The coronavirus pandemic has spread its pangs over almost all the aspects of human living, including health, multiple industries, and the global economy. However, some sectors and industries are seeing an upward trend due to the pandemic, and FinTech is one of them.

Impact on the UK FinTech Industry

We start by breaking down the FinTech ecosystem into its four critical components: talent, policy, demand, and capital. While the UK FinTech industry has suffered short-term negative consequences of the COVID-19 pandemic, several opportunities have also unfolded for the financial services industry to bring about the much-needed transformation and innovation.

The FinTech sector is facing challenges in terms of financial performance, loss of talent, and access to capital. The relatively newer firms are competing for a limited pool of resources. However, economic uncertainties have paved the way for many growth avenues in the FinTech industry in the years to come. The industry will have to evolve through the unprecedented disruptions to the normal, but the future looks bright. The current challenges include:

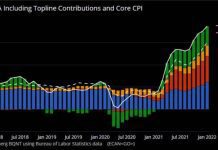

- Reduced Demand for Lending and Financial Services: The banks continue to have a lot of money, healthy balance sheets, solvency standards; however, the pandemic has eroded the demand and quality of lending services. The present economic conditions may also lead to more extensive distressed portfolios and non-performing loans, deteriorating the state of the financial services sector on the whole.

- Reduction in Spending: As a result of the economic and societal uncertainties, people have reduced their discretionary spending and big purchases to remain secure for the future. It has led to lower demand for consumer credit and compression of banks’ near-term margins. With over 8 million people on furlough and more than 1.4 million unemployed in the UK, spending has seen a pronounced decline.

- Management of Loans: It is becoming increasingly difficult for financial institutions to manage the origination of loans, their repayment and collection, and the associated risks. A vast majority of people have lost the capability to pay back their loans, causing liquidity risks to the financial service providers.

Opportunities for FinTech

Despite the ongoing near-term pressures, the long-term opportunities for the FinTech sector are immense. The companies in the FinTech domain possess unique skills and capabilities to be flexible and innovative and address the challenges head-on. The FinTechs are likely to play a significant role in the expected metamorphosis of the financial services industry through their digital tools and other innovative services.

- Stronger collaborations and partnerships among FinTechs and financial service providers: The ongoing COVID-19 pandemic has given opportunities to FinTechs to collaborate better with the financial innovations to offer them faster and more innovative services. The financial institutions are working hard to provide digital services to their consumers and increasing the quality of consumer experiences. FinTechs are helping them fill the gaps through higher volumes of collaborations and partnerships.

- Shift in Consumer Habits to Digital: Due to the fear of coronavirus, the world is shifting towards contactless payments and greater use of e-commerce. More than 59% of the UK population is using digital services more than they used before. The payment systems are moving online, and the customers and businesses are demonstrating more digital confidence by using digital payment systems and digital wealth managers. The necessary shift in consumer behaviour is providing vast opportunities for FinTech companies to assist banks and other financial institutions adapt to the changes.

- Addressing Societal Challenges by Supporting SMEs: In addition to the regular services, the coronavirus pandemic has also led FinTechs to address societal challenges. Many financial technology companies are coming forward to support SMEs while they struggle to stay afloat during tough times. About 16 FinTechs have been authorised by the British Business Bank to offer Coronavirus Business Interruption Loans, and two other FinTechs are offering Bounce Back Loans. FinTechs are also doing all they can to provide innovative digital solutions to the SMEs to make their operations streamlined and seamless.

- Changes in Work Habits with More Remote Working: The repositioning of the working population to remote working has also presented a vast pool of opportunities for FinTechs. The FinTechs and other related organisations are putting efforts to make non-location specific hiring and working smooth and effective.

As a bottom line, FinTechs have faced considerable short-term pressures due to COVID-19. However, the industry is transforming to meet and beat challenges, and it has been successful in converting many drawbacks to opportunities.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals