Australia and India will be the significant contributors for capacity growth in Asia and Oceania’s LNG Industry for the outlook period 2018 to 2022. Australia is set to have the highest liquefaction capacity additions while India will have highest regasification capacity additions among all the countries in Asia and Oceania, according to leading data and analytics company GlobalData.

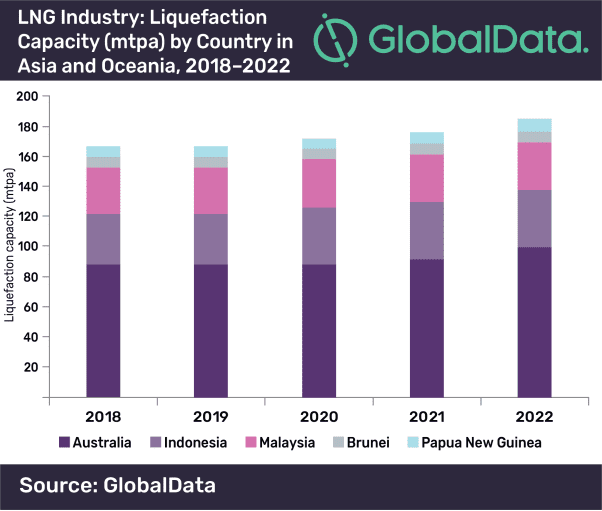

The company’s report ‘LNG Industry Outlook in Asia and Oceania to 2022’ forecasts total liquefaction capacity in Asia and Oceania to grow by 11% from 166.4 million tons per annum (mtpa) in 2018 to 184.7 mtpa by 2022. Similarly, the total regasification capacity is expected to grow by 43% from 24.7 trillion cubic feet (tcf) in 2018 to 35.3 tcf in 2022. Eight LNG liquefaction terminals and 67 regasification terminals are expected to commence operations in the regions by 2022.

Australia will lead Asia and Oceania both in terms of liquefaction capacity additions and capex. The country will have the highest liquefaction capacity additions of 11.5 mtpa, increasing from 87.8 mtpa in 2018 to 99.3 mtpa by 2022. The country is expected to spend $43.7bn or 65% of the region’s total capex on new build liquefaction terminals during the outlook period.

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, explains: “Australia already has significant LNG liquefaction capacity and is one of the leading exporters of LNG globally. The country is further ramping up its liquefaction capacity due to abundant conventional and coal seam natural gas resources, and increasing global natural gas demand.”

GlobalData identifies Indonesia as the second highest country in Asia and Oceania, in terms of total liquefaction capacity additions for the outlook period. The country’s liquefaction capacity will reach 37.9 mtpa by 2022, with planned capacity additions of 3.8 mtpa during the period.

In terms of regasification capacity additions, India will lead Asia and Oceania with total additions of 4.1 tcf. The country’s regasification capacity would increase from 2.8 tcf in 2018 to 6.9 tcf by 2022. The country is expected to spend about $6.9bn on development of upcoming regasification terminals during the outlook period.

Tejomoortula adds: “India is driving the growth in global LNG regasification capacity due to its rapidly growing economy and thriving middle class population. The need to control growing pollution by replacing coal with natural gas for power generation is also driving natural gas demand in the country.”

Bangladesh will be the next highest country globally with planned regasification capacity additions of 1.8 tcf by 2022. The country is expected to spend roughly $3.7bn on the development of new regasification terminals.

In terms of largest liquefaction terminal by capacity in the outlook period, Ichthys in Australia is the top planned LNG liquefaction terminal in Asia and Oceania with a capacity of 8.9 mtpa. The terminal is expected to start operations by 2018 with capex of $37bn.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals