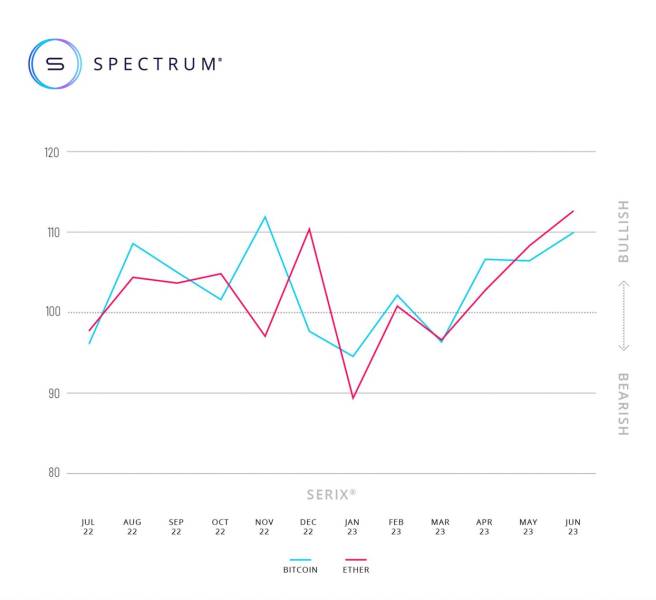

– SERIX sentiment index on both cryptocurrencies risen consistently since start of 2023.

– Retail investors took advantage of the 24/5 access to the securitised derivatives via Spectrum on those two cryptocurriencies.

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX sentiment data for European retail investors for June, revealing retail investor sentiment towards cryptocurrencies Bitcoin and Ether has risen consistently since the index hit its lowest point in January 2023.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

The SERIX sentiment index for Bitcoin hit 110 points in June, the highest level since the start of this year. This bullish sentiment from European retail investors can also be seen in improving sentiment towards Ether, which reached 113 in June.

In recent months the price for Bitcoin has risen from around 16,000 US Dollar, in January, to over 30,000 US Dollar in June, whereas Ether’s price rose from roughly 1,200 US Dollar to above 1,900 US Dollar in the same period.

Using the securitised derivatives listed on Spectrum, retail investors can take long or short exposure on the two cryptocurrencies, the relevant instruments being tradable 24/5, and giving them additional tools to hedge exposure and manage risk. Trading these products on a regulated trading venue offers transparency and investor protection a.

“Interest in cryptocurrencies continues to grow, though their price volatility means investors are increasingly exploring different ways of gaining differentiated exposure to the asset class, including through derivatives. Our choice to offer this within a regulated environment, being the first to do so on-venue on a 24/5 basis, has also been welcomed by European retail investors that value trading on a regulated trading venue,” explains Michael Hall, Head of Distribution at Spectrum.

“We expect this momentum to continue, supported by more, and more diverse, products coming onto the market. The fact that a much clearer regulatory regime for digital and crypto-assets is emerging in Europe with the European Council adopting new rules on markets in crypto-assets, in particular MiCAR, is another welcome development that will give further reassurance to investors in this asset class,” Hall adds.

In June 2023, 102.5 million securitised derivatives were traded on Spectrum, with 34.1% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

84.1% of the traded derivatives were on indices, 10.5% on currency pairs, 3.4% on commodities, 1.7% on equities and 0.3% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (31.5%), NASDAQ 100 (19.5%), and S&P 500 (18.7%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 and the NASDAQ 100 both remained bearish at 97, and the S&P 500 fell from an already bearish 98 to a low sentiment of 88.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades – % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals