Banks, Asset Management and Financial Institutions Are not Ready for Blockchain

The bitcoin’s tech blockchain is operating a major revolution that is creating a new tech trust protocol, using the words of Don Tapscott and Alex Tapscot. The revolution will firstly affect (or is already) affecting the Banks, Asset Management and Financial Institutions.

Blockchain has no major adoption, most of people and businesses, special financial institutions did not even heard about it and is already changing everything’ for banks and financial organisations. It major force in finance is now starting to be seen as the next wave by major global financial institutions, which claim that bitcoin was the “opening act” in something bigger – the blockchain revolution that is now taking big time the center stage.

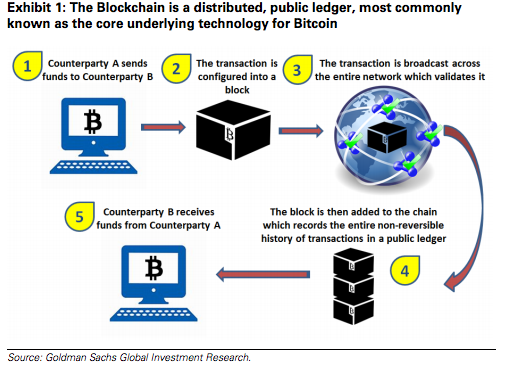

The Blockchain – the disruptive and decentralised (or centralised if you want) technology that underpins Bitcoin transactions – has been coronary to find solutions to applications far beyond just digital currency and now . Jim Schneider, a research analyst in Goldman Sachs Research, explains how the distributed ledger technology works and why it has the potential to disrupt industries from finance to real estate.

These words from Goldman Sachs source: http://www.goldmansachs.com/our-thinking/pages/what-if-i-told-you-full/ synthesise everything:

“From Silicon Valley to Wall Street, technologists and investors alike are buzzing about the potential for the Blockchain to revolutionize … well everything. The hype is high and the potential is real but roadblocks remain. The funding backdrop is healthy and the application eco-system is growing. Once considered the underlying pipes of Bitcoin, this technology is quickly taking center stage from its crypto-currency parent promising an ushering in of a new set of tools to cut costs and challenge the profit pool of the middle-man with a promise to make centralized institutions obsolete. This solution

promises to not just address consumer opportunities but also those for the far more lucrative enterprise.

What if I told you that Bitcoin was just the opening act … with the Blockchain ready to take center stage. In its purest form the Blockchain is a digital platform that records and verifies transactions in a tamper- and revision-proof way that is public to all (Exhibit 1). Levering the same peer-to-peer technology first developed in a dorm room at Northeastern University with Napster (and subsequently built upon by folks like Skype and Spotify) the tool was first born out of a need to track and create Bitcoin. Specifically Bitcoin and other cryptocurrencies required a way of building agreement between all parties involved in a transaction.From buying to selling to trading to storing, every transaction would be chained to each other so one could never duplicate or change the ownership of Bitcoin. This Blockchain allows information to be put in, but never deleted. This complete history … a “shared public ledger” that a network (and the currency) relies on, if you will – made, in the user’s mind, the role of a Central Bank obsolete (Exhibit 2). The fiat of the currency, as a result, was born of the citizens of the internet, not a central clearing institution or agency. Lastly, while the Blockchain associated with Bitcoin remains the most well known, there are growing sets of private and permission-driven shared ledgers gaining traction and worth focusing on.”

Despite Positive Outlook, New Research from State Street Reveals Asset Owners, Managers Lack Readiness for Blockchain

However and despite all this positive outlook most of the Banks, Asset Management and Financial Institutions Are not Ready for Blockchain.

New research from State Street Corporation (NYSE:STT) on blockchain, the distributed ledger that maintains a continuously growing list of data records which are hardened against tampering and revision, unveils that while a majority of asset owners and asset managers (57 percent) expect it to be widely adopted in the investment industry in the next five years, only seven percent currently have initiatives underway to support it.

The survey, conducted in partnership with Oxford Economics, found that 74 percent of asset owners say they believe blockchain will achieve the scale needed for adoption compared to only 42 percent of asset managers. Despite asset owners’ optimism, 48 percent said they don’t know enough about it, and asset managers are even less confident, with 78 percent noting that they need more education.

“A majority of institutional investors are well aware that blockchain, an ‘emerging technology,’ could become an everyday application in the near future,” said Antoine Shagoury, global chief information officer at State Street. “What’s clear from our research is a lack of readiness and uncertainty for how to best plan for this disruption, and a need for more education.”

Additional survey findings include:

- IT and investment teams will be most affected:

The majority of respondents (80%) agree that blockchain will have the greatest impact on IT departments, demonstrating that institutions recognize the need to introduce talent with the skills necessary to adapt to new technical demands. Additionally, 81% of asset managers agree that the adoption of blockchain will equally disrupt their own jobs on investments teams.

- Security represents the biggest concern:

While cryptography is a core component of the blockchain infrastructure, nine-out of-10 respondents worry about how security implementation in blockchains will address existing and future requirements, an issue that the industry needs to tackle in order for wide-scale adoption.

- The private use will trump public adoption:

Regardless of industry-wide adoption, more than half of asset owners and asset managers (55%) are convinced that blockchain is most likely to be used privately by companies with their clients. Only 13% believe blockchain will be used broadly by the public.

“We’re excited by the opportunity blockchain presents and are working to make it a tangible reality for our businesses, partners and clients,” said Hu Liang, senior managing director and head of State Street’s Emerging Technologies Center. “We are actively supporting several blockchain and blockchain-inspired initiatives both internally and as part of a handful of consortia of the world’s biggest banks and technology companies.”

About This Research

The survey, commissioned by State Street and conducted by Oxford Economics, was comprised of respondents from 50 asset owners and 50 asset managers, inclusive of asset management firms, private pension funds or retirement funds, and public pension and retirement funds. Forty percent of respondents were from North America, while 30 percent were from EMEA and 30 percent were from APAC. Results are as of January 2016.

About State Street Corporation

State Street Corporation (NYSE: STT) is one of the world’s leading providers of financial services to institutional investors, including investment servicing, investment management and investment research and trading. With $27 trillion in assets under custody and administration and $2 trillion* in assets under management as of March 31, 2016, State Street operates in more than 100 geographic markets worldwide, including the US, Canada, Europe, the Middle East and Asia. For more information, visit State Street’s website at www.statestreet.com.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals