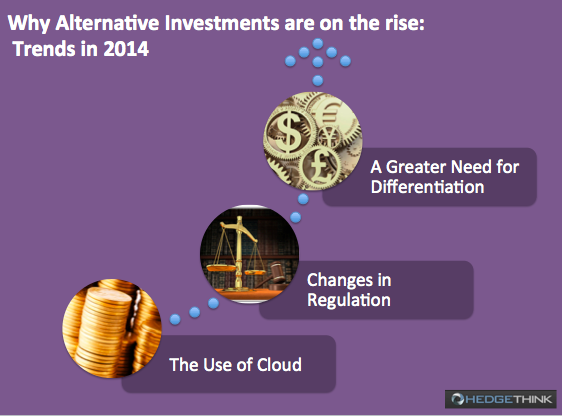

For any hedge fund manager, it is crucial that they ensure the performance of their assets under management (AUM). However, there are times when AUMs underperform. During year-on-year comparisons, there is a chance they may even underperform the S&P 500 index. In case they do, they should seek alternatives. In fact, alternative investments are on the rise. Here is a close look at a few trends in 2014 alternative investments you probably do not know about:

The Use of the Cloud

Cloud computing has changed the IT industry dramatically and the way many businesses operate. With significantly reduced costs of hardware, maintenance and general infrastructure, for most companies, the cloud environment has been embraced with fervour. For alternative investments, a different story envelops due to insufficient security protocols. However, this is changing fast. With rapidly improving framework and security policies, several firms are embracing cloud solutions. They are now enabling investment firms to grow more than ever without limiting activities due to resource bottlenecks. Combined with outsourcing, alternative investments are gaining plenty of ground in the industry.

Changes in Regulations

A vital reason numerous firms have switched to alternative investments is the comparative ambiguity in regulations. While there are plenty of rules and regulations currently in effect which hedge fund managers need to comply with, an increase in operating costs could impact their bottom-line negatively. However, nothing stays the same the Dodd-Frank Bill for example. The Dodd-Frank Bill, and numerous other regulations and acts, have brought in a greater degree of transparency and regulations in finance. While many of its contents are admirable, some regulations and clauses are still ambiguous and thus require refinement. As a result, alternative investments still hold a degree of confusion for managers.

A Greater Need for Differentiation

Contrary to popular belief, differentiation is still a widely-accepted important matter by numerous hedge managers and institutional investors. Choosing a manager for your alternative investments requires in-depth analysis of operational quality, reporting transparencies and their ability to ascertain and manage risk. However, the ability to differentiate a firm through its investments is becoming a growing requirement, particularly in alternative investment firms.

In order to improve their growth, firms require differentiation to act as a post-performance factor. By differentiating themselves from the competition based on more than just performance or strategy, firms can gain greater investments and ensure greater calculations in decisions. This enables them to capitalize on the trends in alternative investments for 2014.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.