Early last week, Ethereum started a strong increase from the $2,750 support zone, and the price is now trading above $3,000, which is near the 100-hour simple moving average. There had been a major declining channel for the second largest crypto coin by market cap, with resistance near $2,925 on the hourly chart of ETH/USD. At this time, it seems likely that Ethereum’s price has been gaining momentum – Ethereum started a steady increase above $3,000 against the US Dollar. It is felt by many traders, that ETH must clear $3,200 to continue higher in the near term. Ethereum found a strong support near the $2,750 level, and that is where it has now started a fresh increase. From there, ETH broke the $2,880 and $2,950 resistance levels to move into positive territory. The next resistance would have been at or near the $3,175 zone. An immediate support sits near the $3,065 level, which would be the 23.6% Fib retracement level of the upward move from the $2,740 swing low to $3,165 high.

On the upside, the next immediate resistance is near the $3,165 level, and the target breakout zone is viewed by professional investors at or near the $3,200 zone. A close above the $3,200 resistance could push the price further higher, all the way up to and possibly through $3,320. On the downside, if Ethereum were to fail to continue higher above the $3,165 and $3,200 resistance levels, it could start a downside correction, with initial support back to near the $3,065 level. The next major support seems to be forming near the $3,000 level, which is close to the 100-hour simple moving average. Any more losses might call for a test of the 50% Fib retracement level which is the upward move from the $2,740 swing low to $3,165 high, and now stands at $2,950. If ETH fails to stay above $2,950, it could resume a steadier decline in the near term. Here is a rundown of the technical indicators: Hourly MACD – The MACD for ETH/USD is slowly losing pace in the bullish zone. Hourly RSI – The RSI for ETH/USD is now well above the 50 level. Major Support Level – $3,065, and finally, the Major Resistance Level – $3,175. Happy investing!

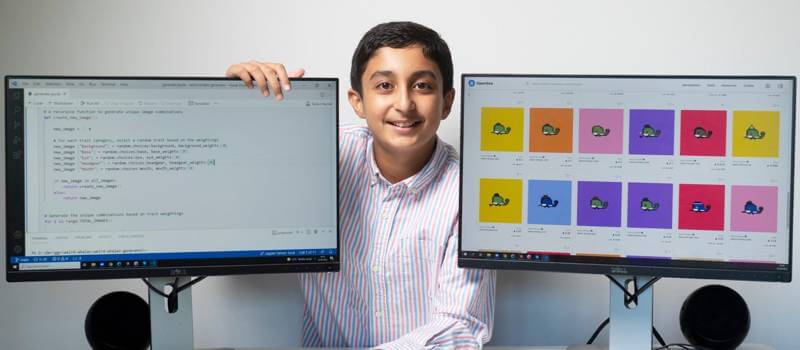

A 12-year old got rich by selling NFTs. Here’s what you need to know

His interest in programming sprouted from when he was just nine years old, and perhaps he was slightly influenced by his father, Imran, who was a hard-working web developer. Benyamin Ahmed started programming by learning HTML and CSS, and once that took off, he advanced his coding skills by learning other programs, including JavaScript. He talked recently to CNBC for an interview and said that his interest in NFTs and smart contracts grew earlier this year. By the way, the twelve-year-old does more than just programming, he also enjoys swimming, taekwondo, and coding. Oh, and did I mention? He is on his way to becoming a millionaire! That feat was made possible by his selling of his hard-earned NFT collection called Weird Whales. When pressed, Benyamin will tell you that his interest in the technology behind NFTs is what motivated him to create his NFT collection, the Weird Whales.

Turns out, his father greatly influenced Benyamin’s passion for technology, and this began as the boy watched his dad working intensely with computers because of his career as a web developer. Once he realized the desire his son had for computers, Imran began showing his son simple little skills in programming. Imran himself admits that his passion for computers grew from the time he was twelve, when his own father got him his first computer. He would learn by trying out the programming written on the back of the box, and this is where he began typing codes and watch them play out in fascination as animations. He took up computer studies at the age of eighteen, and thirty-five years later, he is still passionate about coding and programming and is currently working at the London Stock Exchange. Imran says that he noticed Benyamin’s interest in computers at the tender age of six, and in pursuit to nurture his son’s interest, he purchased a new laptop for Benyamin. He states that it started as fun and games, but after confirming that his boy was genuinely interested, he moved to more structured and formal training.

The training involved coding every day, even during holidays, because, according to Imran, consistency is key in coding. For that reason, he made certain that his boy practiced coding every day, even if for just a half an hour. Turns out, that many people do not know that Weird Whales was the second NFT project from Benyamin. He had initially started off with NFT’s by creating Minecraft Yee Haa, drawing his inspiration from the iconic game Minecraft, where he managed to create and upload forty small and unique Minecraft’s. However, this project did not go far because he created them manually, making it very difficult, and Benyamin did not sell any from his first collection because he did not understand marketing at that time. After studying how to generate NFTS with his father’s help, Benyamin finally used the acquired script to create unique images with different traits and backgrounds. The twelve-year-old stated that his inspiration for Weird Whales came from the popular term Whales in Bitcoin, which represents investors with large amounts of Bitcoins. Benyamin says that the project cost him a total of three hundred dollars and that it sold in nine hours. So far, he has earned more than $400,000. Although he says that he does not own a bank account since his parents are paying for all his expenses, he aims to prove that you do not need a bank account to survive and thrive in the financial world.

U.S Senate candidate proposes Fort Nakamoto as a strategic Bitcoin reserve

Inspired by China’s renewed crackdown on cryptocurrency last week, which led to further downturns across the market, Blake Masters wants to set up “Fort Nakamoto” as a “strategic reserve for Bitcoin.” Likening his vision to sort of what Fort Knox is to gold, the COO of the VC firm Thiel Capital and a U.S Senate candidate, Masters intends Fort Nakamoto to be an affirmative and yet opposing response to Beijing’s increasing anti-crypto position. However, the U.S crypto landscape is uncertain as regulators continue to evade dealing realistically with the issue, for example, by refusing to provide regulatory clarity on what constitutes a security. With that in mind, Masters knows his vision will have an uphill battle. Meantime, a week ago Friday, multiple Chinese agencies stepped up their campaign against Bitcoin and cryptocurrencies, in general, by renewing calls to work together to ban them. According to Reuters, this was the first time all ten agencies have taken coordinated action on the matter. They stated, “Ten agencies, including the central bank, financial, securities and foreign exchange regulators, vowed to work together to root out “illegal” cryptocurrency activity, the first time the Beijing-based regulators have joined forces to explicitly ban all cryptocurrency-related activity.”

Then, an article published by Sohu.com last Monday showed no let-up, and it reported the seizure of over 10,000 crypto miners in Inner Mongolia following a tip-off. Sohu.com is a Chinese internet company headquartered in the Sohu district of Beijing. Their article mentioned that electricity consumption was being monitored to identify those suspected of flaunting the mining ban, which regulators see as a necessary move to reduce the environmental damage caused by crypto mining. Since China’s banning of mining began, authorities in Inner Mongolia have shut down 45 crypto mining operations, and they state that this has saved 6.58 billion kilowatt-hours of electricity per year, which is the equivalent of burning 2 million tons of coal. That is why, in response to this activity in the East, Blake Masters said that the U.S needs to do the opposite by encouraging crypto adoption, starting with a federal Bitcoin reserve.

On that point, U.S Senator Pat Toomey agrees, and following the Beijing ban, he said this is a big opportunity for the U.S. to capitalize on. In a tweet, Toomey, who sits on the Senate Banking Committee, called out Beijing’s hostility to digital assets by saying the regime doesn’t want the Chinese people to have economic freedom. “Beijing is so hostile to economic freedom they cannot even tolerate their people participating in what is arguably the most exciting innovation in finance in decades. Economic liberty leads to faster growth, and ultimately, a higher standard of living for all.” Some would argue that there are bigger forces that don’t want citizens from around the world to have economic freedom. In this case, painting the situation as the U.S vs. China creates fake news.

SEC Chair Gary Gensler Says Crypto Will ‘Not End Well’ if It Stays Outside Regulations

Dr. Doom and Gloom is at it again (wouldn’t it be nice to have even one of our present leaders take a positive spin on any simple shred of news? Does anyone realize they are hysteria-mongering almost each issue on the board or is it just me?)! SEC Chairman Gary Gensler talked about cryptocurrency regulation last Monday in an interview with the former federal prosecutor Preet Bharara at the Code Conference in Beverly Hills, California. Gensler explained that the crypto sector in the U.S. has many “trading venues and lending venues” with “not just dozens but hundreds and sometimes thousands of tokens on them.” Noting that “people will be hurt” if cryptocurrency markets are allowed to operate outside the horizon of regulations, the SEC chairman warned: “This is not going to end well if it stays outside the regulatory space. To think that a field that’s grown 10-fold in the last 18 months — not just in terms of asset value, but in the underlying lending and much more — that it’s going to stay outside of these public policy frameworks and succeed – we’ll end up with a problem and a lot of people will be hurt.”

In August, Gensler made his point clear when he said that the cryptocurrency field is not going to reach any of its potential if it tries to stay outside of the SEC’s laws. Two weeks ago, former U.S. Treasury Secretary Larry Summers also said about the same thing – that cryptocurrency will do better regulated rather than being treated like a libertarian paradise. The SEC chairman said at a Senate Banking Committee hearing that same week that a number of cryptocurrency platforms, including the Nasdaq-listed Coinbase, have many tokens listed, insisting that some of them must be securities. Of course, Gensler then added, as an afterthought (lol – his intention the whole time) that the SEC needs more manpower and funding to better regulate the crypto sector (and into whose pockets might all this extra money be going, I wonder?). This was when he had stated, “Currently, we just don’t have enough investor protection in crypto finance, issuance, trading, or lending,” asserting that the crypto industry was “more like the Wild West or the old world of ‘buyer beware’ that existed before the securities laws were enacted.” Last week, Senator Pat Toomey wrote a letter to Gensler asking for clarity on crypto regulation.

The Best States for Bitcoin Mining In The U.S.

Bitcoin-friendly states will be the ones to benefit the most from innovation and technological development in the coming decades, and Bitcoin mining companies have flocked to the U.S. amid a hash rate exodus away from China. Fueled by extensive investments in talent and equipment, the industry’s profit is highly dependent upon the price for power, and mining farms deliberately select their location to ensure the highest margins. Some U.S. states allow customers to choose their energy providers, which then enable lower costs and tailored solutions. Other regions, however, impose mandates which only inflate prices and push away businesses seeking to create jobs and join a community. According to data from the Global Energy Institute, states like Texas and Washington have the lowest average price for electricity in the country. Both of these states are among the preferred destinations for bitcoin miners, who prefer to become established where power is cheaper since their variable costs are made up primarily of energy.

It turns out that Texas, Washington, Wyoming, Utah, and a handful of other states, provide customers with reliable energy at seven to nine cents per kilowatt-hour (kWh). However, energy prices in the U.S. can climb to nearly double that amount in those states from the East and West coasts. California, Connecticut, Maryland, and a few other states bill customers at 15 cents or more per kWh, and these are the highest energy retail prices in the country. The Global Energy Institute has a map which shows stark differences from state to state. “While the energy mix available within a state will play a large role in state electricity prices, energy-limiting policies in some states act to artificially elevate prices, making the price of electricity much higher for consumers and businesses.” The states with the highest energy prices are those that impose mandates and restrict choices. California, for instance, enforces several laws and incentives related to energy, including advanced technologies, alternative fuels and vehicles, and air quality. It has long been committed to restricting the ability of energy providers to engage in oil and gas initiatives. These kinds of conditions repel Bitcoin miners, as well as most businesses that are dependent upon cheap energy.

According to a CNBC report, Texas, on the other hand, “has a deregulated power grid that lets customers choose between power providers,” and this freedom of choice allows Bitcoin miners to plug into the energy grid and enjoy cheap power even as they diminish their carbon emissions. Companies across the U.S., such as Upstream and Great American Mining, have been building Bitcoin mining data centers geared to leverage both flared gas and stranded energy, which are abundant in Texas. In Washington, hydroelectric power has enabled Bitcoin mining farms to profit with renewable energy. Whereas high scrutiny, intense regulation, and energy-limiting policies inflate energy prices, pushing prospective miners away, freedom of choice and friendlier legislation enable lower costs, which is a more welcoming environment for interested parties. With Silicon Valley becoming a thing of the past, Bitcoin states will soon be hotbeds for a new financial system.

DC Comics Aims to Release ‘One of the Largest NFT Drops Ever’ at This Year’s Fandome

In just under two weeks from now, on October 16, the American comic book publisher DC Comics is planning to drop a large quantity of non-fungible token (NFT) collectibles featuring the firm’s most beloved characters at the DC Fandome event. In partnership with Palm NFT Studio, the comic book publisher plans to release a number of NFTs featuring Harley Quinn, Wonder Woman, Batman, Superman, and Green Lantern. One of the largest and oldest American comic book publishers, DC Comics, Inc., revealed the announcement through Bitcoin.com News, and explained that the NFTs were hand-selected by DC’s publisher and chief creative officer Jim Lee. “We spent a lot of time on how to translate and adapt these classic covers into a 21st-century format such as NFTs. This drop pays homage to our 87-year history while visualizing a future in which NFTs play a foundational role in novel ways of interacting with DC content and unlocking new experiences,” Lee said. The announcement further detailed that the 2020 DC Fandome drew 22 million global views across 220 countries and territories in a mere 24 hours. The firm is expecting that 2021’s Fandome numbers will exceed last year’s and will make it the “first large-scale virtual event with registration powered by NFTs, and very likely one of the largest NFT drops ever.” The company said it collaborated with Palm NFT Studio because the company is “as flexible as artists are creative.”

In addition to that, Lee stated that “Palm’s blockchain provides a 99.99% reduction in energy usage compared to proof-of-work (PoW) systems. The blockchain allows DC to mint millions of NFTs for fans “with near-zero cost.” DC Comics had entered the NFT industry in recent times and has already released NFTs through Orbis Blockchain Technologies Limited and the Veve Digital Collectibles App. Meantime, Marvel Comics has also entered the NFT space by leveraging Orbis and the Veve App. Both firms have warned freelance artists not to publish the company’s brand name characters without permission. DC Comics also stated that their upcoming NFT drop on October 16th will have differing levels of rarity: the premier drop will offer fans the opportunity to collect three covers for each character in three levels of rarity. For example, fans of the Princess of Themyscira, a.k.a. Wonder Woman, can collect covers considered to be Common (1987’s Wonder Woman #1 by George Peréz), Rare (2021’s Nubia and the Amazons #1 by Alitha Martinez), and/or Legendary (Yara Flor on 2021’s Future State: Wonder Woman #1 by Jenny Frison) cover.

Palm NFT Studio’s co-founder Dan Heyman explained during the announcement: “It’s immensely rewarding to work with a partner like DC who understands that blockchain is more than a technology, it’s a sustainable storytelling tool that can reshape the relationship between creators and fans. What does it mean to be a fan? What does it mean to be a collector? These are age-old questions that we get to watch creators like DC answer in brand new ways every day.” DC Comics says fans can register for the DC Fandome event’s free NFT at dcfandome.com.

The post <h5>Digital Asset Insights #35</h5> <h3>Ethereum Regains Strength, Why $3,200 is The Key for More Upsides</h3> appeared first on JP Fund Services.