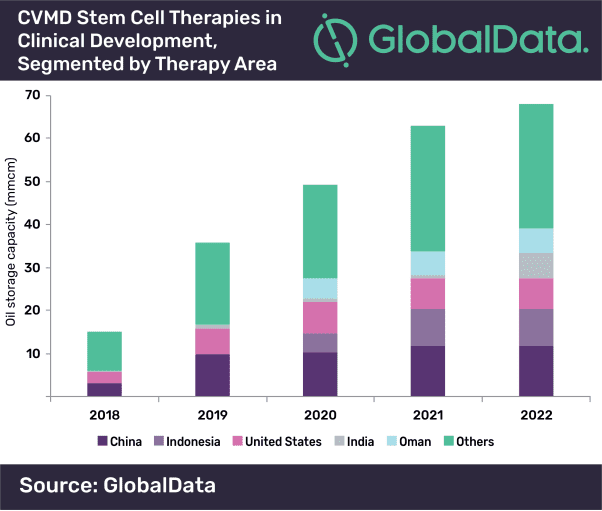

China and Indonesia will be the major contributors for the growth of the global oil storage industry, as they are set to add the most planned storage capacity among all countries over the period 2018–2022, according to leading data and analytics company GlobalData.

The company’s report ‘Global Planned Oil Storage Industry Outlook to 2022’ forecasts global planned oil storage capacity to grow from 15.2 million cubic meters (mmcm) in 2018 to 68 mmcm by 2022. Globally, 126 new terminals are expected to commence operations between 2018 and 2022. The US, China, and India are the major countries, with a highest planned oil storage terminal count of 20, 11 and 8 respectively.

China is the global leader with the highest planned oil storage capacity and also second highest among the countries in terms of CapEx spending for the forecast period. The country is expected to spend about $5.5bn during the outlook period. China’s new build capacity is expected to increase from 3.1 mmcm in 2018 to 11.7 mmcm by 2022, registering a threefold growth during the outlook period

Soorya Tejomoortula, Oil & Gas Analyst at GlobalData, explains: “China is rapidly increasing its oil storage capacity as part of its high priority program to increase its strategic crude reserves. The recent high profile trade talks between the US and China and the resultant trade tensions are further forcing China to boost its strategic crude reserves program.”

GlobalData identifies Indonesia as the second highest country in terms of planned storage capacity additions for the period 2018 to 2022. The country expects to increase the planned storage capacity by 8.6 mmcm by 2022 and has a capex of $2.5bn.

Tejomoortula adds: “As in China, Indonesia too has initiated a strategic petroleum reserves program that aims to store 30 days of crude, leading to the growth of oils industry in the country. Growing demand for petroleum products in Indonesia, especially in the eastern parts, is also driving the growth.”

The US will be the top spender in global planned oil storage industry accounting for about 17% of the global capex on upcoming storage terminals. The country will spend an aggregate amount of $6bn on new build refineries over the period 2018-2022. The country’s oil storage capacity would reach to 7.2 mmcm by 2022, should all the projects be realized.

In terms of capacity, Chandikhol in India is the top planned oil storage terminal in the world, followed by Jask in Iran and Lawe-Lawe CCT in Indonesia. In terms of CapEx, East Grand Bahama terminal in the Bahamas has the highest capex, followed by Hainan III terminal in China and Rapid in Malaysia.

This is an article provided by our partners’ network. It might not necessarily reflect the views or opinions of our editorial team and management.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals