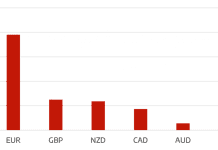

Last week the US Dollar was strong, helped by improved economic data and a surplice NFP number. The strength persisted all week as the DXY moved 1.7% higher to close at 106.89.

Euro was the worst performer as the talk of energy rationing took its toll on the single currency and a move to parity once again became a distinct possibility. Europe still faces the risk of a longer and deeper recession than other major economies. Despite breaking 1.01 the Euro rallied to close the week at 1.0171.

GBP lost ground as the political turmoil of the week unfolded. As Boris Johnson resigned the pound initially moved higher but eventually lost ground to close 0.5% lower.

Once again commodity currencies underperformed. Last week saw risk assets rally but the currencies failed to follow suit. AUD,NZD and CAD all closed the week around unchanged levels.

Oil prices remain very volatile. Supply continues to remain tight and in the near term should be well supported around the $100 mark.

The week ahead sees the Bank of Canada and RBNZ looking to raise rates substantially. We also have PPI and CPI releases which will give more indication to global inflation situation.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post <h5>Cromwell FX Market View</h5> <h3>Euro Suffers as Russia Turns The Taps… Down</h3> appeared first on JP Fund Services.