The COVID-19 pandemic represents the biggest test of the post-crisis financial system to date. The pandemic constitutes an unprecedented global macro-economic shock, pushing the global economy into a recession of uncertain magnitude and duration. The global financial system faces the dual challenge to sustain the flow of credit amidst declining growth and to manage heightened risks. The spread of Covid 19 and the measures to contain it are having a significant impact on the UK and many countries around the world. Activity has fallen sharply since the beginning of the year and unemployment has risen markedly, both domestically and globally. Covid-19 and the measures to contain its spread are dramatically reducing jobs and incomes in the UK. They have also put a big strain on UK businesses’ cash flow.

The unprecedented situation means that the outlook for the economy is unusually uncertain. It will depend critically on the evolution of the pandemic and how governments, households, businesses and financial markets respond. Recognizing these uncertainties, the Monetary Policy Committee (MPC) has constructed a plausible illustrative economic scenario based on a set of stylized assumptions. While the scenario is highly conditional, it helps to illustrate the potential impact of Covid 19 on the economy and the channels through which that impact is felt. Alongside a number of estimates of the sensitivity of the economy to a selection of key variables, it also serves to illustrate the important drivers of the outlook. The Bank of England has predicted the worst economic crash since the Great Frost of 1709. Economists are less optimistic than the central bank about the rate of recovery for the UK economy.

“Current conditions are unprecedented in our lifetime and all forecasters are struggling to make out where the economy stands now”, stated by Bank of England.

Bank of England Report

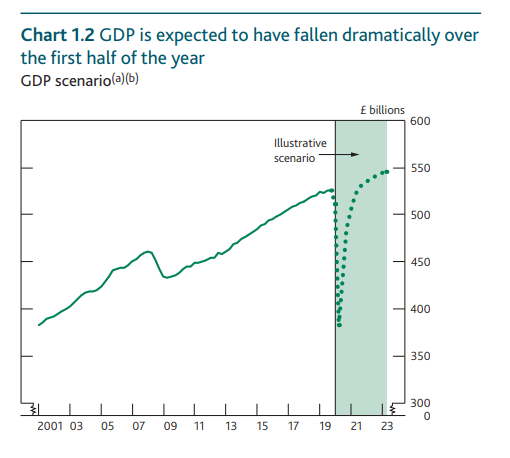

The Bank of England predicts a historic drop of 14% in the UK’s Gross Domestic Product (GDP) this year due to the economic shock caused by the covid-19 pandemic, and unemployment more than double by spring as the coronavirus causes the deepest recession in modern history. Bank of England kept the interest rate at 0,1%. Even so, in the quarterly report, the Bank of England predicts a “strong” recovery in 2021 with a projection of 15%.

The Bank of England (BOE) has announced a series of policy measures designed to help U.K. financial market participants deal with the effects of the coronavirus (COVID-19) pandemic. The latest measures, announced on 20 March 2020, primarily aim to ease the operational burden posed by key regulatory obligations applicable to firms, freeing them up to deal with the challenges presented to the wider economy by the pandemic. The BOE’s three policy committees, the Financial Policy Committee (FPC), Monetary Policy Committee (MPC) and Prudential Regulation Committee (PRC), also announced a package of measures on 11 March 2020, to alleviate the broader impact of COVID-19 on the U.K. economy.

“Our role is to ensure UK monetary and financial stability. We set interest rates to influence spending in the economy and to ensure inflation (the pace of price rises) returns to our 2% target sustainably. Low inflation supports jobs and growth. We ensure the UK financial system is resilient to, and prepared for, the wide range of risks it could face – so that the system can serve UK households and businesses in bad times as well as good,” said the Bank of England in its report. “We have put in place a package of measures that will support households and businesses, help the economy recover and keep the financial system safe and stable. Since January, we have cut interest rates and injected a further £200 billion into the UK economy through quantitative easing. That reduces the costs that some households and businesses face and will help the economy to recover.”

Leaving interest rates on hold at a record low of 0.1% as the economic crisis unfolds, the central bank said economic activity across the country had fallen sharply since the onset of the global health emergency and the lockdown measures to contain its spread. In a warning over the mounting damage to the economy, the Bank said gross domestic product (GDP) could plunge by 25% in the second quarter. For 2020 as a whole, the economy could shrink by 14%, marking the deepest recession for more than three centuries

Bank of England warns coronavirus could cause biggest economic slump in 300 years

The Bank of England (BOE) has forecasted a devastatingly bleak outlook for the U.K. economy in its most recent monetary policy report published on Thursday ahead of Prime Minister Boris Johnson unveiling the new guidelines for coronavirus lockdown. Britain’s economy is now declining “very sharply” and a range of financial asset prices had dropped significantly, members of the BoE’s Financial Policy Committee (FPC) said after holding a meeting on Thursday. They concluded that the BoE needed to publish on May 7 an interim Financial Stability Report alongside its scheduled Monetary Policy Report. Such checks on banks usually take place twice a year, and the next one had not been due until July.

“Given the material developments in recent weeks, the (Financial Policy Committee) decided to supplement its normal practice with an additional interim Financial Stability Report,” the BoE said in a statement.

The central bank’s Monetary Policy Committee (MPC) has “constructed a plausible illustrative economic scenario” to help illustrate the potential impact of the COVID-19 crisis on the British economy. The BOE noted, however, that an unprecedented crisis means the economic outlook is “unusually uncertain,” as it critically depends “on the evolution of the pandemic and how governments, households, businesses and financial markets respond,” the report details.

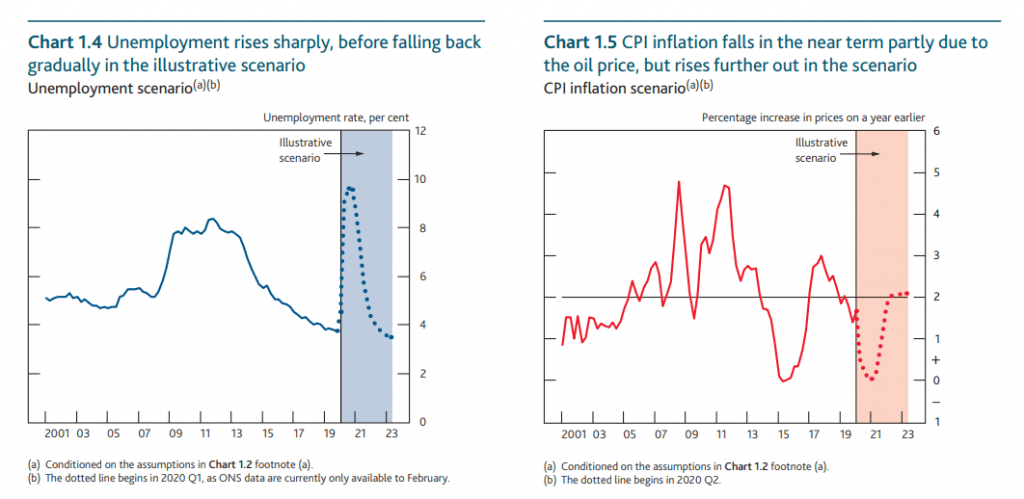

Based on the bank’s own best estimate and historical data, the coronavirus crisis could push the British economy into the fastest and deepest recession in 300 years, since the huge economic slump of 1706 and the Great Frost of 1709. The U.K. economy could shrink by 14% in 2020, the biggest annual contraction since a decline of 15% in 1706 and 13% in 1709. In its first official outlook on the toll taken on the UK’s finances by the Covid-19 pandemic, the Bank cautioned over a “very sharp” fall in GDP of close to 30% over the first half of 2020 and a “substantial” hike in unemployment. It expects gross domestic product (GDP) to a fall of 3% in the first quarter of 2020 and another 25% drop in the second quarter.

Britain’s unemployment rate could hit 9% in the second quarter as the lockdown hammers firms across the economy, although with six million people expected to have been furloughed, it said Government schemes will help soften the blow. The grim forecast came as the Bank held interest rates at the historic low of 0.1% after recent emergency action. It said the fall should be temporary and that activity should “pick up relatively rapidly” as lockdown is eased, but added that it would “take some time” for the economy to recover.

Commerzbank economist Peter Dixon commented: “Current conditions are unprecedented in our lifetime and all forecasters are struggling to make out where the economy stands now, never mind what happens in future. But it is clear that the next few months are going to produce some of the biggest output falls on record.”

The central bank has also forecasted that the unemployment rate in the U.K. is likely to rise to 9% in 2021, a higher joblessness rate than after the 2008-09 financial crisis. The BOE added that the British economy could be on course to shrink by 25% in the three months to June.

Economic Recovery Predictions

The Bank of England governor explained that the economic rebound was likely to happen “much more rapidly than the pullback from the global financial crisis,” the media quoted him as saying. A rough estimate by the central bank assumed long-term damage to the economy would only be 1.5% of gross domestic product (GDP) and would come from missed business investment in 2020. Otherwise, the bank predicted the economy could bounce back in a V-shaped recovery, unlike the U.S. or world economy.

The Bank of England also said that it stands ready to inject more money into the economy if needed. In March, it pledged £200 billion ($248 billion) to support economic activity by buying government bonds. Two of the Monetary Policy Committee members, Jonathan Haskel and Michael Saunders, voted to increase quantitative easing (QE) by another £100 billion immediately.

Many economists expect the Bank of England to increase its asset purchase program in June before the extra £200 billion it gave itself in March is exhausted. They believe more QE is coming. Capital Economics’ chief U.K. economist, Paul Dales, believes the central bank was signaling: “More QE is coming, if not in June, then in August.”

Some strategists and economists doubt that Britain’s economy will bounce back as quickly as the central bank assumes. Morgan Stanley chief U.K. economist Jacob Nell said: “We see this forecast as credible for 2020, but are less convinced by the 2021 recovery, where we take a more cautious view, implying weaker growth, lower inflation, wider deficits and more MPC action.”

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.