Deutsche Bank Imagine 2030 points out how the future of finance will be shaped by the end of FIAT money and the rise of Cryptocurrencies

“We might see the end of FIAT money within the next decade. The forces that hold the fiat money system together look fragile, particularly after decades of low labour costs. Over the next decade, some of these forces could begin to unravel and demand for alternative currencies, from gold to crypto, could take off,” Deutsche Bank Report Imagine 2030

Cryptocurrencies had been around since Bitcoin was first released back in 2008. But it was not until 2017 that cryptocurrencies really drew global attention when the price of Bitcoin surged to almost $20,000. Since then, digital currencies have seen an explosion in their numbers while fulfilling a whole array of different roles: they fuel new forms of funding via Initial Coin Offerings, Ethereum’s network allows for Smart Contracts to be implemented within their blockchain, they can be used as an investment offering or even to pay for daily products as a means of payment. As we enter the next decade, they may take a much more active role as the money of the future.

At least, that is why Deutsche Bank’s Imagine 2030 report pictures the future of finance and money by the end of the decade. With FIAT money in decadence, new forms of currencies will stand up and challenge the long standing monetary system. Especially important is blockchain and the cryptocurrencies they power. With a monetary system in decline everywhere, digital money seems the one-to-go future of currency.

A Monetary Policy in trouble

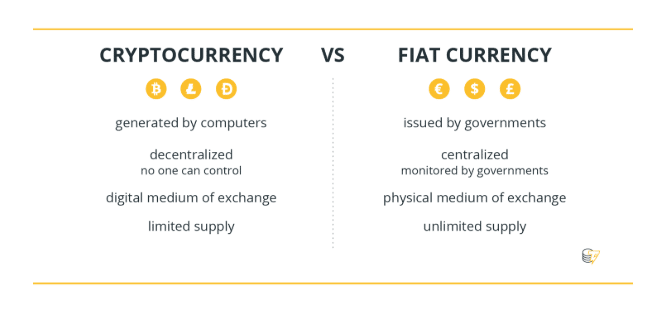

The centralized monetary system is one of those financial mechanisms that is at the verge of being disrupted by new forms of digital currencies. “We might see the end of FIAT money within the next decade. The forces that hold the fiat money system together look fragile, particularly after decades of low labour costs. Over the next decade, some of these forces could begin to unravel and demand for alternative currencies, from gold to crypto, could take off,” was stated in the ‘Imagine 2030’ research.

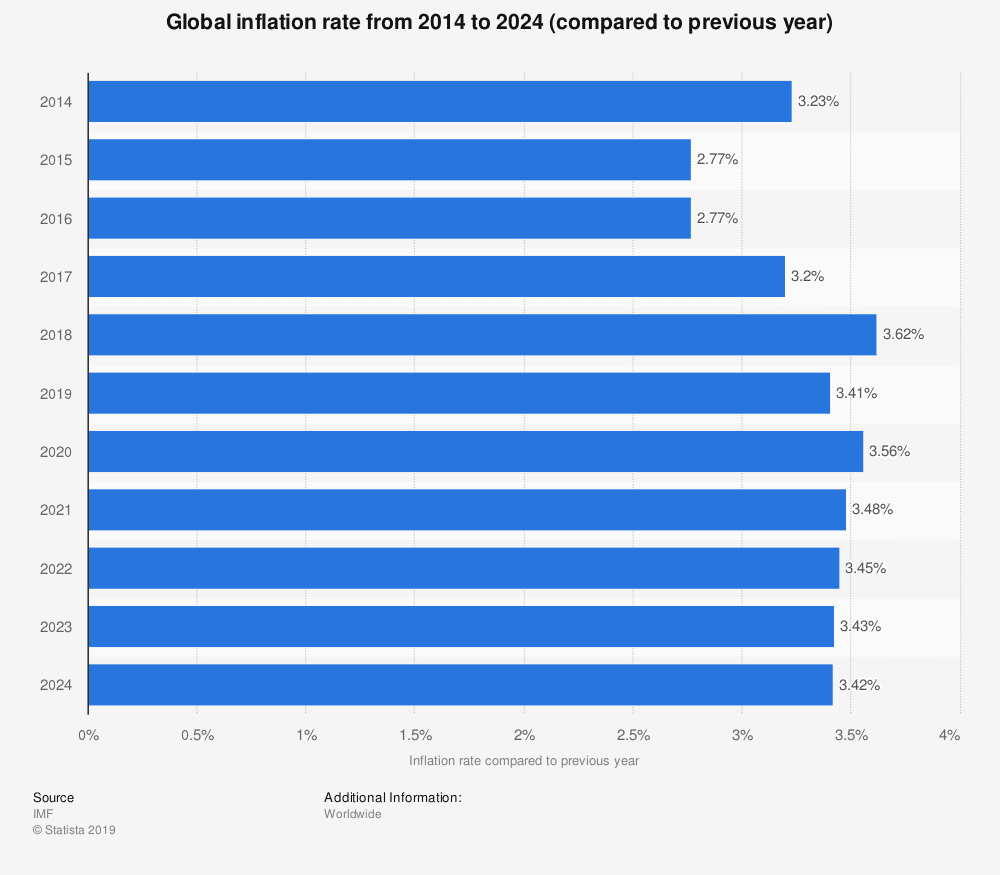

The research points out that behind this demand of digital currencies are two major long lasting –and related– concerns: labour costs and inflation. “We could be at a turning point in governments’ attitude towards labour just as demographics becomes more supportive. Policy may increasingly be shifted towards the lowest-paid workers left behind by globalisation. This likely means higher fiscal spending rather than the overwhelming emphasis on monetary policy that has been the policy of choice of the last decade. Aggressive monetary policy has arguably benefited owners of capital and assets over labour. That has meant inflation, where it has occurred, has mostly been seen in asset prices. Such a fiscal shift towards workers could start reversing this trend,” it was said in the Deutsche Bank report.

Furthermore, it is possible that inflation will become more and more embedded in our system and doubts about the sustainability of fiat money will rise. “The demand for alternative currencies will therefore likely be significantly higher by the time 2030 rolls around. Will fiat currencies survive the policy dilemma that authorities will experience as they try to balance higher yields with record levels of debt? That’s the multi-trillion dollar (or bitcoin) question for the decade ahead.”

The Rise of Cryptocurrencies

To date, Cryptocurrencies have gone through difficult times. Bitcoin hit a tipping point in 2017 and since then it hasn’t fully recovered, dragging all other cryptocurrencies with it. This volatility and the inability of central banks and national institutions to regulate them didn’t help at all. However, this may change in the next decade.

“Cryptocurrencies have always been additions, rather than substitutes, to the global inventory of money. They have not managed to take off as a means of payment despite their well-known benefits, such as security, speed, minimal transaction fees, ease of storage and relevance in the digital era,” Marion Laboure, Imagine 2030, Deutsche Bank Research.

But despite their well-known benefits, cryptocurrencies need to overcome various main hurdles to become widespread. As was stated by the report, digital currencies must become legitimate in the eyes of governments and regulators. That means bringing stability to the price and bringing advantages to both merchants and consumers. In the long run, this would broaden the appeal of cryptocurrencies, hasten their adoption, and give them the potential to eventually replace cash. Governments, banks and card providers share at least a goal: the elimination of cash.

Secondly, cryptocurrencies must also allow for global reach in the payment market. To do so, alliances must be forged with key stakeholders – mobile apps such as Apple Pay, Google Pay, card providers such as Visa and Mastercard, and retailers, such as Amazon and Walmart. If these challenges can be overcome, the eventual future of cash is at risk.

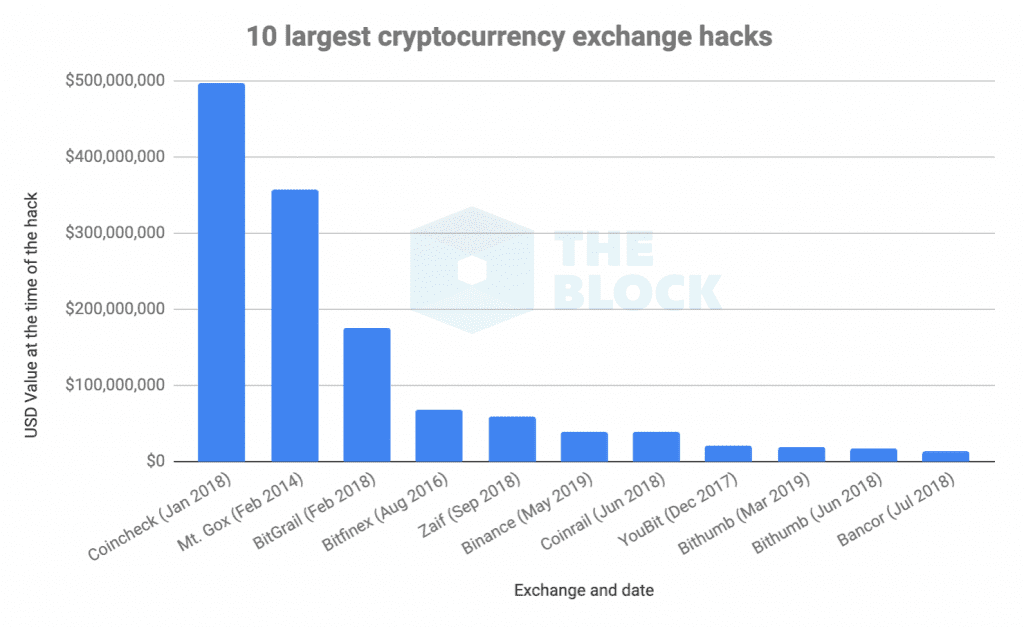

However, the adoption of cryptocurrencies replacing FIAT money comes with its own challenges. “For starters, it will mean basing a robust financial system entirely on electricity consumption. To envision a smooth transmission towards a fully digitalised platform, the financial system needs to be ready to overcome any kind of electricity shutdown or cyberattack. Governments may increasingly need to safely store back up of citizens data in an alternative country. Estonia, for example, chose Luxembourg to store a comprehensive backup of government data, including details of its citizens’ health, population, business registries, as well as a data embassy. Natural disasters, climate change, and global warming are also issues to deal with. They are infrequent but can be crippling. In 1989, Quebec was plunged into darkness for nine hours because of a solar flare,” said economist Marion Laboure for the Imagine 2030 report.

Likewise, as cryptocurrencies are all-digital, cyberattacks might pose a potential risk. In fact, the number of cyberattacks have soared lately. In January 2018, the Tokyo-based cryptocurrency exchange Coincheck reported that hackers had taken £400m. Even though transactions for many cryptocurrencies are public, all 523m stolen coins ended up in nameless accounts. As we look to the decade ahead, it would not be surprising if a new and mainstream cryptocurrency were to unexpectedly emerge. Some countries with historically-strong banking industries are trialling cryptocurrencies. Separately, cryptocurrencies may constitute the best tool for a digital war.

If all of these challenges can be accounted for and governments and consumers back cryptocurrencies, adoption rates will drive the timeline for mainstream use. Indeed, if current trends continue, there could be 200m blockchain wallet users in 2030. Then, the question would be which country will take advantage of being the first to obtain licenses and build alliances. As that occurs, the line between cryptocurrencies, financial institutions, and public & private sectors may become blurred.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.