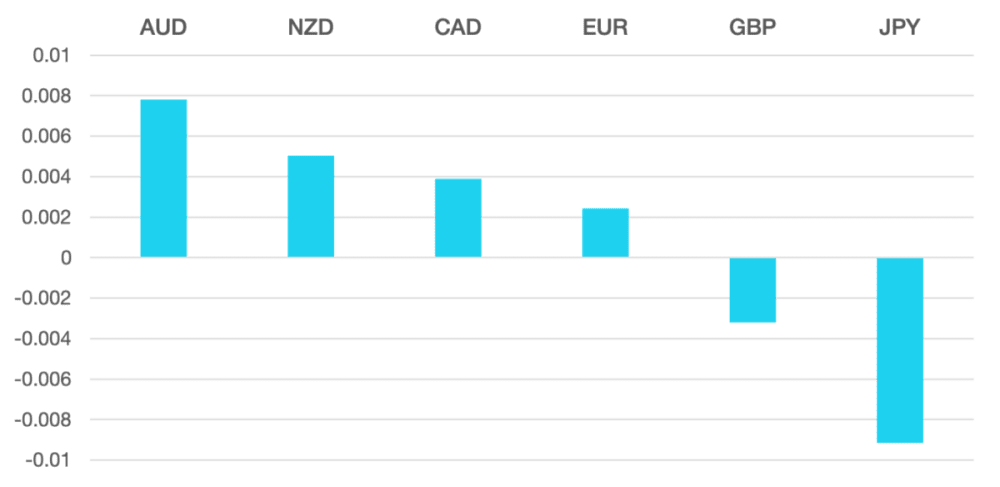

Last week we saw the Dollar move slightly lower as the markets look beyond the inauguration of Donald Trump on Monday.

The markets are now looking more towards the fiscal elements from trade tariffs to expansive stimulus under his Presidency.

The USD crept lower as it consolidated its recent gains however the trend still looks strong. The DXY lost 0.2%.

GBP still remained weak and vulnerable. The UK fiscal landscape remains troubled, and the GBP could come under further pressure. Gilts had a small rally.

The Yen was the firm winner on the week as expectation of BoJ action. The markets are looking to the BoJ to raise rates further. This was coupled with expectation of inflationary forecasts set to be revised higher. Traders have an 80% chance of an interest rate rise.

Oil continued to rise posting its fourth positive week in a row. WTI added a further 1% to close around $77.30.

The week ahead we have Donald Trump taking office on Monday and we expect a large amount of action during his first few days.

Data we have rate decisions from BoJ as well as PMI readings.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post A Quieter Week after Trump’s Inauguration first appeared on trademakers.

The post A Quieter Week after Trump’s Inauguration first appeared on JP Fund Services.

The post A Quieter Week after Trump’s Inauguration appeared first on JP Fund Services.