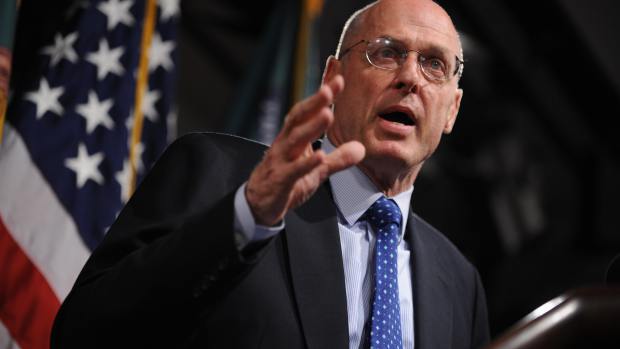

In 2008 at the height of the U.S. subprime mortgage crisis, two prominent Federal housing finance agencies established as Government-Sponsored Enterprises (GSEs) were placed in conservatorship by an act of Congress. The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) were placed under the authority and control of the Federal Housing Finance Agency (FHFA), which was created by the Federal Housing Finance Regulatory Reform Act of 2008. At the time, U.S. Treasury Secretary Paulson strongly endorsed the move, stating that conservatorship was the only form in which I would commit taxpayer money to the GSEs. I attribute the need for today’s action primarily to the inherent conflict and flawed business model embedded in the GSE structure, and to the ongoing housing correction.” While it is generally acknowledged that both agencies were mismanaged and in need of close supervision, some critics claim the oversight move was the first step in shutting down these unwieldy bureaucracies. Investors in Fannie Mae and Freddie Mac allege just such an intention.

Two Lawsuits in Two Days

A New York-based firm described as an activist hedge fund management company filed suit against the U.S. government last week claiming that Fannie Mae and Freddie Mac regulators syphoned off profits from the two agencies thereby depriving holders of their common stock of rightful profits. The complaint alleges that since 2012 FHFA has diverted such profits into the U.S. Treasury at the expense of investors. The action has been characterized as a confiscation, and the amount claimed is estimated to reach $130 billion by next month. Although both suits are similarattacking the terms of the government bailout mechanismthe latest suit seeks injunctive relief against net worth sweeps and a declaratory judgment that the modified bailout terms and accompanying sweeps are illegal. According to the complaint, The net worth sweeps make plaintiffsand all of the other common shareholders’shareholders’ in name only.”

Constitutional Claim

The plaintiffs allege that the FHFA actions violate the Fifth Amendment of the U.S. Constitution: i.e., the taking of private property for public use without just compensation. The Court of Federal Claims asserts that the intention of the conservators is to to strip profits from the companies. Accordingly, it seeks damages, disgorgement, and restitution for the investors.

Other Hedge Funds File Separate Suits

About 20 other hedge funds and investors have previously filed lawsuits over the governments channeling of Fannie Mae and Freddie Mac profits away from investors; however, those actions are based on the claims of preferred stockholderswhose dividends were eliminated in 2012as opposed to the interests of common shareholders.

Read More:

best hedge fund managers of all time

best performing hedge funds 10 years

top 10 biggest hedge funds us 2024

biggest hedge funds in san francisco

what is not a benefit of having a good credit score?

David draws on 20+ years’ experience in both legal practice and in business services delivery since his own call to the Bar in 1989. With several years in the startup environment, including as a co-founder in the legal tech space specifically, he brings a unique and timely perspective on the role of data, automation and artificial intelligence in the modern and efficient delivery of services for legal consumers. Having been both a corporate buyer of legal services and a services provider, he identifies the greater efficiency and value that can be achieved in legal operations for corporate buyers especially.

An attorney, David worked for law firms Pinsent Masons and Linklaters in London before moving to New York to join Credit Suisse. As CAO, he helped negotiate & execute the relocation of Credit Suisse into its new NYC global HQ. Subsequently, David directed major global outsourcing, shared sourcing, HR operations & process efficiency initiatives including the digitization of records, the global roll-out of PeopleSoft HRMS & Y2K. David has worked extensively in the UK, US, Philippines, India and China markets in the areas of data management, human resources and business process outsourcing.

Most recently, David has been successfully investing in and serving as an advisory board member of several legal services start-ups including a cloud-based solution for legal process automation and e-filing; and a technology solution for large-scale capture of court and other public data used for litigation analysis, among others.

David graduated from the University of Manchester with Honors in Law and Bar School (College of Legal Education) in London, and has been a member of Middle Temple since 1989. He is the founder and former Chairman of The Global Sourcing Council.

Member: Bar of England & Wales, ABA, NYCBA, ACC, DRI