2022 has been an extraordinary year, marking the end of an extraordinary decade and a half since the Global Financial Crisis (GFC). A sharp and swift rise in real discount rates has caused bruising losses across asset classes, ending the panacea that ‘lower forever longer’ interest rates delivered for risky assets over many decades. Government bonds have suffered particularly badly, with the steepest decline in returns since the late 1700s.

One of the biggest questions for 2023 is how soon central banks will pause, or even reverse, their discount rate increases and what impact this will have on the value of cash flows across asset classes. Certainly in 2022, the bulk of asset market moves can be explained by changes in the discount rate; both earnings and earnings projections, a decent proxy for equity cash flows have risen this year. On balance, our judgment is that the odds of a quicker, sharper shift in policy are mounting, and prospectively quite fast.

Interest rates have increased dramatically in major economies in 2022. While the increase occurred across the curve, it was particularly sharp at the short end: for instance, the 500bp rise in 2-year US real rates between March and November was remarkable, as was the move in the expected level of fed funds in three years from 1.5% to 5% in just six months.

Five-year real rates (measured five years ahead), that many view as a long-term steer on ‘neutral’ policy rates, have soared from 50-year to levels last seen prior to the GFC. They stood at just -85bp in the US and -1.4% in Europe a year ago, whereas in early November, they were at 1.50% and 1.25%, respectively.

There are good reasons for them to be here, including a significant shift in the fiscal-monetary mix, a turn in structural trends such as globalisation that preserved the downtrend in government bonds and favourable demographics. But there are good reasons, too, for them to pause for breath, with mounting headwinds for both inflation and growth.

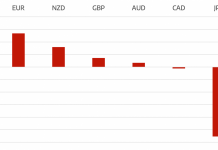

Persistently high inflation has tested central bank credibility in 2022, forcing them to set interest rates in the ‘rear view mirror’. But effective policy rates are priced to reach a fairly restrictive 5.0-5.5% in the US1 and nearly 3% in Europe by mid-2023, just as growth and inflation weakness from tightening already feeding through the system starts to bite. In turn, a pause in the dominant force of rising discount rates driving weakness in asset prices this year almost certainly offers some respite: the question is how much.

The balance of forces favours meaningful cuts once policy reaches its ‘peak’, with BNPPAM research forecasts of sizeable cuts (to 11⁄4%) by early 2024. We expect the US to lose three million jobs early in 2023, with payrolls falling by 300 000 or more. The housing market should continue weakening, and while it is fair to warn against drawing too many parallels with the GFC, especially on the impact of housing on growth, the impact of inflation should be more obvious given the stickiness of housing rents on services inflation. Europe’s economic outlook is similarly poor, with greater downside risks from the ongoing war and the energy crisis, with less of a savings buffer in household balance sheets to boot.

Every risk has attached to it a price. European equities for example look even more vulnerable after the latest rally, with earnings expectations still overly optimistic in context of the weak macro environment we anticipate. Some Asian markets, and parts of US tech, look more interesting – and the latter could benefit considerably should discount rates settle down. All in, we are neutral on equities, focused on relative value.

By contrast, being long high-quality European corporate credit at (still) fairly distressed valuations remains compelling to us – and our largest risk position in BNPAM multi asset portfolios going into 2023. At the time of writing, although lower than the 2020 crisis levels seen a few months ago, the implied default rate for the best-rated European corporates is still 8%, multiples of both the worst five-year rate and any historical average. And, with firm fundamentals, the prospect of supernormal profits seems significant. Unusually at this point in the cycle, leverage ratios for European IG companies are contained and falling and interest coverage is high. Corporate balance sheets look firm from a credit investors’ perspective: companies are long cash and with longer duration debt.

We also favour commodities, ex agriculture and livestock. This is an area that continues to provide important diversification for multi-asset portfolios, benefits from the shift towards ‘going green’ and acts as a hedge for some of the geopolitical risks that pepper the investment horizon. Having been short of government bonds for most of this year, quite significantly so during some periods – we are today neutral. But with circa 4% returns ‘locked in’ to US 10 year bonds, valuations in some segments of bond markets are starting to look interesting to be long of in 2023.

(1) 4.9% in OIS rates plus 50bp for balance sheet run off using the Fed’s own estimates.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals