The Venture Capital (VC) Investments in Germany show resilience amidst global market uncertainties amongst major economies like China, the US, the UK, and India. GlobalData reveals that there is a need for an innovation strategy to cultivate unicorn startups.

Germany experienced a notable shift in venture capital (VC) investment trends in January 2024 despite a decline in the number of deals compared to the same month in previous year. While deal volume decreased, the total value of investments surged, showcasing resilience amidst global market uncertainties. This contrasted with declines seen in major markets like the US, China, the UK, and India. However, despite this growth, there is a pressing need for an innovation strategy to cultivate unicorn startups, reveals GlobalData, a leading data and analytics company.

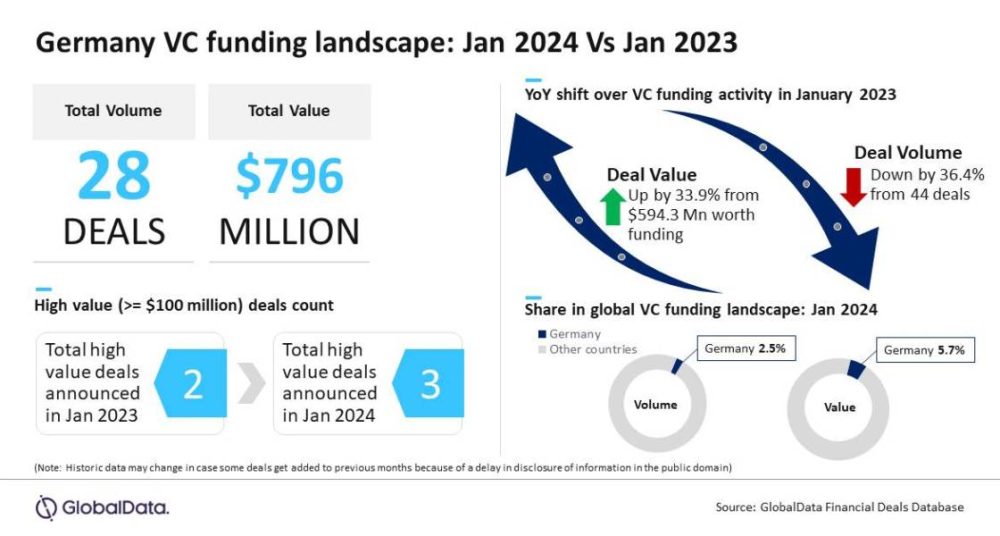

An analysis of GlobalData’s Deals Database reveals that a total of 28 VC funding deals were announced in Germany during January 2024, which is a year-on-year (YoY) decline of 36.4% compared to announcement of 44 deals during January 2023. However, despite the decline in deals volume, the total value of investments grew by 33.9% YoY from $594.3 million in January 2023 to $796 million in January 2024.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “It is interesting to note that Germany showcased this growth in investments value at a time when most of the key markets registered decline due to dent in investor sentiments amid volatile market conditions.”

Key markets such as the US, China, the UK and India witnessed respective VC investment values fall by 37%, 31.4%, 41.3% and 50.3% YoY in January 2024.

Bose adds: “While the UK and India did not see the announcement any VC deal valued more than $100 million during January 2024, Germany saw the announcement of few such deals.”

The notable VC funding deals announced in Germany during January 2024 include $294 million raised by Everphone, $129 million secured by Ineratec and $109.5 million raised by FINN.

However, Germany lagged peers in terms of unicorn creations. While the US and China saw the birth of three unicorns each during January 2024 and the UK and India saw the birth of one unicorn each, Germany did not mint any unicorn during the month.

Bose concludes: “As Germany navigates the evolving landscape of venture capital investment, the January 2024 data reveals both strengths and areas for improvement. While the surge in investment value showcases resilience, the absence of unicorn creations underscores the need for continued innovation and competitiveness. Moving forward, strategic efforts to foster unicorns and sustain investment momentum will be critical for Germany to solidify its position as a leading hub for innovation and entrepreneurship.”

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals