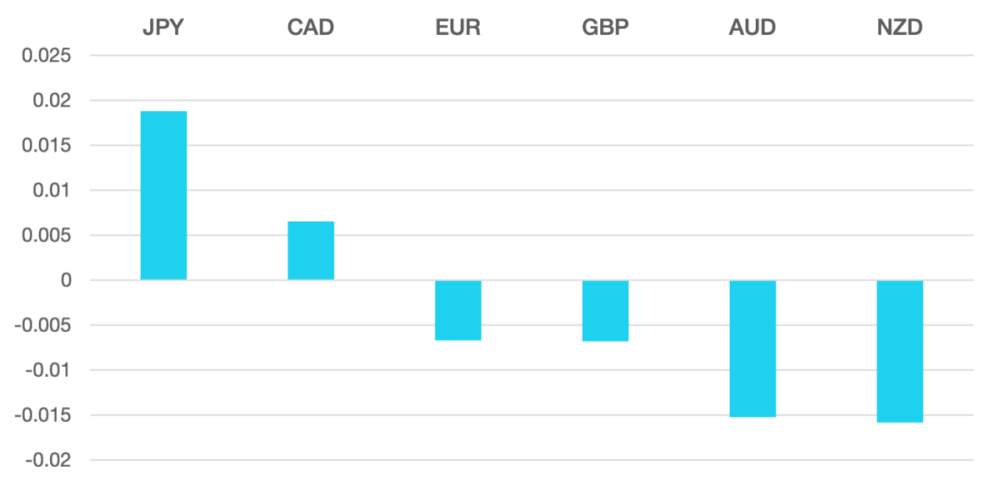

Last week the US Dollar moved into No.1 spot across the currency markets as both the Dollar Index and Yields surged through their resistance levels. It could be seen as early positioning ahead of the upcoming US Election, but these are still 2 weeks away.

On the back of this strength JPY had a difficult week. Chat of intervention by officials had little or no effect as further uncertainty continued with the snap elections. Another contributing factor was the Chinese market which continues to weigh heavy in the region. The stimulus announced previously has failed to really spur any follow through and traders are nervous about the region.

The US Presidential election is beginning to tell though. Despite the strong US Dollar we are seeing a lever of nervousness enter these final 2 weeks. We have payrolls next Friday as we head into November, and we are seeing the probability of rate cuts by the Fed sitting around 90% for November but as low as 70% for December. These set of unknowns will make the market more volatile over the next couple of weeks.

Oil continued its volatile path losing around 4%. I am certain Monday will see a change post the Israel escalation vs Iran, but the week saw oil close around $72.

The week ahead is just getting interesting and the next 9 days even more. We have the US Election looming large now along with heavy data.

We have BoJ interest rate and US GDP with the week rounded off by NFP.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dominant Dollar first appeared on trademakers.

The post Dominant Dollar first appeared on JP Fund Services.

The post Dominant Dollar appeared first on JP Fund Services.