The housing market has always been a key indicator for how the economy is performing for the average American as owning your own home should rightfully be the aim and dream of any hard working family. Let’s look at 3 key predictions at what trends may be awaiting us as the year progresses and if there is to be any rise or fall in the housing sector.

Interest Rates To Rise In 2019

Predictions seem to be pointing to interest rates rising throughout 2019 and this as we know will almost certainly lead to increased costs of borrowing for consumers and not really a good sign for house sales, we can see how sales fell month on month for a prolonged period during 2018 and if we are looking at the these predictions for inflation and the effect on interest rates then it would not be a stretch to be foreseeing a lower than ideal level of sales for the year. But although the cost of borrowing will be higher due to these interest rate rises how will house prices be affected, will they rise or fall? It’s a tough one to see and the forecasts are rather mixed but it’s entirely possible that prices could fall which could be good news for first time buyers but leave many current home owners in trouble with a loss of equity in their properties.

Smaller Markets May See A Rise

So it seems with the interest rates rising and therefore the cost of borrowing rising and the threat of a price crash on the horizon then it’s all bad news, right? Well yes and no as it depends on where you are and what you are looking at with regards to the market. If borrowing is difficult and less affordable then it stands to reason that people are going to start looking at buying properties in areas that they may not have been interested in before as key markets become out of their reach. This could be particularly good news for developers in certain areas, you can see, for example, how vibrant the new development scene in Iowa is and this is typical of many mid-sized or small markets that are on the increase.

Foreign Property Investment On The Increase

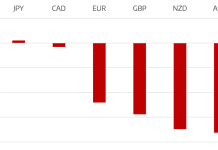

There has been a huge increase of foreign investors in US property, with the rise of the middle class in China that has been a particular consumer base driving this. The Chinese middle class see the US real estate market as a safe investment for their families futures and with the middle class in China set to continue to grow through the next few years this can only mean a hike in prices as more and more properties are taken up and unavailable due to this trend continuing to rise. It is good news in a way as it shows how strong these investors see our housing market but this only works if we can service the demand for housing which would require developers to be more active than anticipated.

Contributed Content

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals