Last year was a beneficial year for all alternative assets except hedge funds. Private equity made profit from more attractive valuations of leveraged buyout. The average return on venture capital fund was 26%. The private real estate generated annual returns of over 16% in the last three years. But hedge fund performed worse with an average return of just 3.33%. The industry witnessed significant growth in assets and improvement in exit environments. The question is whether the industry can maintain the growth trend in 2015. In order to answer this question we need to address some critical issues the industry faces today and the ways it resolves these challenges.

1. Alternative Investment managers need to keep a close watch on CalPERS fallout.

Last September, the California Public Employees’ Retirement System (CalPERS) announced to exit all hedge funds. On top of this, this January CalPERS decided to cut back on the number of Private Equity Managers. CalPERS is the largest public pension fund in the U.S., with $300 billion in assets. It may have contagious impact on other public funds. Regular flow of fund from pensions, endowments and other sources of long term investments may slow down. The industry has to work hard to neutralize and control spread of CalPERS action across the pension and other institutions.

2. Though Globalization opened new opportunities, the Alternative Investment Industry has remained mostly centred in North America and Europe.

A Global Alternatives Survey shows that for the Top 100 managers, North America continues to be the largest destination for alternative capital (45%). Overall, 38% of alternative assets are invested in Europe and 7% in Asia Pacific, with 10% being invested in the rest of the world. Once Templeton, pioneer of International Investing, advised investors to invest globally. He said, If you search worldwide, you will find more bargains and better bargains than by studying only one nation. Today this advice is equally applicable to Alternative Investment Managers also. Globalization provides opportunity for alternative managers to search both new investments opportunities and new investors. When going global managers however need to understand clearly the taxation, regulatory, and other local implications. They should look for countries that have investment friendly environment with less government regulation and interference. Invest in countries that have lower taxes, higher rate of savings, higher research budgets and no significant fiscal or trade deficits. In recent years alternative investment is picking up in emerging markets such as China and India. Diversification globally will enhance return and boost risk-adjusted performance. Deloitte in 2015 Alternative Investment Outlook highlights that alternative fund managers will need to give their full attention on globalization in order to grow.

3. Uncertainties bring both threats and opportunities for managers.

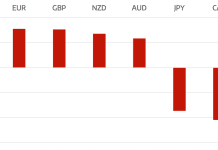

Drastic fall in Oil price, strengthening of dollar, geopolitical instability and other events have created a lot of uncertainties in the Global Economy. This has brought higher volatility in markets. Whether markets are moving higher or lower, one thing is for certain that volatility is here to stay. High volatility brings both the opportunities and risks for investors. The investors are likely to increase their Alternative investments portfolio to minimize exposure due to the uncertainties in the economy. Institutional investors, family offices and high-net-worth individuals are expected to enhance their allocations to alternative investments. Alternative investment managers may exploit this opportunity.

4. New regulations such as AIFM Directive have changed the working environment.

A recent survey reveals that new AIFMD requirements create significant challenges for the U.S. firms operating in Europe. “The Alternative Investment Fund Managers (AIFM) Directive will have a profound structural impact on the fund industry, both in Europe and internationally,” says Michael Hornsby, EYs AIF Club Chairman. The managers have to focus more on regulatory and compliance requirements. Alternative Investment Industry is often criticised for lack of transparency. Lack of availability of adequate information makes the Industry opaque. Industry transparency needs to be improved. “No media” strategy does not work anymore in the new environment. Managers need to use various media channels including social media to enhance brands. Transparency, openness and better compliance would create an atmosphere of trust.

5. The industry is passing through the consolidation phase.

Large institutional investors generally prefer to allocate to the large-sized managers. Small and mid-sized managers, even if performing well, are facing difficulty to raise capital, build an institutional infrastructure, and manage the complexity of global regulations. Small managers are likely to shut down or integrate themselves with large players to enjoy larger economies of scale. Large asset managers may use this opportunities to attract talents who have demonstrated high performance in the industry.

To conclude, Alternative Assets Industry has potentials to grow in uncertain and volatile market and alternative fund managers are quite optimistic about growth. But investors who have other lucrative investment options would continue to ask for better performance from the managers. Therefore,managers need to address these challenges and demonstrate to prospective investors that would overcome hurdles in order to grow in 2015.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.