Last week with little surprise from central bank announcements the US Dollar retook pole position as President Trump continued to make tariff announcements on Canada and Mexico.

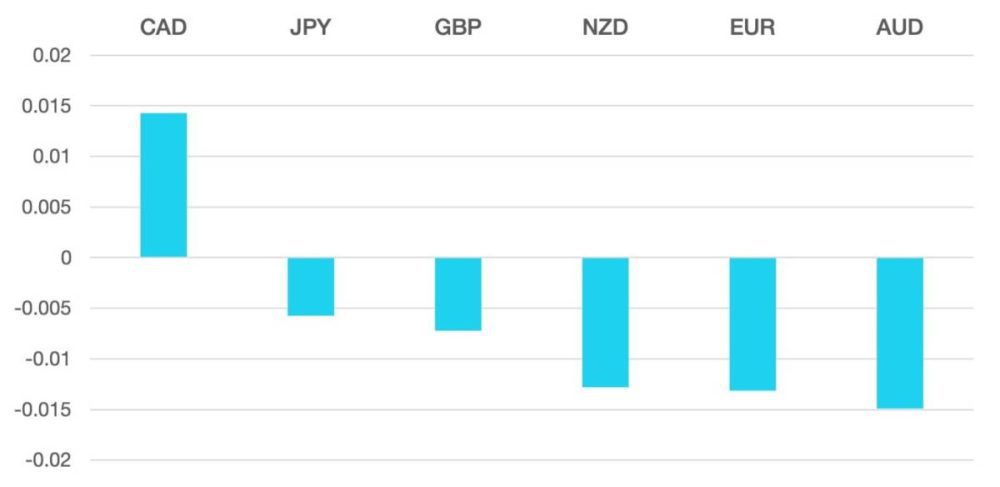

The US Dollar regained most of the losses from the previous week with the DXY 1% higher. the President firstly brought in tariffs against Canada and Mexico and only late Friday were these pushed back for 1 month as further talks were expected. This led to large swings not only in currencies but stocks as traders looked to how this could affect inflation.

The Euro lost ground while the GBP consolidated. With no surprises from the central bank decisions last week GBP made gains vs the Euro, but both lost to a resurgent Dollar. The risk of tariffs hurt the Euro more as Trump said a deal could be done with the UK. European car manufacturers bore the brunt in the stock markets.

The Yen ended the week second worst after last week’s gains. Post rate hike any level of support for the Yen seemed to evaporate sending the currency weaker through the week vs all major pairs.

All the commodity sensitive currencies gave up last week’s gains with AUD and NZD falling around 1.5% vs the US Dollar. AUD was the largest loser on the week as the latest data numbers reinforced the the RBA will move to policy easing. Q4 inflation numbers came in lower than expected with a 25bps cut expected in February.

Oil continued its move lower with WTI losing 1%. The next level of support is seen around the $65 level.

With President Trump it feels that every day is a new volatile day with the surprising Whitehouse announcements and comments.

From a data perspective we have PMI and NFP on Friday.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Dollar Takes Back Top Spot first appeared on trademakers.

The post Dollar Takes Back Top Spot first appeared on JP Fund Services.

The post Dollar Takes Back Top Spot appeared first on JP Fund Services.