When the USDJPY is looked at statistically, its volatility has increased 300+% from 2021. Underlying why this year was such a difficult market for many.

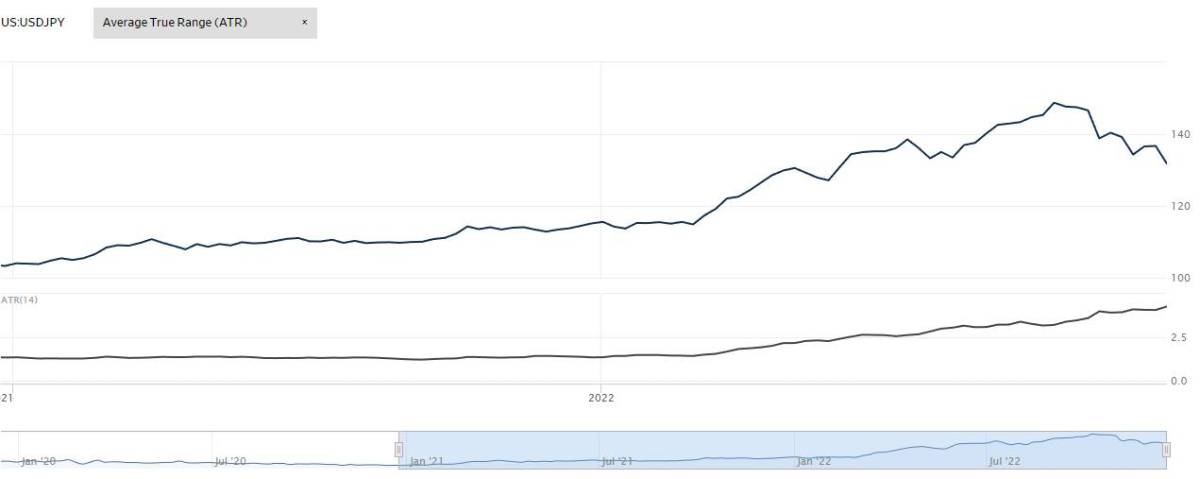

This graph from the Wall Street Journal demonstrates the increasing volatility the USDJPY has produced in 2022 compared to 2021:

Of note is the ATR (average true range) statistic. It measures the trading movement during the period (in this case 14 days).

During 2021 the ATR measured between 1.20 and 1.30 for the whole year – a very consistent measurement.

During 2022 the ATR increased to measure 4.26 – a dramatic increase in volatility over the previous year.

The increase in ATR from 1.2 to 4.26 is a 355% increase. This is a huge jump in market movements, indicating just how violent some of the trading periods have been.

If we look at the USDJPY chart just over the past month we can see these violent movements play out:

The sharp falls, and equally dramatic rises can be seen occurring and reoccurring during November and December 2022.

Fundamentally this is due to inflation figures softening/improving but the US Federal Reserve still deciding to raise interest rates.

As the market attempts to guess the interest rate moves, then react to those moves the markets are in a state of violent flux.

Volatile markets are generally due to the difficulties of predicting and pricing in future information (like interest rates).

Unpredicted news therefore can have the most effect on the markets- and this was shown perfectly by this week’s announcement of monetary policy tightening by the Bank of Japan. It was an unexpected announcement and the markets reacted strongly:

The previous moves primarily around guessing the US interest rate decision were nothing compared to the market reaction of the Bank of Japan’s announcement. Within minutes the USDJPY dropped 400+ pips as the Yen strengthened and the market digested the news.

These markets can present an opportunity- we made our clients 1.5% return in just over an hour.

But, they can also present a risk. Dramatic movements can cost money too. A number of times we have seen our profits get cut away due to the dramatic reversals demonstrated.

Come to the end of 2022 bMAMS can look back proudly at achieving a positive return for out clients during the most difficult trading year in modern memory.

As these markets reduce in volatility in 2023 profits should increase and provide bMAMS clients a safe, risk-adverse option to achieve above-average market returns.

Originally posted on https://www.bmams.com.au/

The post bMAMS: USDJPY- 300% more volatile this year first appeared on trademakers.

The post bMAMS: USDJPY- 300% more volatile this year first appeared on JP Fund Services.

The post bMAMS: USDJPY- 300% more volatile this year appeared first on JP Fund Services.