The month of February began quite like any other, save for a few eventful happenings in the digital currency/asset space. The introduction of blockchain wallet recovery services by Wallet Recovery Services, co-founded by anonymous individuals, one of whom goes by the name “Dave Bitcoin.” The service quickly gained traction with more than 60 requests for wallet recovery daily. The software, which ran on the Linux node and hosted on Amazon Web Services, tries millions of passwords in quick successions and uses brute force attacks during the wallet recovery process.

In the same first week, up to 75 Ethereum 2.0 violators were fined $30,000 for double voting on the Ethereum network. These violations occurred on nodes belonging to “Staked.us,” who admitted to overlooking risks posed on the web to enable better performance. Their lack of caution was made to cover the cost of the incident, saving their clients from future losses.

Dogecoin experienced a rise after a series of tweets by Elon Musk, CEO of tech company Tesla and SpaceX. The tweets were followed by a surge of 50% in price by the end of the day. 800% surge by the end of the first week of February sent traders rushing to take advantage of the opportunity posed by the rise in price.

Newsletter provided by JP Fund Services.

DeFi & Apple Pay

Inconspicuously, decentralized finance made some noise which got louder as the days went by. This was evident in the move made by digital payment provider BitPay when they added support for apple pay.

According to BitPay, their cardholders in the United States can now purchase from the Apple store with the digital currency in their BitPay wallet using their prepaid MasterCard. They have also announced that support for Google pay and Samsung will be added later this year. This is setting the pace for others like MasterCard, who are making plans to exchange digital currency for merchants on its network.

Earlier that week, there were suggestions that mobile tech giants Apple sought to enter the digital currency space. It may likely begin with creating wallets for over 1 billion of its users. All this happens all Tesla invests $1.5B in Bitcoin with plans to accept payments in Bitcoins shortly. The project is said to have begun in 2018 when Musk first tweeted about Bitcoin and other digital currencies. Not just him, but several other big investors seem to have taken an interest in the digital currency community. Lately, investors like Bill Miller and Paul Tudor Jones II are advocating for digital currencies like Bitcoin for use against inflation. The announcement by Tesla moved the price of Bitcoin up by 14%, taking it to a new all-time high of $44,801 as at the time of the said report.

Ethereum 2.0 Launches Beacon Chain

By the second week, Ethereum had been in the news non-stop, owing to the release of the new Ethereum 2.0, the most obvious one being Beacon Chain. This deposit contract for the Ethereum 2.0 holds over 3million ETH, worth slightly over $5.5 billion at the market rating as at publication. Though recently launched, the contract held over $3million ETH as at the time of the report. Beacon Chain will serve as a bridge between Ethereum 2.0 and the old Ethereum network. Week two also saw Elon Musk’s continuation, tweets, and the digital currency community frenzy. A significant highlight of the week was the surge of Bitcoin to its new all-time high, which seemed to continue its uptrend at that publication time. According to him, Musk’s tweets centered around the Dogecoin were “for fun.” It was hard to believe that a single tweet from the billionaire would cause a storm in the digital currency community, but it did. Thankfully, the wave seems to be settling down. However, all the dust raised during the short period became evident as even altcoins like the Ripple went on an uptrend as traders watched to see how high its price would rise.

Strong start for Ethereum on the CME

The beginning of the second week saw Ethereum futures trading on Chicago Mercantile Exchange. It began with an opening price of $1,669.75 after going live on Sunday of the previous week. 77 contracts had been traded on the exchange as many sights were set towards February expiry.

With this, it was no surprise that those institutions that had earlier bought BTC were setting their sights on ETH, that and the fact that the Ethereum network (which is the most used network) is filled with so many potentials. This insight was stated by the co-founder of Messari and digital currency investor Qiao Wang. At the time of that report, Ether was trading at $1,838, which was a record high for the digital currency, but experts foresee the likelihood of it rallying to more than $5000 in the long run.

Though Bitcoin mining is no easy task, miner Bitfarm seeks to raise $31M in funds from shares to institutional investors. They intend to use the funds to acquire more miners to boost working capital and expand their mining infrastructure. This sale made it the third financing sale for them this month, and many were on the lookout for more sales like that before the end of the month. Meanwhile, Bitcoin hit its new record high of over $43K after the news of Tesla’s investment in the digital currency.

As many got on board the digital currency train, wallet providers were making room to accommodate the ever-growing community. Wallet providers like Ledger are already making plans to support Decentralized Finance (Defi) on their mobile applications. They announced earlier that the new accommodation would accompany the updates, slated later that week. The update was to allow connections with DApps through integration with WalletConnect (an open-source protocol.), solving the unavailability of decentralized applications to mobile users.

With the Ethereum frenzy, Casper, a close competitor of Ethereum and even a fork, is set to launch this year. However, the news was that BSN, China’s Blockchain Infrastructure Service Provider, seeks to add Casper to its network. This will make Casper available to developers on BSN after its launch. The aim is to offer standardized development environments and cloud services to allow DApps from various blockchain networks to build on the same platform. As more developers join in developing decentralized applications, the US SEC seems not to be left out. The SEC commissioner Hester Peirce said that the United States’ capital markets are ready for a Bitcoin exchange-traded product. According to Peirce, many people are prepared to trade a bitcoin ETP, and it is best to give them a natural way than having them look for alternatives.

Custody boost to digital assets

In what seemed like a digital asset theft month, the second week of February saw another individual who thought it would be better to steal digital assets than work for them.

The man from Alabama who faced several charges for stealing over $150,000 in digital assets, carried out the theft through SIM-swapping, where over 300 contacts were transferred from over 60 smartphones and hundreds of sim cards to mobile phones in his possession, bypassing two-factor authentication security to access the online accounts of the victims. The culprit Joseph chase Oaks is charged with identity theft, scam among others.

As the use of digital currencies continues to gain prominence, institutions like BNY Mellon, the largest custodian bank, plans to allow customers custody of digital assets by year’s end. Although its partners remain unknown, many believe that this plan will open up more decentralized finance opportunities shortly. As seen earlier in the same week, payment facilitators like MasterCard also intend to support the transaction of digital assets directly on their already massive network.

At the same time, Amazon announced their intention to launch a digital currency project in Mexico. This project aims to extend the range of services to their customers. Uber, like Amazon, has also stated their intention to accept digital currencies as means of payment on its platform. However, both companies have made it clear that they will not be adding any digital currency to their balance sheet. R3, during the same week, launched a new computing platform called a conclave.

They aim to use it to bring more privacy to sensitive business data and create trusted services for reducing cost, reducing fraud, and many more. While many continue to state concerns about using digital assets for illicit purposes, others believe that there is still room to develop better policies regarding digital assets and their uses.

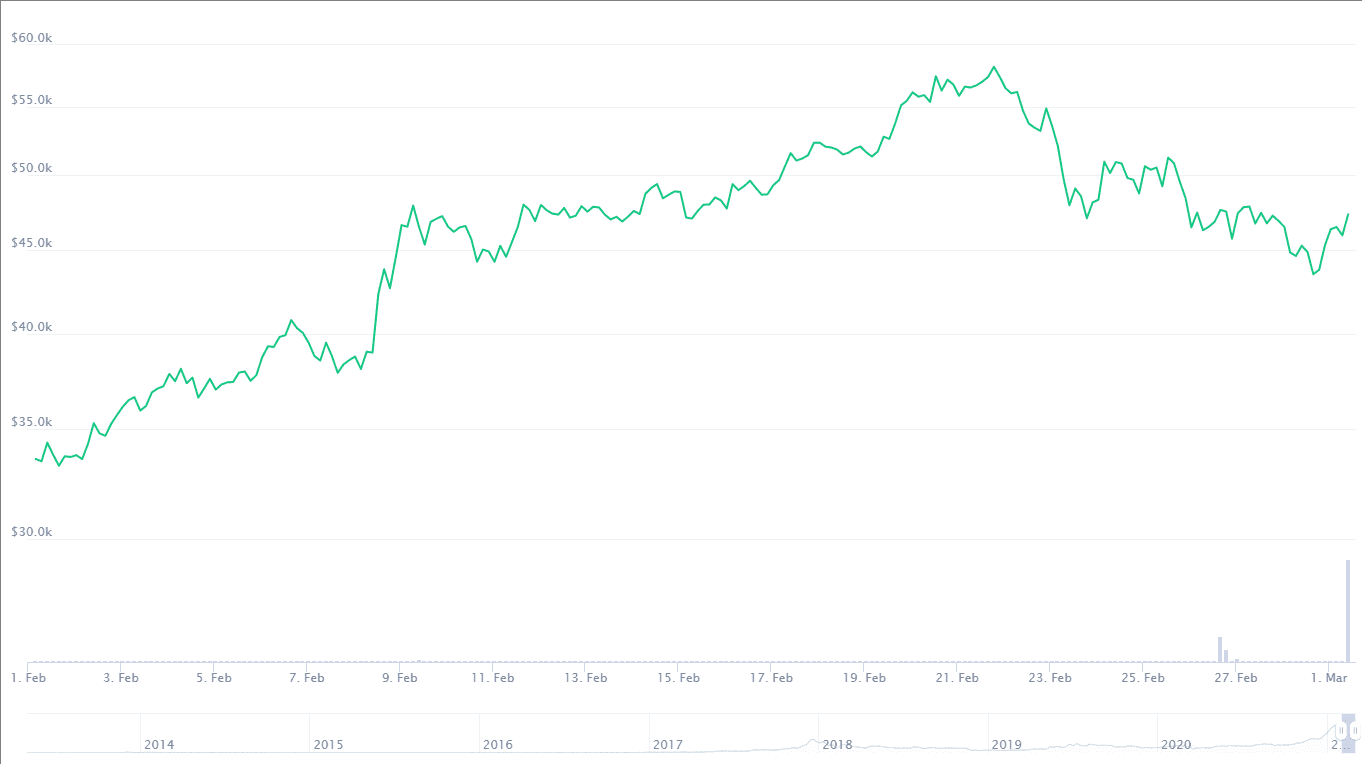

Bitcoin hits all-time high

The third week’s highlight was the number one digital currency bitcoin (BTC) hitting a new all-time high, crossing a little over $57,000. This was a 95.5% price increase, just barely two months into the year 2021. This price increased the market cap to $1 trillion. It reached a new high of $57,492.00, which was over 8.77%within 24hrs and settled back to $57,264,55. Before the end of 2020, BTC’s price was around $29,000, and with its current price, it would put the profit at over 300%. More than the last 12 months. The spike in the price is connected to the events from earlier in the month when Tesla announced its $1.5 billion worth of digital assets for its treasury.

While BTC was busy hitting a new high, the first publicly traded Purpose Investment’s Bitcoin Exchange-Traded Fund (ETF) in North America collected $421.8 million worth of Assets Under Management (AUM) within two days. The ETF, which officially began its trade on Toronto Stock Exchange (TSX) as “BTCC” on Thursday the 18th, saw huge interests trading over $100 million on its first trade day. In 24 hours, it went from its initial amount to $421.8 million AUM. This put the Bitcoin ETF at the top of the list of the digital assets to look out for as February ended. By this time, the Evolve ETF had begun trading in the same stock exchange under the ticket “EBIT” and racked up as much as $1.271 million AUM on its first trade day. Both ETFs charge a 1% management fee.

Cold Wallet Hacks and Hard Forks

While new digital assets were breaking new records and making gains, a hack on a cold wallet belonging to Stakenet, a U.S. creditor firm, made it the second attack on the same platform within three years. The last hack was in 2019 and caused a loss of NZ$24 million approximately (US$15.5 million) and left NZ$2.7 million (approx US$1.97) worth of digital assets remaining unused. Reports indicated that NZ$62,000, about US$45,000, were transferred out of its cold wallet on the first of February.

According to the New Zealand liquidator, Grant Thornton, it gave no authorization to move funds, and the incident was being investigated. After the loss of funds to the breach in 2019, Stakenet has had hopes of getting back all its assets, and there have been calls for an explanation from Grant Thornton under whose watch the theft occurred, asking how they managed to fail in securing the digital assets.

Being on the news for weeks seemed only to be the beginning for Ethereum as developers scheduled the Berlin hard fork for the fourteenth of April at a 12,244,000 block height. This decision came after the Ethereum All Core Developers meeting on Friday the 19th. The hard fork hopes to go with various contract optimization, including gas efficiency. It is also likely to include an update to how the Ethereum Virtual Machine (EVM) is protected against Denial-of-Service (DDOS) attacks.

Security fraud in Australia

On Thursday the 4th, a Manhattan court oversaw the prosecution of an Australian man, Stefan He Qin, who pleaded guilty to security fraud after cheating investors of over US$90 million. Dozens of investors were cheated of their investment, some of whom were from the United States. This prosecution came after He Qin failed to meet his investors’ redemption request and tried to steal from another fund under his control. His attorney then stated that his client was ready to accept full responsibility for his action and do his best to make amends. Meanwhile, Ethereum continued to make new highs, reaching as high as $38,332 but then lost its momentum as the weekend closed in. The loss in speed was attributed to the diversion of traders to other high-flying digital assets. While the digital assets were making record highs, the Central Bank of Nigeria (CBN) issued a directive to all banks to close all digital asset-related accounts in the country. Stating that digital currencies were not legal tender, and all banking, non-banking and financial institutions were among those given the directive. Given this directive, Binance temporarily suspended naira deposits on Friday the 5th without a stipulated time for when the suspension will be lifted. It was believed that the CBN’s action would cause an on/off-ramp in the impact on fiat currency. The directive, however, did not affect peer-to-peer platforms, which were where a majority of the country’s digital assets trading is done. As traders prepared for that weekend, attention was on Bitcoin as it attempted another bull run.

Better Regulation and Morocco’s CBDC

With the advancement in digitization, it becomes harder to secure digital assets, and it’s even more difficult to quell the increasing cases of crimes being committed with digital currencies. In agreement, the Australian Financial Market Authority (FMA) reported on Friday the 19th that there is a need for stricter regulation. Its report stated how in 2020 alone digital assets and its traded products made up two-thirds of its investment fraud reports. According to the FMA, crimes committed in this category usually include fake stock offers and bogus ICOs. Despite all these, there remains a growing number of digital asset scams advertised on various social media platforms. Although one cannot wholly regulate the digital currency world, the steady rise in digital assets-related crimes is cause for worry. Despite these growing concerns, many continue to embrace the digital currencies space. Many central banks are launching their own Central Bank Digital Currencies (CBDCs) to show just how much potential these digital assets have. One of those willing to ride with the trends is Morocco’s central bank Bank-Al-Maghrib (BAM). Sources indicated the BAM has been investigating the benefits of having its own CBDCs. This new development came four years after its ban on digital assets in the country.

The investigation’s main aim is to analyze just how the CBDCs will affect the country’s economy. Regardless of the ban on digital currency assets like the BTC from the country four years ago, they continue to thrive, with countries like Nigeria, South Africa, and Kenya being the only African countries having the most digital currency trade. The third week saw a lot of digital currency adoption by many entities and organizations. Even the prestigious British auction house Christie’s was not shy to dip its toes in digital assets. The auction house confirmed its acceptance of Ether (ETH) as payment for a digital art auction coming soon. According to a report on Thursday to Bloomberg, Christie’s indicated that for the work of digital artist Mike “Beeple” Winkelman, it would be accepting Ether as a form of payment. Christie’s, however, made it clear that its premium must be paid in U.S. dollars. The piece called “EVERYDAY’S: THE FIRST 5000 DAYS” is a collage of thousands of art pieces the artist has posted online since 2007 and will be delivered to the buyer along with an encrypted token that is unique, nonfungible, and contains the artist’s signature.

Ghana’s Central Bank on the block

While on the topic of regulations, in West Africa, Ghana’s central bank uses blockchain technology to launch a live testing pilot on fintech innovation and regulation. In a bank statement on Thursday the 25th, a wide range of innovations are bound to be covered by the sandbox. According to the report also, “…the sandbox will be available to banks, specialized deposit-taking institutions and payment service providers including dedicated e-money issuers, as well as unregulated entities, and persons who meet the sandbox requirement.” The fintech company EMTECH are providers of the underlying technology for Ghana’s bank to run the innovation and regulatory sandbox and are also collaborators in launching the sandbox. Still, in West Africa, digital currency traders and exchanges alike are beginning to feel the impact of the ban placed by the Central Bank of Nigeria (CBN) early in the month. One of the most popular exchange platforms in the country, Luno traded Bitcoin at a 46% premium. This increased the average price of Bitcoin on the platform than on any other major exchange, which sold at around $48,000 as of Friday the 26th. Luno, a subsidiary of Digital Currency Group, said the increase in premium from 38% earlier in the week was due to a drop in liquidity which the bank caused.

In digital asset exchange, low liquidity increases the conversion difficulty and also hikes the price. No thanks to the ban, traders are now forced to turn to other means of exchanging their digital currency. While the dollar to naira published by the Central Bank of Nigeria (CBN) on Friday the 26th was ₦379 to $1, the informal exchange rate was at ₦475 to $1, which influenced the price of Bitcoin. Officially Bitcoin was listed at ₦33,000,000, placing $1 at about ₦690, though some users pointed out that $1 went for about ₦700 on the platform, putting the cost of bitcoin between $45,866 and $69,000 in Nigeria at the moment. These are highlights of the events around the digital asset space in February, and many hope that March would come with its fair share of events worth looking forward to, as well as opportunities for digital asset traders to make a profit.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals