Exchanges today mirror the Internet networks of yesterday; they are siloed therefore lacking interconnection and are focused on a subset of assets. This fragmentation has been exacerbated, with the advent of the new digital asset markets. What can be the glue creating interconnectedness as the first truly hybrid full exchange and post trade ecosystem, bridging the gap between traditional and digital assets? How can this enable Exchange 4.0 for all types of products and services between players across the Fintech enabled capital markets value chain? Let’s explore how the fourth industrial revolution (sometimes called 4IR) can now lead to Exchange 4.0.

Growing pains for Digital Assets

There is an exponential growth in the digital assets market, with considerable institutional interest from the likes of Microstrategy, Mass Mutual, Ruffer, Fidelity, Tesla, etc.:

- Fidelity (06/15/20) – surveyed nearly 800 institutions in the US and Europe, and found that a third of big institutions own crypto assets.

- Deloitte Blockchain Survey (2020) – surveyed a sample of 1,488 senior executives across 14 countries and found 83% of the survey respondents believed digital assets would serve as an alternative or outright replacement for fiat currency in 5-10 years.

Digital assets will be a leapfrog from the current environment and will bring in a global interplay. Yet there are some serious constraints which need be addressed for the market to scale. The issue to date has been the inability to deploy capital and move assets seamlessly with lack of interoperability between legacy platforms. This is a historic problem for exchanges which has persisted since their inception as floor-based marketplaces and continued as they moved to electronic trading. Participants in financial markets run their own services, including custody in silos and moving assets between these participants is cumbersome, slow and expensive resulting in inefficiencies. The new so called digital exchanges, custodians and banks have merely replicated this analogue model therefore also presenting huge inefficiencies for asset portability. There is even more fragmentation in the current environment with multiple blockchains, centralized and decentralized digital asset exchanges, with no proper links between traditional and digital market infrastructure. As institutional players increasingly come into the market there is a need to make this interconnection more efficient.

Exchanges and Digital Assets

Traditional exchanges will need to digitally transform themselves and seek both technological and knowledge enhancing partnerships. Aside from the technology itself, to enter into digital assets, they require regulatory, operational and business level guidance to be able to integrate the external digital processes into their non-digital activities. The key question will be how they will avoid replicating old silo-based models to truly embrace the digital revolution.

There is a global need for capital markets trading in stable regulated environments, which can be future proofed, whilst bridging the gap between traditional and digital assets. Solutions that solve this not just with technology, but also at a transactional business flow level whilst addressing the cross border regulatory requirements, are the ones which will then lead to fundamental change in the capital markets space. There is therefore a need for interconnected exchanges across assets and jurisdictions (in the same way we have seen interconnected telecommunications networks), underpinned by regulatory frameworks and supported by automated securitized contracts across the exchange network from issuance and trading to clearing and settlement.

4IR and Exchange 4.0

Just as the world is experiencing a fourth industrial revolution (4IR), exchanges are beginning their own new phase. The 4IR concept is the driving force behind the Internet of Things (IOT), where AI, automation and web technology combine to create “smart” versions of everything from cars to refrigerators. A similar idea is taking hold in the world of exchange trading, as data driven smart contracts, tokenization and distributed ledger technology (DLT) make it possible to facilitate true asset portability while linking far-flung liquidity centers. This will help form much more powerful ecosystems leading to Exchange 4.0.

The old world and the new world will have to coexist in the foreseeable future, with the gap needing to be bridged between blockchains and legacy networks. The need to make these interconnections more efficient is being driven by large established institutional players who are increasingly coming into the digital assets market to capture new revenues. Solutions which meet the cross border regulatory requirements, through technology and at a business level, are the ones which will lead to fundamental changes in capital markets. Digital hub-based models, which can connect many upstream and downstream participants together with other services, will be the ones seeing real traction as they will bridge the gap between existing traditional and blockchain enabled digital market infrastructure.

Centralized Finance and Decentralized Finance (DeFi) have been to date pretty much in parallel silos, however this will start to change as we see a greater intersection between the two. As a result, an increasing number of capital markets participants will move from running their services in silos (which makes the moving of assets between participants cumbersome, slow and expensive) to a blockchain enabled integrated model, with a seamless link from digital to traditional financial infrastructure.

Exchange 4.0 is not just about Exchanges

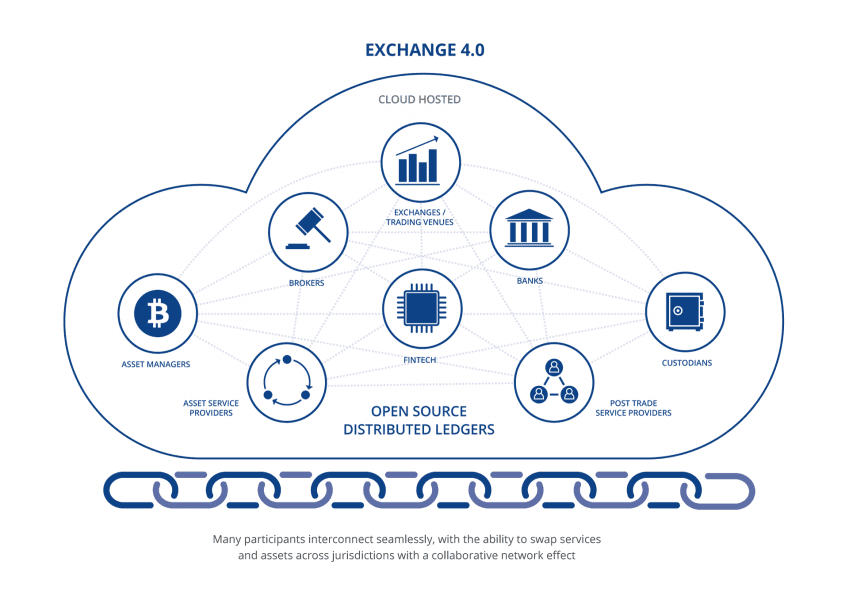

Exchange 4.0 is not just about the exchanges themselves interconnecting. It can be seen as a cloud based, blockchain enabled construct to interconnect multiple industry participants – digital asset exchanges/trading venues, banks, brokers, asset managers, asset service providers, custodians, other post trade providers and FinTech service vendors – to facilitate greater asset portability with more efficient trading, clearing and settlement. The exchange becomes a bidirectional network effect of products and services between all these participants for mutual benefit, thus eradicating the age-old exchange silos.

Exchange 4.0 therefore represents a huge opportunity globally to realise the intended collaborative effects of blockchain, in a way that integrates both traditional and digital finance as part of a cohesive global digitally interconnected ecosystem.

Hirander has expertise in extensive electronic trading and FinTech spanning 25 years, with successful syndication to investors and substantial exits. He is the Chairman & CEO of GMEX Group and its climate fintech platform-as-a-service ZERO13, which won the COP 28 UAE TechSprint for the use of blockchain to scale climate finance. He is one of the Top 10 influential business leaders of blockchain technology in the UK All Party Parliamentary Group report. He is also featured in LATTICE80’s Top 100 influencer list for the UN Sustainable Development Goals agenda for pioneering blockchain technology solutions. Hirander was also recognised as the Most Influential CEO 2024 – UK (Carbon Credits) by CEO Monthly, a digital magazine published by AI Global Media.

Previously he was the co-founder and Chief Operating Officer of Chi-X Europe Limited, instrumental in taking the company from concept to successful launch. At the time of his departure in February 2010, Chi-X Europe was the second largest equities trading venue in Europe, just behind the LSE Group, and was subsequently sold to Bats Global Markets (now part of CBOE Global Markets) for $365M.