You have a high-potential idea with faith and passion to make a big success. All you need is to fund at different stages -from idea to reality. Capital can come from many sources provided the idea shows a promise to be converted into a commercial venture. Startups now have a large ecosystem; many investors and funds have joined the expanding pool of funding. Private Equity, Venture Capitals and Angel Investors all are important sources for funding startups. They nurture ventures at early stages of their development and act as links in the finance value chain from idea to IPO.

Diverse categories of investors have come up who invest in new ventures at different stages of journey towards commercial success. These investors believe in the philosophy of ‘higher risk, higher reward’. They take a big risk in your big idea. You have to make them feel comfortable that you have right idea and right team that can make a revolution.

Startup needs seed money

Every new venture requires some initial capital to start, known as seed money or seed capital. This comes from your close friends and family members who see your passion and have faith in your ideas. They come forward to help venture turn dream in reality. Seed money is also available from some government agencies and universities. Private investors and philanthropists like Warren Buffet and Bill Gates too have set up foundations and trusts to fund startups activities for community development.

Accelerators and Incubators help germinate seeds

Accelerators offer hands-on assistance to startups besides some finance. To start with, you can join an accelerator’s short duration program, say for three to four months. You get funding, free office space, bundled professional services and mentoring. In exchange, the accelerator takes about five percent equity stake in your company. It helps the startup get off the ground.

If your idea needs a longer time span say more than a year or so to conceive and develop, you may look for an incubator. An incubator brings in an external management team to manage an idea developed by your team. Incubator too provides a physical office space, networking opportunities, and basic business services. These facilities save your time and energy and enables your team to focus more on the core activities. The incubator however takes a larger amount of equity, compared to accelerator. Accelerator and incubator both have reduced initial capital cost and time to germinate seeds.

Angel investors take early stage risk

Then come Angel investors. They are affluent individuals who invest in your idea at a very early stage. They fund and take some but not controlling stakes in the company. They are involved in the strategic decision making process. Angels generally opt out in the next round of financing, selling their stakes at higher valuations depending on success of the idea. They fill in the critical gap between seed money and VC stage before your project moves to PE and IPO stage in the finance value chain.

Venture Capitals nurture through funding series A to F

After the seed funding, VCs provide funds for growth. Venture capital investments are made in exchange for some equity in the company. VCs provide cash required at various stages of development through a series of rounds A to F, provided the project continues to move through successfully. Successful completion of each milestone enhances market valuation of the start-up company.

VCs are generally active investors. Venture capital firms do not just provide capital, rather use their knowledge, experience and network to help the company achieve success. Experienced team of the venture capital firms usually plays a key role in making strategic decision and guiding the new company through the development process.

Private Equity invests in the start up’s long term growth

Private equity firms raise funds from long-term investors such as pension funds, endowments, and high net worth individuals. PEs use these funds, along with borrowed money, to invest in ventures that have the potential for high growth. Their investment is generally for a three to seven year period.

PE investors take controlling stakes in the company. Private equity seeks to create value over the long-term.

IPOs reward early investors

The VCs and PEs invest in companies always with intention to exit at a premium. They invests in startups early and earn a big pay-off in IPOs later. Once high valuation is achieved, they sale their stake in full or part through IPOs and earn huge profits. The growth of the economy and booming share markets have created favorable conditions for PE and VC-backed companies to issue IPOs. This makes their exit easy, making substantial profits for their investors.

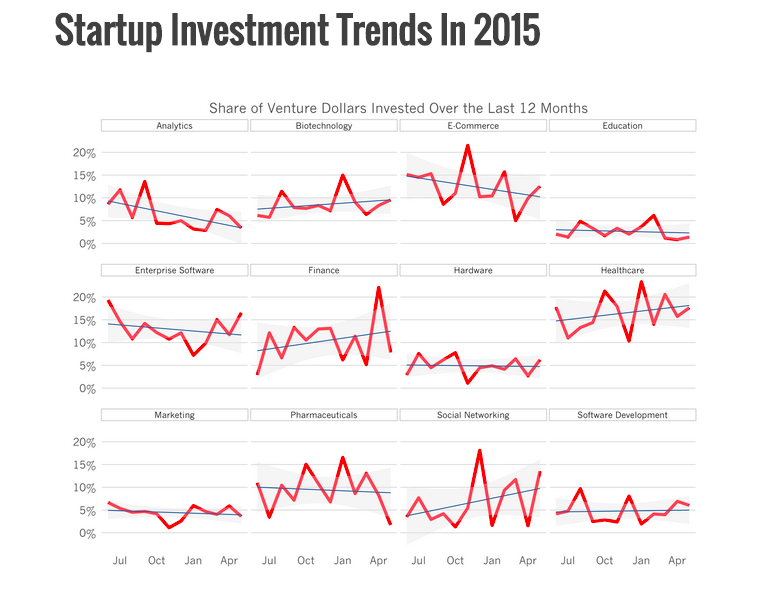

Startup Investment Trends

According to Tomasz Tunguz with reference to Mattermark data, in the last six months more than $57B was invested by VCs. The sectors that attract investors nowadays are biotechnology, financial technology, healthcare, and social networking.

Source: Start Ups Investment Trends in 2015

To sum up, a startup requires several rounds of financing before it generates adequate revenue. PEs, VCs, Angel Investors and others are available with risk capital. You may fund your venture through gradual dilution of your stake in the company as it grows.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.