Of the five major alternative asset classes – private equity, hedge funds, real estate, infrastructure and private debt – infrastructure is comparatively young and evolving. Though infrastructure assets class constitutes less than 5% of the total $7 trillion alternative assets industry, it is growing fast. Last year infrastructure assets jumped over 20%, crossing $300bn mark. The average size of infrastructure funds closed in 2014 was also higher $1.0bn, compared to $688mn in 2013, reports Preqin, a leading source of data and intelligence for the alternative assets industry. Institutional investors, pension funds in particular, are increasing their exposure to infrastructure for long duration investments with steady cash flow. The industry outlook for 2015 remains positive.

Like other alternative asset classes, the Infrastructure Private Equity firms pull cash from investors. They invest in infrastructure such as roads, bridges, dams, ports, airports, energy, and communications. The projects span from green field development of new projects to brown field development of mature assets matching with growing demand patterns. The assets generate steady and high returns over a long period.

The opportunities for significant progress in coming years exit. Let’s have a look at the some key areas of this fast growing sector.

Emerging as a distinct asset class

Infrastructure assets class is comprised of highly heterogeneous assets, diversified and unrelated to markets. Each subsector has its own lifecycle and distinct performance behaviour. The performance of infrastructure assets is also closely tied to the economic growth of the region and country. So the governments also support privatized infrastructure investment that encourages economic development. They encourage investments by public financial institutions in infrastructure and provide various fiscal incentives. These characteristics differentiate the infrastructure assets class from peers in the alternative investment industry.

Infrastructure assets are very long-term assets that can provide stable income to match liabilities. The revenues are inflation linked. The demands are inelastic. Infrastructure assets provide both growing and defensive revenue streams. They are more transparent as the funds are invested in tangible, visible and understandable assets. Infrastructure has long life cycle and provides relative immunity to the business cycle. It provides reasonable diversification and risk mitigation from market fluctuations. The long duration, steady cash flow and inherent inflation hedge of infrastructure investments hold considerable appeal to pension funds, endowment funds and institutional investors, searching for high yields and inflation protection.

Fund Raising

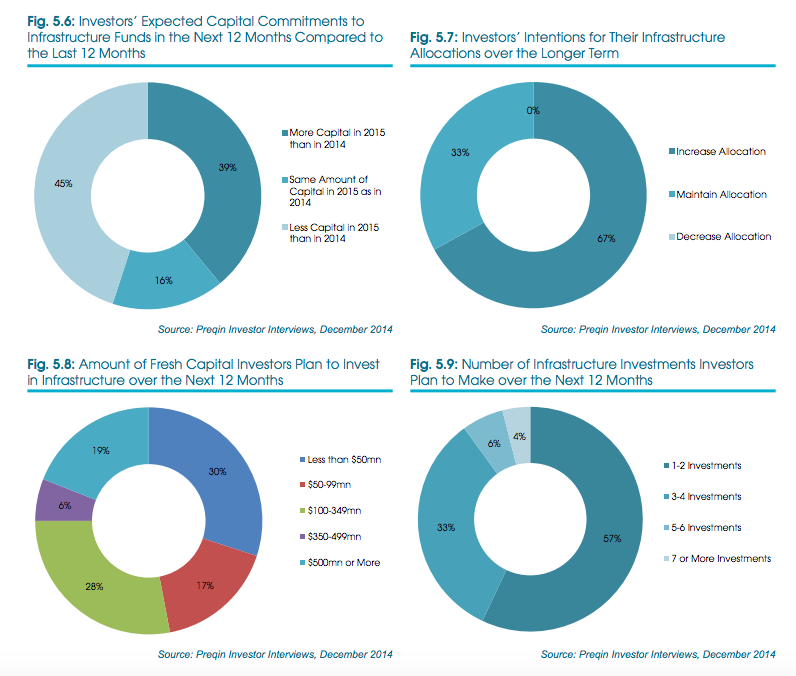

Investors earlier used to consider allocation to Infrastructure as a part of overall allocation to Private Equity portfolio. This pattern is changing. According to a survey conducted by Preqin, majority of infrastructure fund investors now have a completely separate allocation to this asset class.

Source: Preqin Investor Outlook, Infrastructure, H1 2015

Investors prefer fund managers with a proven track record. Flow of capital is likely to be more concentrated towards a few managers in coming years. Small firms may face difficulty in fundraising challenging in 2015.

Source: Preqin Investor Outlook, Infrastructure, H1 2015

Investment Opportunities

Infrastructure continues to grow as an independent alternative asset class. Europe is the preferred destination for infrastructure, followed by North America. But the investable universe is small and funds take a long time to invest. The market is relatively small when compared to other alternatives. Investors are concerned over lack of adequate number of attractive infrastructure investment opportunities and their present pricing. High valuations for infrastructure assets and non-availability of attractive investment opportunities may affect fundraising in short term. The investors may prefer to wait and watch before making fresh commitments.

Regulatory

Unlike other classes of the alternative investment industry, infrastructure is highly regulated. It has high barriers to entry. Social activists and government regulations delay the project implementation. The committed funds remain unutilised for a longer period. Managers need to focus more on compliance.

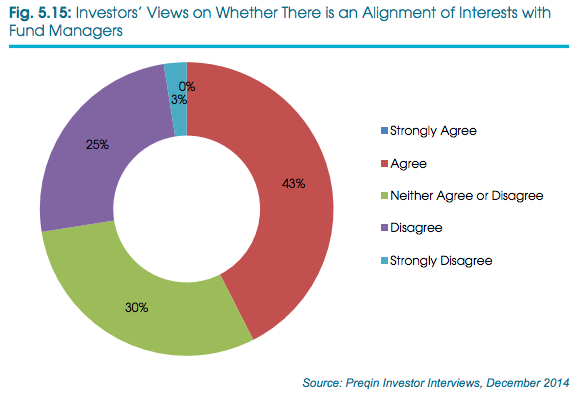

Fees

The investors are also concerned over the high level of the management fees and performance fees charged by Infrastructure Assets Private Equity. No profit should be made out of management fees. Management fees should cover only costs and not be a source of profit.The Industry need to review the performance fees. Alignment of interests between infrastructure fund managers and investors can be improved by redesigning the fee structure.

Operational structure

Investors are looking for alternative structures to pooled funds. Large and Institutional investors prefer Co-Investments and Separate Accounts. This enables them to monitor their investment and have greater control over the direction of their capital.

To conclude, infrastructure is emerging as an Alternative Asset, distinct from other asset classes. Managers are optimistic about its potential for growth. And institutional investors are willing to diversify and provide long term capital provided the attractive opportunities are made available for investment. Managers have to explore and offer such opportunities for maintaining upward trend in 2015.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.