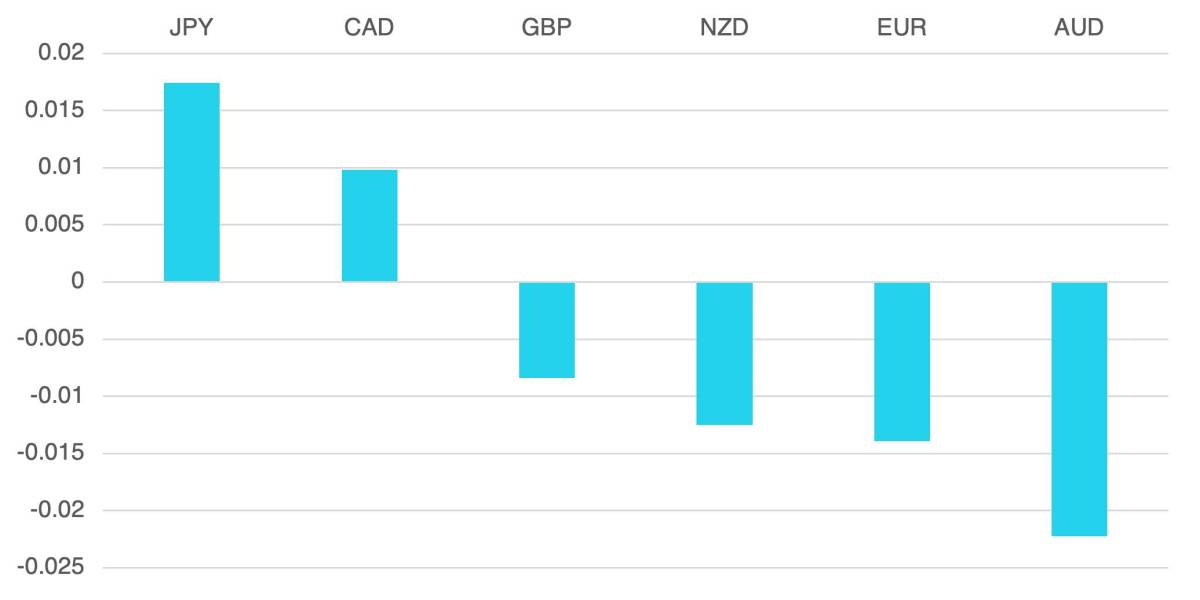

Last week saw another week of strong data from the US. This led the market to disregard any level of terminal rates as markets look to be set for higher and longer than expected. Inflation remains strong with the risk off theme continuing. The USD showed strength with the DXZY closing +1.3% on the week.

The Euro lost vs the USD but remained flat against other crosses. The ECB continues to talk about further 50bps rate increases and this helped support the single currency.

GBP was lower vs the extending dollar but remained on the front foot vs other pairs. This was broadly due to a PMI release to the upside, but the currency continues to remain fragile.

Commodity currencies felt the effect of the strong dollar and rising yields as they continued to lose vs the US Dollar. NZD lost around 15% while the AUD lost more than 2% as the risk off continued to hit the commodity currencies hard.

Oil continued had its quietest week in a while as it traded broadly unchanged on the week.

The week ahead sees a possible break in the deadlock for the border of NI and the EU with rumours swirling late in the week that a deal was possible, Data wise we have retail sales, GDP and PMI from around the world economies.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Connect with trademakers

Follow us for the latest news & insights

Cromwell FX Market View

Fed Moves to Higher and Longer

first appeared on trademakers.

The post Cromwell FX Market View Fed Moves to Higher and Longer first appeared on JP Fund Services.

The post Cromwell FX Market View Fed Moves to Higher and Longer appeared first on JP Fund Services.