eFront, a financial software and solutions provider dedicated to Alternative Investments, has published its latest Quarterly Private Equity Performance report, showing that venture capital funds globally reached their best post-2009 crisis period performance in the last Q4, surpassing the previous best recorded one year earlier.

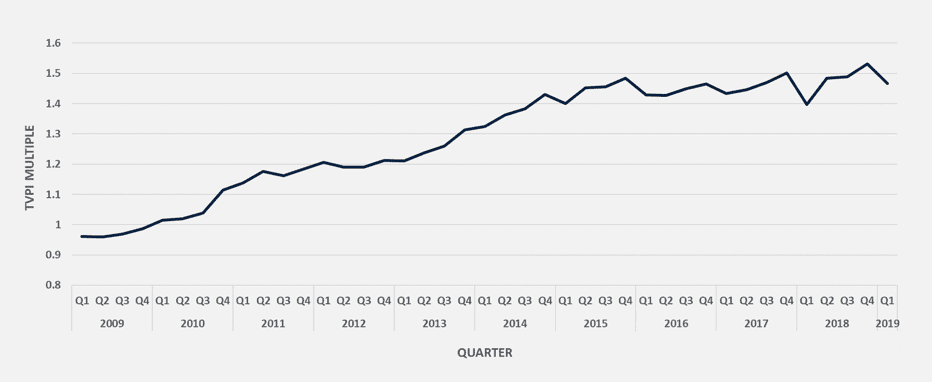

eFront’s latest Quarterly Private Equity Performance Returns shows that VC returns, as measured by multiples on invested capital (TVPI) have continued to recover from a drop in Q1 2018 (to 1.398x), reaching an all-time high of 1.531x in Q4 2018. Despite a slight fall in Q1 2019, performance remains well above the long-term average, and the calendar year of 2018 ranks first in terms of positive return deviation.

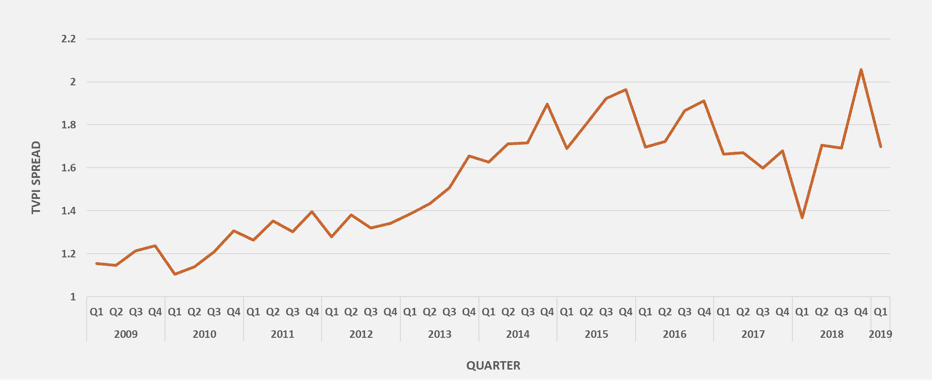

At the same time, risk – measured by the dispersion of returns between the top and bottom 5% of performance – has remained within the average of the period 2014-2019, despite a spike in Q4 2018, and below the levels of years 2014 to 2016, signifying that high levels of return are associated with comparatively low levels of risk (Figure 2).

The findings are a boost to the sector, following on from recent analysis from eFront that, despite improving performance, the majority of VC funds do not hit their hurdle rate.

Key findings

- Performance of VC funds globally reached 1.531x in Q4 2018 – the highest level on record – before dipping back below 1.5x in the first quarter of this year

- 2018 was the best ever year for VC performance, with high returns associated with low risk and shorter time-to-liquidity, as VC funds capitalized on a favorable exit environment

- Return dispersion in 2019 remains below the level seen in 2014 to 2016, at a TVPI spread of around 1.7x – equating to a comparatively low level of risk

- Time to liquidity has trended downwards since the record high seen at the end of 2015, and now sits at around 3.3 years

- Western European VC funds continue to significantly outperform the long-term average, pointing to a potential renaissance for the sector

Time-to-liquidity, meanwhile, has been relatively stable during the past four quarters, varying between 3.20 and 3.56 years, although the general trend is still downwards. 2018 is below the average in terms of liquidity deviation, confirming the trend initiated in 2015.

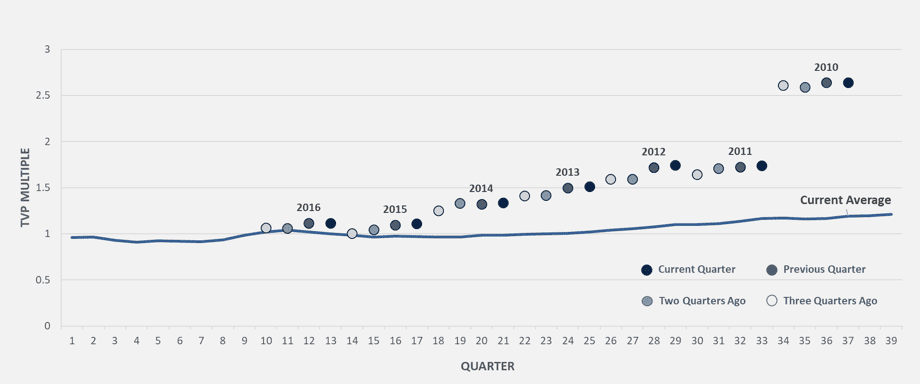

The situation for US venture capital funds has not evolved radically over the past year, but in Western Europe the picture is different, with funds here significantly outperforming the long-term average. Even with the integration of 2009 (an extremely high performing vintage) to the historical average, the significant positive spread between active funds and historical average remains visible, with 2010 funds performing particularly strongly. All vintage years from 2010 onwards are now outperforming the historical average, with Q4 2018 and Q1 2019 continuing this trend.

Tarek Chouman, CEO of eFront, commented: “Active venture capital funds recorded a very impressive close to 2018, far exceeding historical performance averages. These high last-quarter returns remain associated with comparatively low risk and shorter time-to-liquidity, as VC funds capitalize on a favorable exit environment. This global data masks a clear geographical divergence, as US funds registered a rather muted performance, while Western European VCs consolidated their outperformance, pointing to a potential renaissance for European venture capital funds.”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals