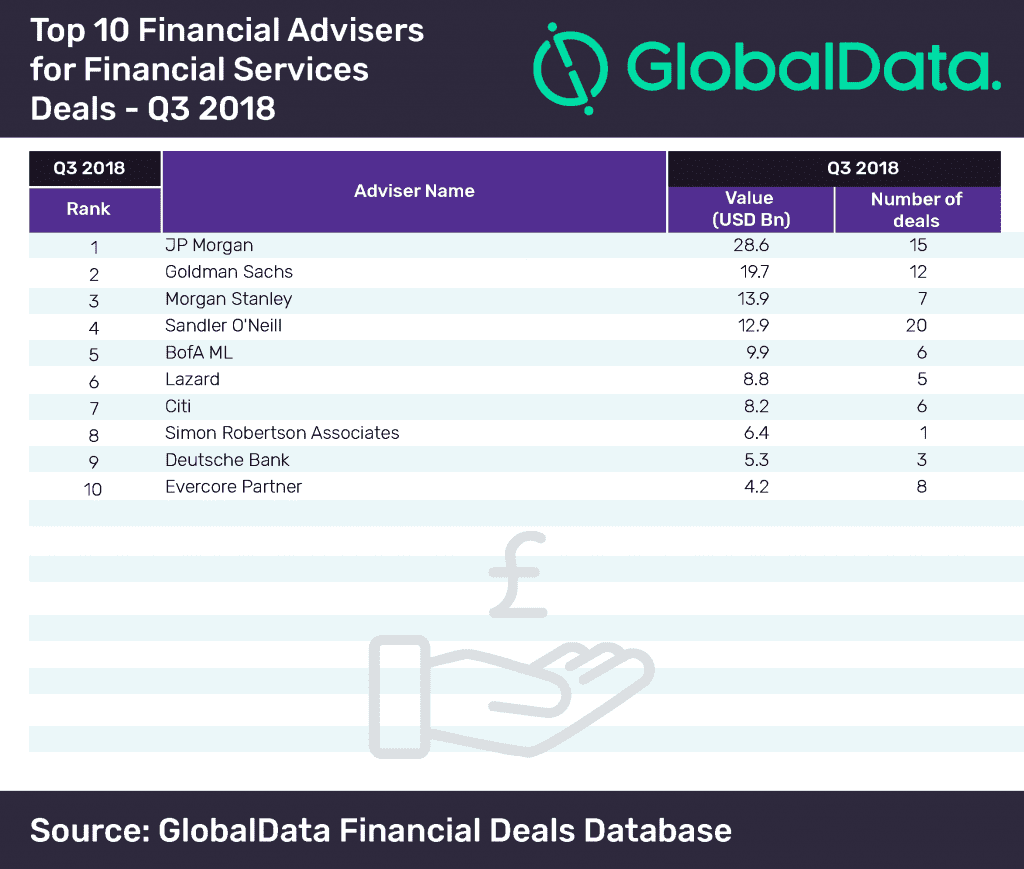

JP Morgan topped the rankings in the latest mergers and acquisitions (M&A) league table of the top 10 financial advisers for the financial services industry for Q3 2018, compiled by leading data analytics company GlobalData.

JP Morgan secured the top spot based on its total advised deal value of $28.6bn, from 15 deals during the quarter – the second highest in terms of volumes.

According to GlobalData, which uses its tracking of all merger and acquisition, private equity/venture capital and asset transaction activity around the world to compile the league table, Goldman Sachs and Morgan Stanley came in second and third with $19.7bn and $13.9bn, respectively.

GlobalData league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including advisor names.

Global financial services deals market Q3 2018

The financial services industry saw an impressive overall rise of nearly 84% in value – from $51.22bn to $94.19bn – during Q3 2018 when compared to the same quarter in 2017. Volumes too complemented the growth with over 25% from 633 to 795 during the quarters under review.

Citi, which stood seventh in the financial services league table, beat all its competitors in the global league table of top 20 M&A financial advisers released by GlobalData recently. The financial services industry’s top banker JP Morgan turned out fifth in the global list.

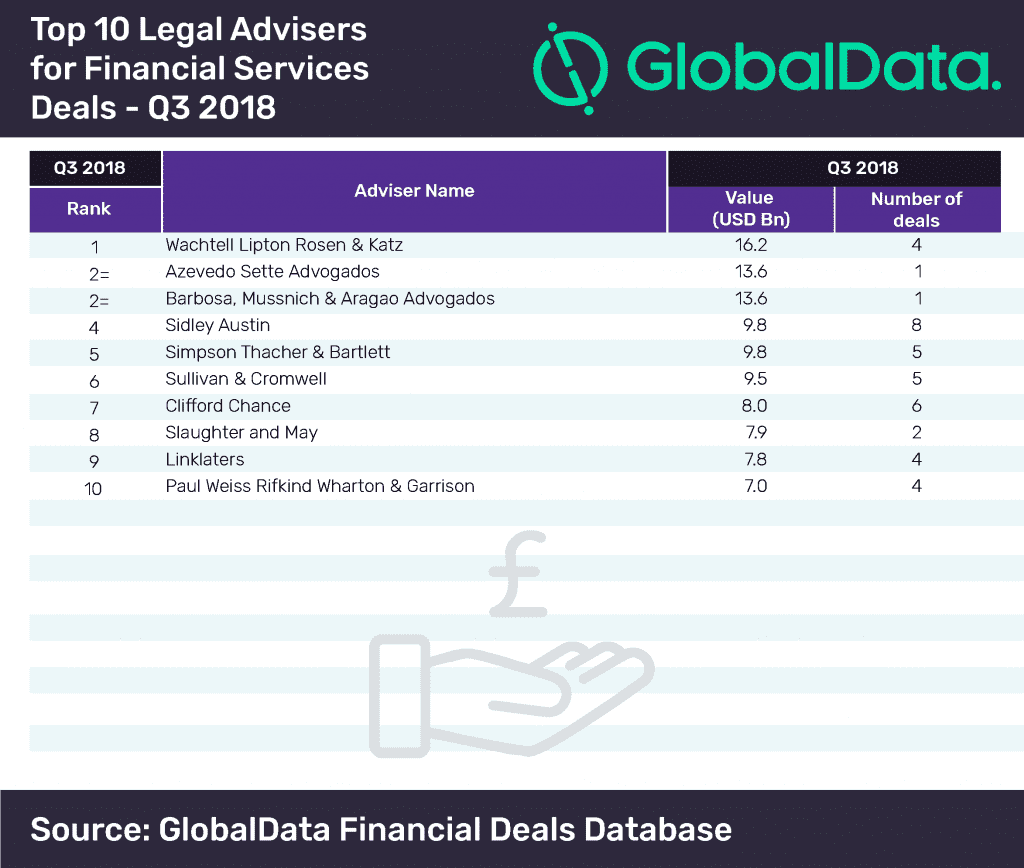

Morrison & Foerster tops the M&A legal advisers Top 10 table

New York’s Wachtell Lipton Rosen & Katz led the top 10 legal advisers table for Q3 2018 with a value of $16.2bn earned in just 4 deals – four less than the table’s highest deal-maker, the fourth-ranked Sidley Austin, which was valued at $9.8bn. Two legal advisers, Azevedo Sette Advogados and Barbosa, Mussnich & Aragao Advogados tied at the second spot with identical figures of one deal each valued at $13.6bn.

More than 4,000 companies use GlobalData league tables and to ensure further robustness to the data, the company also seeks submissions from leading advisors, through an advisor submission forms on GlobalData, which allows both legal and financial advisors to submit their deal details.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals