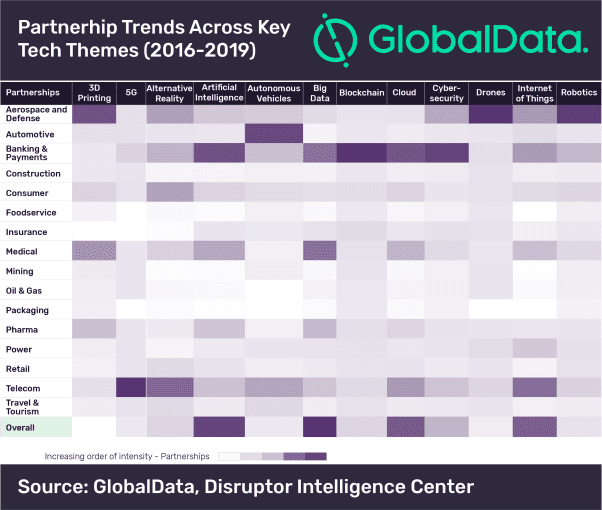

The advent of new technologies is rapidly disrupting the value chain of all sectors. Companies are increasingly forming partnerships with start-ups to better serve their customers. Against this backdrop, the banking and payments sector led the disruptive tech partnership landscape between 2016 and 2019, according to GlobalData, a leading data and analytics company.

GlobalData’s Disruptor Database, which analyzes and showcases technology partnership activity across companies and sectors, reveals that driven by artificial intelligence (AI), banking and payments edged past other sectors in terms of the usage of technologies across various themes.

Manish Dixit, Disruptive Tech Analyst at GlobalData, says: “With technology disrupting the traditional business models, it has become imperative for businesses to partner with technology innovators to stay relevant.”

An analysis of GlobalData’s Disruptor Database reveals that among the various tech themes, big data, AI, cloud, Internet of Things (IoT) and cybersecurity were the most prominent across sectors while partnership activity across 3D printing, drones, and autonomous vehicles remains low, largely because they are relevant only to the sectors where there is a unique application.

Dixit adds: “AI continues to be the critical enabler of banks’ digital transformation process as it significantly reduces costs by automating manually intensive processes while enabling highly personalized digital experiences.”

Interestingly, several companies across the sectors are forging tech partnerships to address some of their long-standing issues. However, the scale and pace of digital transformation underway in the banking and payments sector indicates it will outpace virtually all other sectors in terms of technology partnerships.

Dixit continues: “The single most important criterion when selecting vendor partners is industry expertise. This is a testament to the unique regulatory environment of the sector and the need for partners that truly understand the risks and opportunities that present.”

For example, UK-based retail and commercial bank National Westminster Bank recently announced tech partnership with Microsoft and AI specialist DreamQuark to predict future risks and opportunities across its chosen markets and customer segments, using a combination of simulations run through the system leveraging AI.

Similarly, Visa has partnered with Canadian conversational banking technology provider Finn AI to serve the needs of digital banking customers with a virtual assistant.

Novartis and Microsoft have recently partnered to leverage data and AI to transform how medicines are discovered, developed and commercialized.

Earlier this year, retail giant Walmart partnered with car start-up Udelv for testing autonomous grocery delivery service.

German footwear giant Adidas had partnered with 3D printing company Carbon to manufacture a new line of customizable athletic shoes with Futurecraft 4D technology.

Disney partnered with Holoride, a start-up spun out of luxury carmaker Audi, to bring its virtual reality game ‘Marvel’s Avengers: Rocket’s Rescue Run’ to backseat passengers in Uber vehicles.

Dixit concludes: “Each of these initiatives demonstrates the underlying fact that partnerships are necessary for enterprises as they are under tremendous pressure not only to gain competitive advantage but also to sustain.”

Read More:

Renaissance Technologies fund performance

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals