Last week was a quiet one as lack of further data coupled with the expectations of early rate cuts from the Fed diminishing. The Fed is currently holding rates with a March cut priced at 20% compared to 65% at the beginning of 2024.

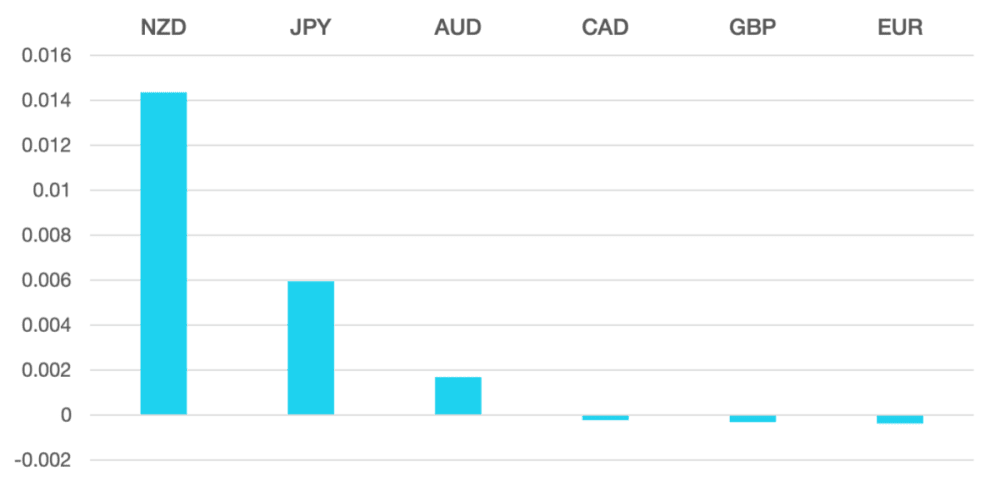

The USD broadly moved in a sideways pattern vs all other majors . The DXY closed above the 104 level. We should see the USD have further gains as the rate cut hopes fade.

The Pound is still struggling for any gain’s vs a strong Dollar. A positive is that it remains the best performer of the G10 currencies vs the Dollar losing around 1% so far and may have its seventh week streak vs the Euro continue.

Euro continues to struggle. With poor data the single currency hit a fresh 13 week low and German Yields moved higher. As ever the US Dollar has led the fall for the Euro as the unwinding of interest rate cuts have only helped the Dollar and left other currencies languishing.

Commodity currencies reversed the previous weeks struggles as the risk on environment continued in equities. The AUD managed to break into positive territory for the week having touched a 3-month low. RBA lowered its 2024 GDP forecasts but still expects rates to touch around 4% by years end. Continued concerns over the health of the Chinese economy continue to weigh on the Aussie

The week ahead we have the important US CPI which will certainly bring some volatility to the week. The market and the Fed are closely watching the inflation situation and if the number disappoints, we may see rate cuts being priced back in quicker.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Quiet week with volatility on the horizon first appeared on trademakers.

The post Quiet week with volatility on the horizon first appeared on JP Fund Services.

The post Quiet week with volatility on the horizon appeared first on JP Fund Services.