Credit markets have been a huge beneficiary of ultra-low interest rates and quantitative easing (QE) over the past ten years. In turn, this has forced investors to delve further into the fixed income space – away from their former reliance on government bonds – to achieve decent returns and compelling income. The underlying corporations who issue corporate debt have also benefited materially, enjoying a willing audience to finance their business by buying their debt at very low interest rates, and with long maturities.

However, we are now in a phase where central banks have stopped cutting interest rates, and some are now assessing the future pace of interest rate rises (the US has already raised rates eight times since 2015). Meanwhile, the central banks of the world which engaged in quantitative easing over the past ten years are now actively looking at ways to incrementally reduce their balance sheets. In Europe, for example, the European Central Bank (ECB) is soon expected to announce the end of formal QE and the active expansion of its balance sheet. Noteworthy, then, that the average cost for a European business raising financing in the credit markets has doubled since February, and is now at a level close to when the ECB first announced its corporate bond purchasing programme in March 2016.

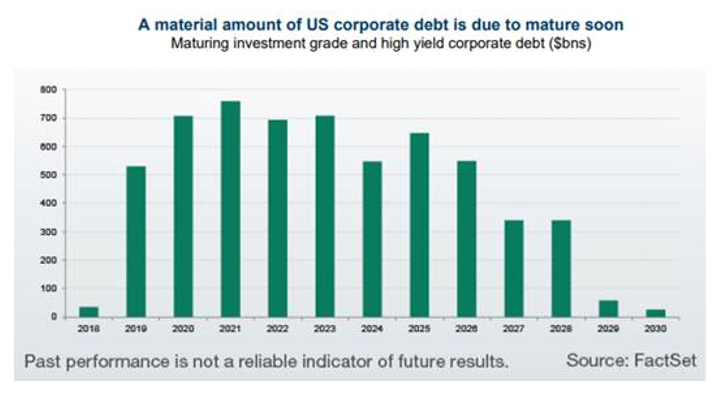

In summary, the game is changing, the cost of capital for corporates is rising and for credit markets this is important. One of the key challenges for 2019 and 2020 is the material amount of debt issued by companies over the past few years which is due to mature, and which will likely need to be refinanced. While the cost of financing at this juncture remains low in a longterm context, it is higher, and (in some markets) quite some way above the erstwhile lows of the current economic cycle. For many businesses, this is unhelpful but manageable; for others, it is likely to become problematic. For some, it will ultimately end in the disaster of default.

High debt levels echo the past, but with a twist

As they say, history never truly repeats itself, but it often rhymes. As we enter into the later stages of the current economic cycle, some echoes of the end of the last cycle (the 2008 crisis) are becoming apparent. In the run up to 2008, debt levels were high in both households (via mortgages) and financial businesses (like banks) – the two areas which would ultimately combine to create the ‘patient zero’ of the global financial crisis.

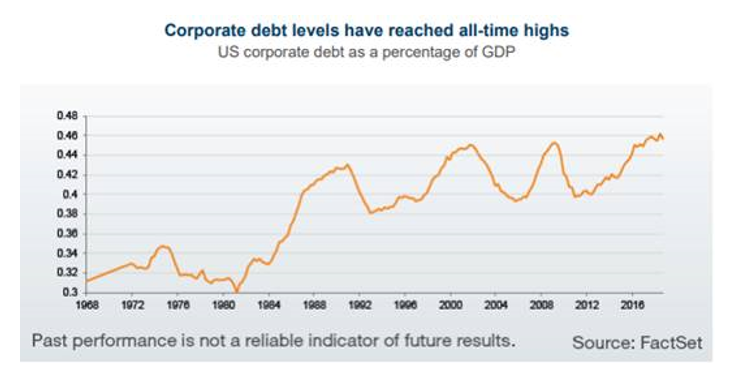

Today, this late cycle exuberance is evident once more, but in new places. US households at least have much lower debt levels relative to 2008, while heavy regulation in the financial sector keeps debt lower there too. This time around, the big debtors are non-financial businesses. According to data from the US Federal Reserve (Fed), the ratio of debt to assets for non-financial businesses is currently close to its highest level in two decades. Even more startling, and perhaps more concerning, is that corporate debt as a percentage of GDP in the US is now at an all-time high, as illustrated by the chart below.

Regulators, who were caught napping in the financial crisis of 2008, seem more alert to some of the exuberances in the credit markets this time round. In fact, in the US, the current Fed chair and his predecessor have both mentioned exuberances building up in the high yield and leverage loan space (higher risk areas of the credit market), which may become a material problem for parts of corporate America, if the cost of capital continues to rise.

Yet rising costs of capital are just part of the story. As long as corporate earnings remain robust, a company’s ability to refinance its debt at higher levels is more manageable, since growing revenues help to cushion some of the impact of higher financing costs. Real difficulties emerge when the cost of capital is higher and earnings are falling, or (in an economic recession) collapsing. In our view, we are in the latter stages of this economic cycle, meaning that this point is likely to become more relevant over the next 12-18 months, particularly for weaker businesses and lower-rated corporate debt.

Indeed, when this occurs, most of the pain manifests itself in high yield, lower-rated debt. However, given that around 50% of the higher quality, investment grade market is currently rated ‘BBB’ (the lowest possible rating for investment grade debt) compared to just 20% in 2007, this market may be more impacted than in the past.

What does this mean for credit exposure in our portfolios?

‘Easy money’ in credit markets has already been made in this economic cycle. Our exposure to credit is likely to come down further over the next 12-24 months, until more fundamental value appears (if our economic roadmap evolves as expected). The credit exposure that we still hold will continue to focus on the higher quality end of the market, liquid and more esoteric areas of credit with low correlation to other parts of the fixed income space (like asset-backed securities). We also continue to look at the alternative investment space, in particular hedge funds, as a way of monetising a more challenging environment for corporate credit.

This article has been written by David Absolon, Investment Director at Heartwood Investment Management, the asset management arm of Handelsbanken in the UK.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals