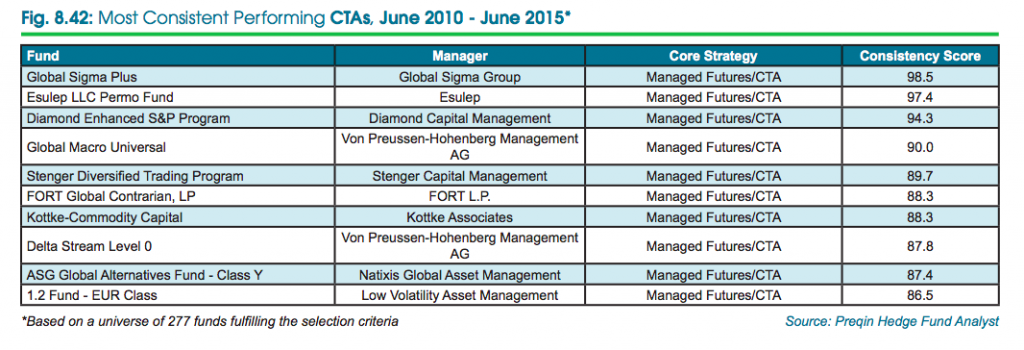

The Global Sigma Plus fund is at the top of hedge funds which have most consistently delivered strong and stable performance. This finding is based on ratings of hedge funds by Preqin– a leading source of information for the alternative assets industry. The Global Sigma Plus fund have consistently generated higher returns and lower volatility than their peers over the past five years from June 2010 to June 2015. The fund follows the CTA strategy for investments and is managed by Global Group.

The analysis is constructed on the database of over 12,000 hedge funds. Out of these, around 1350 funds have completed five years and so only these hedge funds were considered for comparative ratings over their consistent performance. The funds were ranked over four criterion: annualized return, volatility, Sharpe ratio and Sortino ratio.

The percentile rank methodology was used and the average of the four percentile values was considered to determine the fund’s Consistency Rating. Funds were grouped into seven top-level strategies- Equity, Macro, Event Driven, Credit, Relative Value, Multi-Strategy, and CTA. Separate ranks were assigned within each strategy.

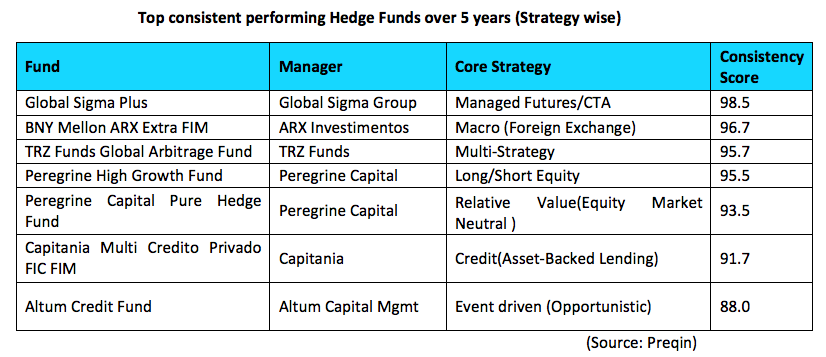

CTA strategy based Global Sigma Plus has scored 98.5. Macro, Multi and Equity are next three strategies which have been adopted by hedge funds with high consistency scores exceeding 95. Event Driven top fund Altum Credit Fund has consistency score of 88.0 only. The performance of Event Driven funds is more dependent of availability of good opportunities and so is less consistent.

Other key highlights:

- Best performers in two out of seven strategies are from one firm, Peregrine Capital. While its Capital Pure Hedge Fund with relative value strategy has scored 93.5, Peregrine Long/Short Equity High Growth Fund has high consistency score of 95.5

- Long/short equity is the most commonly sought-after strategy by the investors. Out of 1350 shortlisted funds for analysis, 518 funds use equity strategies. But their performance is highly concentrated among a few. Four of the five best equity hedge funds are from the two managers Peregrine Capital and 360NE. All of the top 10 consistent performing equity strategies funds scored in the 90th percentile for each criteria.

- Top list in the macro strategy is dominated by ARX Investimentos and Verde Asset with three and four funds in the top ten, respectively.

- In the multi-strategy, six of the top ten funds are based in Brazil. While the TRZ Funds Global Arbitrage Fund is at the top with a score of 95.7, ARX Investimentos has two funds in top ten.

- Third Point Management occupies four positions in the list of top ten Event Driven Strategies Funds.

- Only 51 fund managers appear in the list of top ten consistent performer with any of seven strategies over last five years.

- ARX Investimentos has emerged as a top performer with highest number of its funds appearing; its six funds are in the list. ARX is followed by three fund managers- Verde Asset, Third Point and III Capital – with four positions each. Peregrine Capital appears at three places and four managers at two places each. All other 42 hedge fund managers have done well in only one fund each.

- The Hedge Funds Industry employs a diverse range of strategies. But managers prefer specialisation and generally concentrate in one or two strategies for better consistent performance. Out of 51 high performing fund managers, only four could in the top 10 list of two or more strategies.

To sum up, while there are thousands of fund managers offering different products, only a few has given consistently high performance on the long run. Institutional investors, which make up two thirds of the total hedge fund capital, prefer tested and large hedge funds. Hence, the fund managers should concentration on a few funds and improve their performance, rather than on their quantity. Generating consistently better performance is more critical than any other factors for fundraising in a competitive environment.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.