Across the globe, it is encouraging to see such a significant increase in the amount of capital being invested in young, innovative companies. With the performance of the asset class also improving for many recent fund vintages, many investors are looking to put more capital to work in venture capital funds. This is likely to encourage even greater levels of venture capital financing in the year to come, says Christopher Elvin, Preqin Head of Private Equity Products.

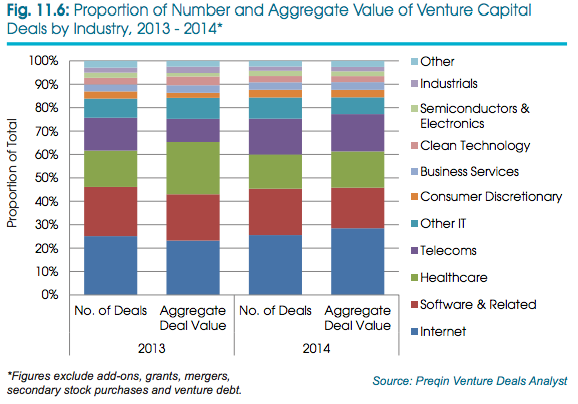

Year 2014 was a great year for the Venture Capital Industry. It recorded a significant improvement in its performance. The amount of venture capital invested in 2014 was $87bn, over 58% increase over previous year. The average return on venture capital fund was 26%, higher than any other private equity fund type.

Source: 2015 Preqin Global Private Equity and Venture Capital Report

The question is whether the VC industry can maintain the growth trend in 2015. Yes, it can. However, it has to tackle successfully some issues which this industry is facing today. Lets take a look at the challenges ahead.

1. An analysis of data reveals that the VC industry is still far away from the peak of 2000; Venture Capitals had invested $105 bn in start-ups in 2000 and brought them quickly for IPOs. But investors confidence was shaken by the tech bubble burst in 2001 and investment fell steeply below $30 billion. Since then, the venture capital continued to struggle to return to its golden days. The investment never reached even one-third of 2000 level. It took a decade to overcome the crisis and only recently the VC industry has started looking up. Last year it could reach $87 bn, but yet far away from $105 bn. The Industry has to work hard to cross its own earlier peak and sustain that. One silver lining is that the average number of deals during last two years matches with 8000 deals in the peak year.

2. The uninspiring returns by the venture capital industry since the dot-com crash have made fundraising tough. IRR of venture capital tumbled into negative from a high of 38% IRR achieved in 2000. Only after 2008, IRR started moving up. With the improvement in financial markets, Venture Capital funds have delivered returns on par with the All PE benchmark over three years. With high returns by the VC industry in 2014, fundraising is picking up. This need to be consolidated and improved further.

3. The VC industry has mostly been centred in North America. More recently, however, there have been encouraging signs in emerging markets. Five of the top 10 largest venture capital investments last year were in China and India. The aggregate value of deals in both countries jumped three times over previous year. China witnessed around 500 deals valued at $13bn and India around 400deals valued at $5 bn. China and India which together constitute one-third of world population offer good opportunities for start-ups. Though the two countries did not go into recession, both are passing through slowdown phase. As start-ups usually might take five to 10 years to mature, the Venture Capital managers would have to wait longer to exit from their investments and make reasonable return. The VC managers need to frame a long term strategy to increase their activities in Asian countries. The investors would have to make long-term bets that create both higher risks and opportunities.

4. North America remains at top for venture capital investment with deals valued at $54bn, more than half of the total $87bn in 2014. European economic crisis affected the Venture Capital and number of deals declined by 18% and deal value remained almost static at around $9 bn in 2014. 25 venture capital funds created in London since 2010 are yet to see an exit. Naturally it is difficult to do fund raising for European focus Venture Capital especially for start-ups.

5. The uncertainties created in the Global Economy in recent past are harmful for the VC industry. Investors would prefer to retain cash than making long term investment in new ventures. The VC managers have to play role of mentor and give strategic advice. The VC is not just capital. It is more than money for start-ups. The VC provides supportive capital in trying years and also during bad phase of economic cycle. The VC managers have to provide active support, work hard to solve tough problems with entrepreneurs and have to work with them during bad phase also.

In short, a recovery is well underway for the venture capital industry and investors are exhibiting signs of increased confidence, as reflected in the rising amounts of capital secured by venture capital funds, and deal and exit activity is growing. However, conditions are still tough, and venture capital fund managers seeking capital commitments need to continue to demonstrate to prospective investors that they have a strong strategy and deal pipeline, and a good alignment of interests, reports Preqin.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.