The US Dollar was the overall winner last week making impressive gains across the board. A further firming of yields and speculation of further Fed tightening propelled the USD. The market is now expecting a 50bps rate hike in May and could end the year between 2.5% and 3.5% depending on incoming data and developments over the coming months.

Euro was the only winner against the USD as eventually some ECB members began talking about a chance of a July rate increase.

As the risk off mood continued commodity currencies were once again among the worst performers. Commodity currencies have once again aligned themselves to the broader risk sentiment and as stocks slipped at the end of the week these to moved lower against the dollar.

Oil remains highly volatile as we are still nowhere near a resolution in the Ukraine crisis. Last week the WTI fell 2% to $101.68 This weighed on the Canadian Dollar which also took a tumble as inflation continued to rise. Canadian inflation came in at 6.7% vs 6.1% as forecast by the markets.

The week ahead would expect to see a continuation of last week. Data wise is a little lighter with BOJ rate decision and GDP numbers from the US and Canada.

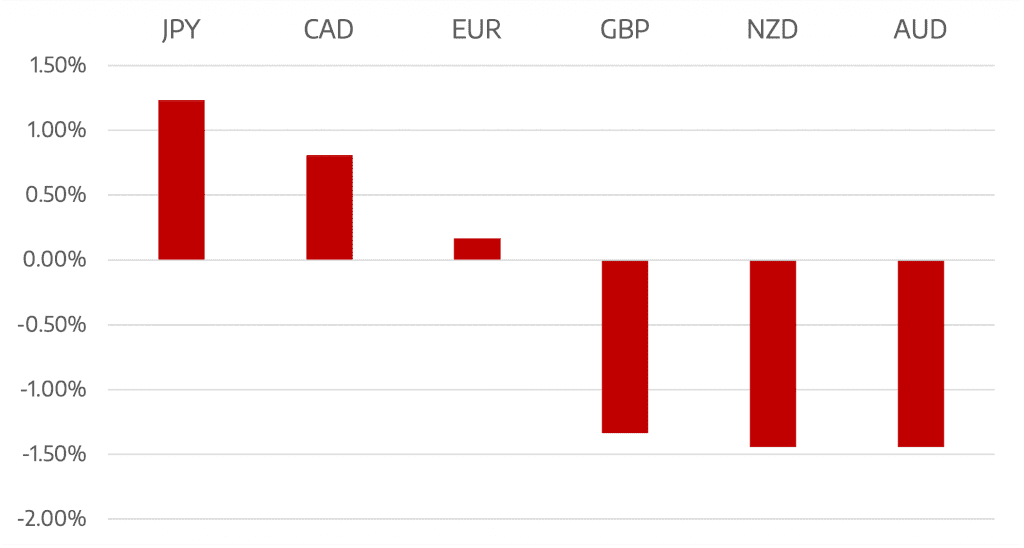

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Big Gains for the US Dollar

appeared first on JP Fund Services.

The post Cromwell FX Market View Big Gains for the US Dollar first appeared on trademakers.

The post Cromwell FX Market View Big Gains for the US Dollar first appeared on JP Fund Services.

The post Cromwell FX Market View Big Gains for the US Dollar appeared first on JP Fund Services.