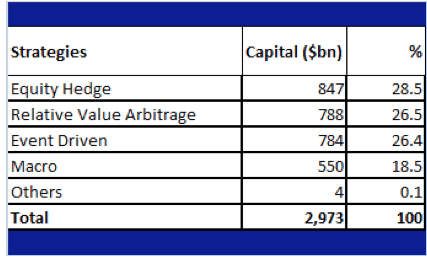

Today, Hedge Funds Industry grown to $3tn and inflows from investors are increasing. Hedge Fund Investor Strategies are critical and are part of the industry DNA. Hedge Fund Managers employ a diverse range of strategies and trade a variety of asset classes. But the top three strategies – Equity Hedge, Fixed Income based Relative Arbitrage and Event Driven are used to manage $2.45tn, over 80 percent of the total capital. And investors prefer to invest more in Hedge Funds based on these strategies.

Let us have a closer look at the three strategies.

1. Equity Hedge,

2. Relative Value Arbitrage

3. Event Driven

To visualise that better:

Source: Hedge Fund Research

Equity Hedge strategy dominates with $847 billion capital

Equity Hedge strategy is the top strategy and manages 28.5% of total Hedge Funds capital. This category continues to grow with $33 billion inflows in the first six months of the current year.

The equity hedge strategy is commonly referred to as long/short equity or market neutral. In Long/Short strategy, hedge fund manager either purchases stocks that are undervalued or sell short stocks deem to be overvalued.

In Market Neutral strategy, a manager applies the same basic concepts, but seeks to minimize the exposure to the broad market. This is done in two ways. If there are equal amounts of investment in both long and short positions, the net exposure of the fund would be zero. The second way to achieve market neutrality is to have zero beta exposure. In this case, the fund manager seeks to make investments in both long and short positions so that the beta measure of the overall fund is as low as possible. Either of these long/short strategies is used within a region, sector or industry, or is applied to market-cap-specific stocks.

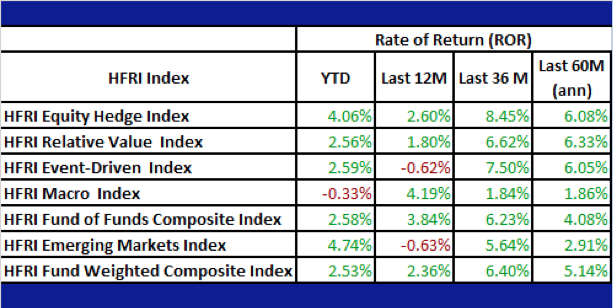

The HFRI Equity Hedge Index gained 4.1% in the first half, also the strongest outperformance compared to U.S. equities since the first half of 2010. Equity Hedge strategy has given high return over a long period, it posted an average gain of 8.45% in last three years.

Relative Value Arbitrage (RVA) and Event Driven (ED) have almost equal capital

The next two strategies Fixed income-based Relative Value Arbitrage (RVA) and Event Driven (ED) in are equal in popularity with almost matching capital of $788bn and $784bn respectively.

Fixed income-based Relative Value Arbitrage (RVA) received strong inflows of $9.3bn from investors in the first half, bringing total capital in RVA strategies to $788 billion, 26.5% of total HF industry capital. Relative Value Arbitrage is a catchall for a variety of different strategies used with a broad array of securities. The underlying concept is that a hedge fund manager is purchasing a security that is expected to appreciate, while simultaneously selling short a related security that is expected to depreciate. Related securities can be the stock and bond of a specific company; the stocks of two different companies in the same sector; or two bonds issued by the same company with different maturity dates and/or coupons.

Event-driven managers try to benefit from corporate shake-ups such as mergers and acquisitions or leadership changes. Investors allocated $5.5 billion to Event Driven (ED) strategies while Event Driven strategies manage $784 billion globally, 26.4% of total industry capital.

While the HFRI Relative Value Arbitrage Index gained 2.56% in the first half of this year, the HFRI Event Driven Index gained 2.6% during the same period. Both strategies have shown good performance and given annualised return exceeding 6% over a period of three to five years.

Source: Hedge Fund Research Indices

While Macro strategy also manage $550 billion, they received the smallest inflows of $4.26 billion from investors in the first half. The macro strategy bets on macroeconomic trends using stocks, bonds, currencies, interest rates and others. Macro strategy managers invest in stocks, bonds, currencies, commodities, options, futures, forwards and other forms of derivative securities. They tend to place directional bets on the prices of underlying assets and they are usually highly leveraged. These are the strategies that have the highest risk/return profiles. While the HFRI Macro Index posted a decline of 0.3% for the first half, it has given high return of 4.19% in last 12 months.

To sum up, Equity Hedge, Relative Value Arbitrage and Event Driven are the top three Hedge Funds strategies that are preferred by the investors and have given high annualized return of over 6% in past five years.

Read More:

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.