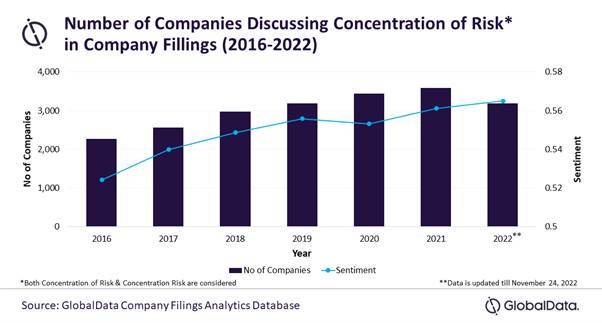

Discussions around ‘Concentration of Risk’ (CoR) in company filings have seen a slight fall in 2022 and a minor improvement in sentiment, according to GlobalData. The leading data and analytics company notes that CoR discussions peaked in 2021, with 3,568 companies discussing the topic while 2022 saw just over 3,100. Meanwhile, sentiment rose from 0.56 in 2021 to 0.57 in 2022.

CoR refers to the amount of risk a business is accepting when they make a purchase. A single investor relying on a single investment is 100% risk.

Using its Filing Analytics database, GlobalData was able to identify which industries were discussing CoR the most in company filings. The company found that industries with the highest number of CoR discussions included the banking & payments and construction sectors, followed by consumer, oil & gas, and technology. The retail industry was the most positive about CoR, while banking & payments was least positive.

Combining industry sectors with other keywords, GlobalData was able to identify the areas in which CoR was being discussed within each industry.

Misa Singh, Business Fundamentals Analyst at GlobalData, comments: “Companies in the banking & payments industry were discussing CoR around loans and accounts receivable. Meanwhile, CoR around trade receivables was discussed by automotive and construction companies. Automotive companies also indicated CoR in cases of financial distress or other adverse events related to major vehicle manufacturers or related lenders/suppliers. In the oil & gas space, companies were discussing credit risk resulting from investment operations, derivatives trading, and customer receivables, while technology companies were talking about being exposed to credit risk through cash, cash equivalents, derivative contracts, investments, and capped call transactions.”

GlobalData’s research also reveals the activities of individual companies.

Indian multinational conglomerate Reliance Industries mentioned avoiding CoR by managing its credit risk. Credit risk is actively managed using Letters of Credit, Bank Guarantees, Parent Company Guarantees, advance payments, factoring & forfaiting, and advance payments without recourse to the company.

In the technology industry, Micron Technology was talking about CoR in foreign currency hedging as the company has a limited number of counterparties to its hedges but large notional amounts. Meanwhile, software company Workday discussed CoR in the context of both marketable and non-marketable equity investments. Another software company Atlassian saw discusses around mitigating risk via master netting arrangements.

In the construction space, Ahluwalia Contracts discussed CoR with respect to trade receivables being reasonably low—as the majority of its customers are government organizations. MYR Group mentioned being subject to CoR as only a small number of its consumers account for a sizable part of company revenue.

In the banking & payments industry, the highest CoR can be found in loans. Asset management company Apollo Investment Corp and business development firm Prospect Capital Corp mentioned managing CoR in their filings by limiting their follow-on investments, despite having the required funds.

In the retail industry, CoR can be related to the geographic spread of customers, especially with respect to trade receivables. As a result, Maisons du Monde is focusing on international development to maximize its geographical distribution and reduce risk.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals