The long short equity manager universe is highly fragmented. Investors can increase the probability of achieving higher returns if they focus on managers concentrated in the relative undervalued segments of the equity markets, along with areas of the market with greater inefficiencies. Managers should be selected that can clearly articulate their ability to gain an information advantage and capture market inefficiencies and whose skill can be quantified by outperformance of a customized benchmark.

By Donald A. Steinbrugge, CFA – Founder and CEO, Agecroft Partners

There has recently been increased interest in long/short equity strategies after strong relative performance in the 1st quarter of 2020 relative to equity indices and the perception that the recent sell-off and rebound in the marketplace have created an environment for long/short equity managers to excel. This is great news for approximately 25% of the hedge fund industry that focuses on the strategy after a decade-long decline in the percentage of total hedge fund industry assets.

For investors looking to hire a long/short equity manager, it can be a daunting task narrowing down the thousands of funds focused on the strategy. Initially, investors focus on the typical evaluation factors for a hedge fund which include the quality of the organization, investment team, portfolio construction and risk controls such as management of net exposures and position sizes of longs and shorts, and quality of service providers. In order to increase the odds of identifying a manager who will outperform, investors should also focus on three high level areas:

· The relative valuation of the segment of the equity market in which the manager specializes

· The level of inefficiencies in these markets

· The manager’s ability to gain an information advantage and capture these inefficiencies

Relative valuation of markets. Many long/short equity managers specialize within the global equity markets in certain areas ranging from geography, market capitalization, sectors, to value versus growth styles. These areas may include a single country like the U.S., China or Brazil, a region like North America, Europe or Asia, developed markets versus emerging markets, small/mid-capitalization versus large capitalization, or sectors such as technology, healthcare, consumer and energy.

Most managers run a long-biased portfolio with the average net exposure around 50% long. This results in a high correlation in performance to the area of stocks in which they specialize, and a meaningful portion of their performance driven by the beta to those stocks. Therefore, comparing performance across long/short equity managers is not a good indication of their relative quality. Instead, it is beneficial to consider the following:

· Create a custom benchmark for each manager. Various components of the global equity markets perform differently year to year. In order to determine if a long/short equity manager is adding value, their exposure-adjusted performance should be compared to a custom benchmark based on the part of the equity market in which they specialize. For example, a long/short equity manager focusing on small-cap U.S. growth companies with an average net exposure of +60% should be compared to 60% of the Russell 2000 growth index. This is something that long only investors have done for years, but has been used much less frequently in the hedge fund industry.

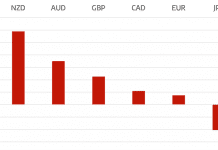

· Determine whether managers are biased to outperform. Investors should focus on long/short managers that are concentrated in the most undervalued areas of the global equity markets. This process begins with reviewing historical relative price-to-earnings ratios for different parts of the market such as small-cap versus large cap, growth versus value, developed markets versus emerging markets, and the U.S. versus China. These ratios are then compared to their current levels to determine which part of the equity market seems to be relatively undervalued from a historical perspective. The next step is to try to identify if there are any changes in relative expected earnings growth rates across each of the areas evaluated that would have caused changes to relative valuations.

Over long periods of time, temporary pricing distortions develop among different areas of the market which eventually reverse. This causes a rotation of outperformance for these various areas. Over the past century, the market has consistently overpaid for earnings growth and large-cap stocks, which has resulted in long-term outperformance of value and small-cap stocks. This performance trend has reversed itself over the past decade. This reversal has created an environment where value and small cap stocks are trading at valuations levels near their all-time lows relative to growth and large-cap stocks. The question is, has the world changed or will we see a huge snap back in the performance of small-cap and value stocks?

Level of inefficiencies. Inefficiencies in security pricing are highly correlated to the size of a company’s market capitalization, the amount of Wall Street analyst coverage, the percentage of stock owned by institutions, and the complexity of the business. The greater the level of inefficiencies in security prices, the higher the potential divergence between market price and intrinsic value, and the more opportunity for investors to generate alpha through security selection. Investors should consider paying hedge fund fees to managers who are likely to earn them by delivering alpha-driven returns to their investors. This is most likely to come from managers who specialize in less efficient areas of the market. For the parts of the market with the most efficiently priced equities, investors would do best to allocate through long-only, low fee investment vehicles.

Information advantage. Investors should only invest in hedge funds where the manager can clearly state what inefficiency in the market they are taking advantage of, and what their differential advantage is in capturing this inefficiency through their investment process. There are many ways that long/short equity managers try to get an edge with a few much more successful than others. Some of these include:

1. Food chain analysis

2. Focusing on catalysts/events (corporate spin off, new management)

3. Greater expertise in a sector or region

4. Pattern recognition

5. Big data and analytics “arms race” for alpha

6. Fundamental analysis

7. Quantitative

It is also important to understand what a manager is doing differently on the short side of their portfolio. Investors find managers with demonstrated skill in security selection and execution on the short side of the portfolio to be adding substantial value. Some managers do not actively short individual stocks, and may use cash or equity market indices to broadly hedge their portfolios. Other managers who are actively shorting individual equities may do so in a couple of ways: pair trades that directly hedge a portion of the portfolio, or alpha shorts where their main objective is to generate profits. Most managers tend to use a shorter time horizon for shorts, given the expense of shorting due to the high cost of borrowing some of the more crowded stocks. They also tend to have smaller positions, due to the inherent unlimited downside of short positions.

Article written by Donald A. Steinbrugge, CFA – Founder and CEO, Agecroft Partners

Don is the Founder and CEO of Agecroft Partners, a global hedge fund consulting and marketing firm. Agecroft Partners has won 38 industry awards as the Hedge Fund Marketing Firm of the Year. Don frequently writes white papers on trends he sees in the hedge fund industry, has spoken at over 100 hedge fund conferences, has been quoted in hundreds of articles relative to the hedge fund industry and has done over 100 interviews on business television and radio.

Don is also Chairman of Gaining the Edge-Hedge Fund Leadership Conference; consider one of the top conferences in the hedge fund industry. All profits from the conference are donated to charities that benefit children, which total over $2 million since 2013.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals