From China to France, Sweden to South Africa, there are many countries around the world exploring the idea of central bank digital currencies (CBDC). Just like fiat money, central bank digital currency would be fixed in nominal terms, universally accessible, and valid as legal tender for all public and private transactions.There are many obstacles to overcome and we are still in the early stages, but thanks to new technologies such as blockchain, we are finally reaching the future of digital money.

But to understand how CBDC can be developed and implemented on a national level, we need to take a closer look at how money is issued in modern societies. As of today, there are two main types of fiat money. Central bank money is legal tender created and backed by a central bank. It represents a claim against the central bank and – with the crucial exception of cash in the form of banknotes and coins – is mainly used for wholesale payments. On the other hand, commercial bank money is created by commercial banks when they issue credit, either through loans or credit lines. Most of the fiat money in the world is commercial bank money, and it is widely used as a retail means of payment,(with retail here meaning payment between non-financial institutions, corporates or individuals).

Central banks digital currencies represent a new form of central bank money, and it would be possible thanks to new technologies, especially one Distributed Ledger Technology called blockchain. Blockchain uses cryptography to secure transactions made within the platform. As all data is stored in groups, or “blocks” of information, it is impossible to delete or modify information previously stored “on the chain” because blocks are replicated across multiple ledgers. Blockchain is the foundational technology of cryptocurrencies. Bitcoin, first released in 2008, is the most prominent and strong of the hundreds of digital coins that have been launched since then.

One of the major concerns about cryptocurrencies is that they have been created by private entities and whose market prices have exhibited very sharp fluctuations in recent years. They are highly volatile. That has been a long-lasting problem carried out by almost all cryptocurrencies. However, in 2017, new digital coins pegged to fiat currency were released, with Tether as one of the early projects. These were generally focused on solving the payment problem for blockchain-based platforms specifically, but the idea has stuck among larger financial institutions. From Facebook to JP Morgan, there are many enterprises exploring the idea of issuing their own stablecoin.

Developing a Central Bank Digital Currency

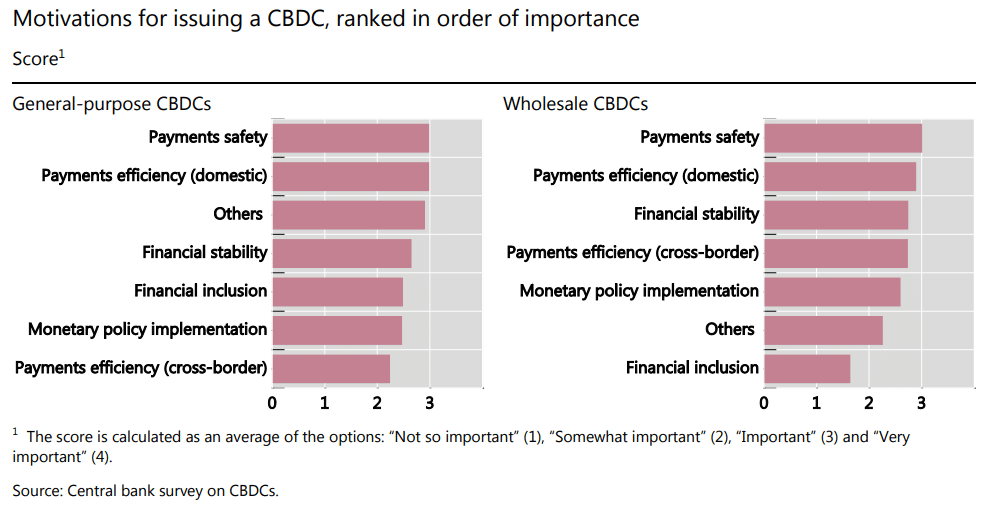

Central banks all around the world are analysing how cryptocurrencies could be actually implemented on a national level. In fact, around 70 percent of central banks have already started CBDC projects, with China at the forefront of them all. The benefits are real, and the monetary system could become more transparent, it could deploy potentially new regulatory monitoring and enforcement tools, issue cheaper cross-border remittances, make improvements to the interbank payments infrastructure and bring innovation in retail markets.

When developing a CBDC, central bank’s objectives should be to maximize the effectiveness of CBDC in fulfilling the basic functions of any public currency, namely, its efficiency as a medium of exchange, its security as a store of value, and its stability as the unit of account for economic and financial transactions.

As seen in the white paper ‘Central Bank Digital Currency and the Future of Monetary Policy’, by Michael D. Bordo and Andrew T. Levin, the professors identify the following characteristics of a well-designed CBDC:

▪ An account-based CBDC could serve as a practically costless medium of exchange. Such accounts could be held directly at the central bank itself or made available via public-private partnerships with commercial banks.

▪ An interest-bearing CBDC could provide a secure store of value, with a rate of return in line with other risk-free assets such as short-term government securities. The CBDC interest rate could serve as the main tool for conducting monetary policy.

▪ To facilitate the gradual obsolescence of paper currency, CBDC could be made widely available to the public, with a graduated schedule of fees on transfers between cash and CBDC. Consequently, adjustments to the CBDC interest rate would not be constrained by any effective lower bound.

▪ The monetary policy framework could foster true price stability, that is, the real value of CBDC would remain stable over time in terms of a broad consumer price index. Such a framework would facilitate the systematic and transparent conduct of monetary policy.

Central Banks Digital Currency: The Future of Money

As a recent Consensys white paper stated: “Blockchain-based CBDC, which represents a new technology for the issuance of central bank money at the wholesale and retail level, offers a number of potential advantages for central banks. It could be a strong catalyst for financial services innovation by providing a viable, large-scale payments system for tokenised assets markets – offering a risk-free, widely accessible alternative to privately-issued stablecoins, like Facebook’s Libra, which serve a similar purpose but could expose users to credit and/or liquidity risk.”

The paper also added that widespread use of CBDC instead of private payment tokens could also help central banks retain sovereignty over monetary policy in tokenised assets markets, an important consideration should such markets come to represent significant portions of the economy. Other benefits include potentially new regulatory monitoring and enforcement tools, cheaper cross-border remittances, improvements to the interbank payments infrastructure and innovation in retail markets. CBDC could also be a superior replacement to physical cash, helping alleviate some of the risks and costs associated with banknotes. Depending on how it is designed, a CBDC could support financial inclusion by providing wide-scale access to risk-free reserves.

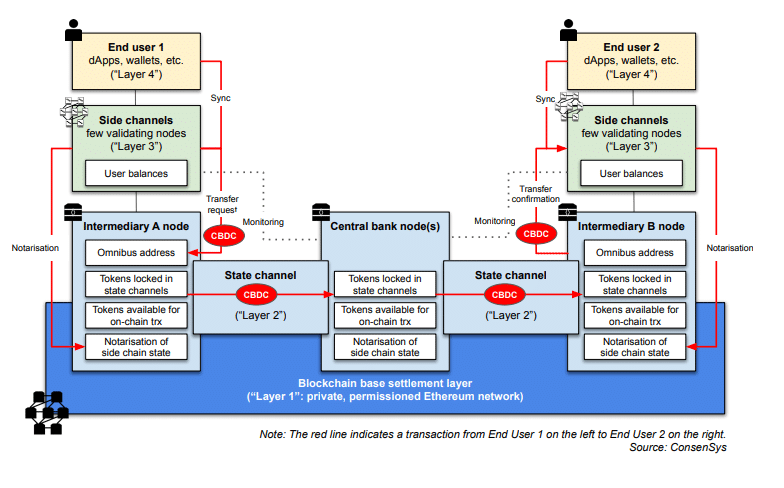

To palliate the potential risks – particularly in retail CBDC (that is, tokenised central bank money accessible to the general public), central banks might consider to issue CBDC on a large-scale, private, permissioned network in which central-bank appointed intermediaries act as nodes and service providers.

And the report lays out a proposed setup where the central bank would issue the currency as well as authorise and onboard intermediaries, but only intermediaries would distribute CBDC directly to the public. Because the integrity of the system is embedded in the technology, the number and type of intermediary service providers on this platform would however be much larger and broader than is the case with the distribution of central bank money today.

In this scenario, and as the issuer of the digital currency, central banks would have direct control of the money supply, while users of the currency would not be exposed to the risks of private currencies. It would provide the basis for a large-scale, evolving and easily adaptable infrastructure offering a continuously expanding number of shared services to various stakeholders. End users would benefit from a much more open, vibrant, competitive and above all innovative environment than today, with secure and user-friendly access to the benefits of tokenised assets markets.

“There are certainly risks involved in issuing a CBDC, and central banks will have to weigh these carefully. But they will need equally to evaluate the risks of not issuing CBDC, or doing so too slowly. Without a CBDC, the future of digital money would be largely if not wholly in private hands, leaving businesses and individuals exposed to the risks of private issuers or lack of access to digital tokens in certain markets,” the withe paper ended with.

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.