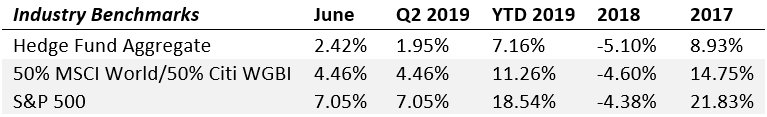

After dipping into the red last month, the global hedge fund industry returned to positive territory in June with an aggregate industry performance of +2.42%, according to the latest eVestment hedge fund performance data covering the month of June. This brings year-to-date (YTD) average gains to +7.16%, building on the positive performance the industry experienced from January to April of this year.

All major strategies and primary markets were positive in June, in contrast to what happened in May. Among primary strategies, Event Driven – Activist funds had the strongest performance in June, returning an average of +3.97%. These funds’ YTD performance is also among the strongest, at +8.96%. Long/Short Equity funds had a strong June as well, returning +3.17%, and lead in YTD returns among primary strategies at +10.00%. Long/Short Equity managers have benefitted from the global equity market rally, and many funds within the category were among the most-viewed on eVestment’s platform in June.

Other highlights

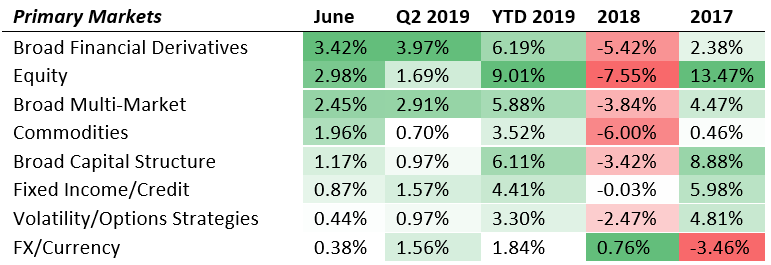

Among primary markets, funds focused on Broad Financial Derivatives had the strongest performance in June, returning +3.42% for the month, bringing YTD performance to +6.19%

In the equity funds spectrum, they also performed well in June and YTD, returning +2.98% for the month and +9.01% so far this year.

Among the sea of green in June, other notably positive average performances were turned in by Managed Futures funds (+3.77% in June), Quantitative Directional Equity funds (+3.08% in June) and Macro funds (+2.33% in June).

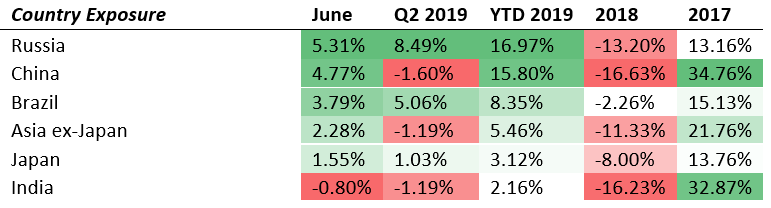

Russia and China focused funds continue their string of strong performances, returning an average of +5.31% and +4.77% respectively in June. Russia and China focused funds are also outshining the rest of the industry YTD, returning an average of +16.97% and +15.80% respectively. Both Russia and China funds are coming off strongly negative performances in 2018. Likewise, India-focused funds continue to have challenges, returning -0.80% in June and eking out YTD returns of only +2.16%. This is, however, an improvement from these funds’ disastrous -16.23% average returns in 2018.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals