- Domestic economy is under pressure – but the market is cheap.

- Bonds are no longer boring.

- The US is expensive, and emerging markets overlooked.

- Geopolitics impact commodities.

2024 is not going to be a year of rapid or sustained economic growth. Market consensus in recent weeks seems to have shrugged off recession fears and is pricing in a Goldilocks scenario, where central bankers cut interest rates but not because they are forced too by an economic hard landing. We aren’t quite as optimistic. Countries and corporates that have loaded up on debt in an era of zero rates will struggle to meet borrowing costs. Any economic wobble will hit tech and growth stocks hardest, and hot money will flow to lower risk assets.

Domestic economy is under pressure – but the market is cheap

As for most developed markets, the growth outlook for the UK is underwhelming, with GDP expected to grow by 0.6% next year, with a lingering risk of recession. Inflation is likely to trend lower but remain elevated, versus both the US and Bank of England target for some time.

But good news for investors – this bad news is priced into the market. The UK stock market has traded on a discount to its international peers for a number of years – first Brexit, then a lack of tech stocks, and a political maelstrom have made the US more attractive on a relative basis. But we believe there are some great companies in the domestic market being unfairly discounted.

And while volatility is likely to continue through 2024, on a long-term view this could be a great opportunity to pick up cheap stocks with international revenues, attractive dividends, good dividend cover and robust balance sheets.

Bonds are no longer boring

We appear to be the only ones, but we’re listening to the forward guidance of central bankers when they say this is a pause not pivot, and rates are likely to stay higher for longer. We therefore expect no imminent big downwards movement in bond yields but see scope for lower yields (and higher prices) further out, with higher volatility along the way.

Investors should not be put off by this outlook – we think this could the most interesting entry point for bond investors in decades. There is potential that you are either rewarded with income – from higher-for-longer yields – or growth, as yields fall. Volatility is hard to stomach but can offer opportunities for good quality active fund managers to take advantage of price fluctuations.

We think high quality corporate bonds offer an attractive yield premium over government bonds. However, this premium is less than you expect to see in a recession – so we see downside if the economic outlook deteriorates as you are not being adequately compensated for that risk.

The US is expensive, and emerging markets overlooked

For equities, growing corporate earnings will be challenging. Slow economic growth and still high inflation mean lower margins. However, valuations are below average in most global markets and offer upside for long-term investors.

Many Asian and emerging market companies are trading at a significant discount compared to their developed market counterparts. China, in particular, is a beaten-up region we think is worth looking at despite the negative headlines. While there are clearly question marks over some sectors such as property, looking ahead over the next five to 10 years, this presents an attractive entry point for investing in China.

On the flipside, valuations in the US look close to fair value when compared to their history. The top 10 constituents of the S&P 500 are trading at significant higher valuations compared to the rest of the market. We therefore don’t consider the US to be the most compelling market to buy going into 2024. Every portfolio should have a good allocation to the US, but we encourage investors to diversify their risks to include other styles, sectors and countries. While recession risks can sometimes create a buying opportunity for contrarian investors, we think the macroeconomic headwinds in Europe are just too tough to justify investing new money in the region this year – though as with all major economies it has its place in a diversified portfolio.

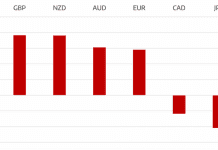

We are not bullish on Japan either – though for different reasons. Lower interest rates than in the rest of the developed world should boost the attraction of equities and prove a tailwind for the market, and there are interesting governance reforms in the region. But the weakness of the yen has dragged on performance for UK investors, and we expect this to continue.

Geopolitics impact commodities

The Israel-Hamas war has had a devastating impact in the Middle East. It has also had a global market impact, pushing up the price of both gold and oil amongst other commodities.

The perceived safe haven of gold offers protection against inflation over the long term, by sustaining its purchasing power, but is a poor hedge against shorter term price rises. We think it is expensive at these levels, but it is likely to remain so due to record peacetime government debt levels and heightened geopolitical tensions. In 1973, a war between Israel and its neighbours led to a crisis which saw the price of oil quadruple within a year. Investors should expect higher oil prices for the foreseeable future.”

The article is by Emma Wall, head of investment analysis and research, Hargreaves Lansdown.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals