicists, and signal processing experts. The firm’s most famous fund is the exclusive Medallion fund, which only contains personal money from the executives at the firm.

Despite crossing over from academia into business, he retains the respect of his academic peers, including top theoretical physicist Edward Witten, who said: “It’s startling to see such a highly successful mathematician achieve success in another field”. Simons has also earned accolades from within the financial services industry, having been named as the Financial Engineer of the Year by the International Association of Financial Engineers in 2006. In 2005, he was the top-earning hedge fund manager in the world.

A Very Generous Man

Simons has put almost as much effort into giving away his vast wealth as he has into making in the first place. Along with his wife, he founded his own charity the Paul Simons Foundation supporting education, health, and scientific research. He also founded Avalon Park, a nature preserve in Stony Brook, and the Math for America organization.

In 2008, he gave the biggest-ever gift to a public university in history with a $60 million donation to Stony Brook University. After the University Foundation, which is headed up by Simons, lost $5.4 million in Bernard Madoffs Ponzi scheme, Simons donated another $150 million.

He has also been particularly active in autism research, donating hundreds of millions of dollars and leading the organizational effort, and is also a major donor to the Democrats.

Although he has been blessed with great fortune over the years, he and his wife suffered a double tragedy with the death of their sons Paul in a cycling accident and Nick in a car crash. Despite, or perhaps because of, the high level of public interest in him, he has always shunned the limelight, and interviews are rare. In explanation of his secretive nature, he quoted Benjamin the Donkey from George Orwell’s Animal Farm: “”God gave me a tail to keep off the flies. But I’d rather have had no tail and no flies.”

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.