After the financial crisis in 2008, the traditional lenders such as banks had to struggle hard to comply with new guidance from regulators on lending practices. Though demand for debt remained, the banks became conservative to meet the credit demands. This restricted the flow of debt financing from the traditional sources and created opportunities for non-bank lenders. The Alternative Assets Industry saw an opportunity in the gap between the demand for debt and availability of credit from the traditional sources. This resulted emergence of Private Debt as emerging alternative asset class.

Today, private debt has become a greater source of capital to companies. It is a fast growing alternative asset class. This provides an attractive alternative investment asset class for investors. “Private debt funds have generally been providing investors with net returns in excess of 10% per annum on average, with funds with vintage 2009 producing returns of 17% on average,” reports Preqin.

Source: Preqin Investor Outlook, H1 2015

Private debt vehicles include direct lending, mezzanine, distressed debt, special situations, and venture debt funds. Direct lending structure is closer to fixed income investments, whereas mezzanine and distressed debt funds look like more private equity-style methods. Mezzanine and distressed vehicles have been a part of the private equity financing segment since long, direct lending is comparatively new with a conservative risk similar to other fixed income instruments. However demand for different types of Private Debt would continue to diversify the portfolio.

Source: Preqin Investor Outlook: Private Debt

Fund Raising

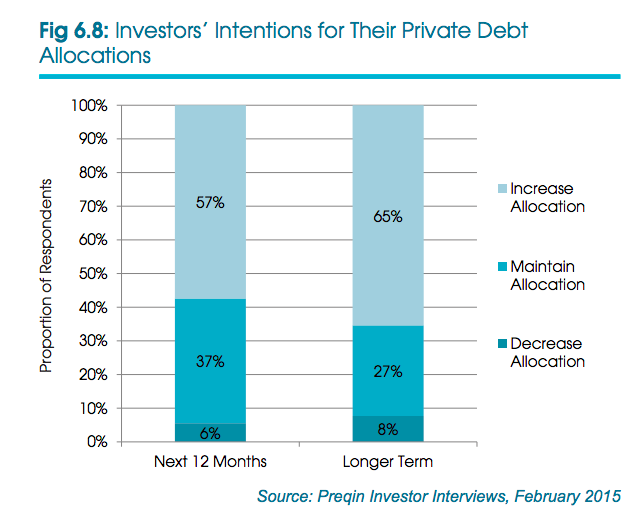

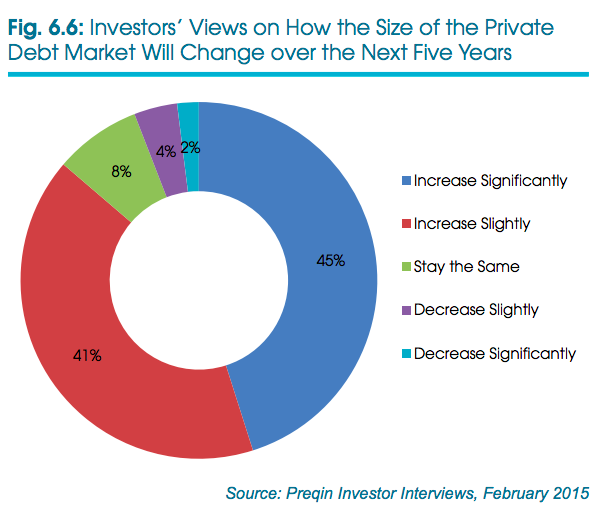

Fundraising for private debt funds has seen high growth since the global financial crisis. The debt funds got a boost by prevailing low interest rates environment and investors search for higher yield. Limited Partners such as pension funds, endowments and other institutional investors are expanding asset classes and have raised proportions of their assets to private debt assets class. At the start of 2015, the fundraising by 193 private debt funds were in progress for $108 billion, an all-time high. The number of private debt funds closed in 2013 was 137, up by 45% from 2012. Thus, investors are increasing their exposure to Private Debt.

Direct lending

Direct lending is preferred by the institutional investors and other conservative investors compared to mezzanine and distressed debt funds. Though presently the number of distressed and mezzanine funds are more compared to direct-lending funds, direct lending funds are likely to soon outnumber them. The capital raised by Direct-lending funds jumped four times in two years to $29 billion in 2014 from $7.1 billion in 2012. Direct Lending is likely to spur further growth in the Private Debt Alternative Asset Class. Institutional investors that invest in the private debt are likely to allocate more fresh capital to direct lending funds in 2015.

Geographic Preferences

According to the survey by Preqin, “Europe is viewed favourably by 69% of investors. This is a consequence of the relative immaturity of the European private debt market compared to North America, coupled with a significant amount of potential deal opportunities as Basel III regulations start to kick in. North America is still viewed by a significant 57% of respondents as presenting attractive opportunities, whereas only 14% of respondents thought Asia presented strong opportunities at present.”

There is increasing activity in the UK, France, Germany and Southern Europe. Non-bank lenders recorded 195 deals in the UK and mainland Europe in 2014, up 43% on the 136 deals for 2013, according to the Alternative Lender Deal Tracker from Deloitte. Banks are also teaming up with alternative lenders to provide more flexible structures to the borrowers.

Investors’ concerns

In a survey the investors have shown concern over large amounts of dry powder, committed but unutilized money. Investment opportunities are limited to deploy the funds raised. Slow recovery of global recovery is affecting the performance of private debt. Second, as private debt segment operates much like a fixed income product and hence the return may not match the high returns generated by other alternative assets. Management fees and performance fees should not be structured like that for private equity or hedge fund.

To conclude, the growth of private debt as an alternative assets class has been remarkable in recent years. Investors are looking for suitable opportunities to invest more. The private debt fundraising market is likely to be at an all-time high. With the improvement in global economy, the private debt industry is expected to meet the investors’ growing expectation in 2015.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.