Last week saw the round of central bank announcements. The rate rises were as the market expected both the ECB and the Fed surprised with a more hawkish tone however the BoE delivered a more dovish tone.

The US Dollar initially took a bid post FOMC but further economic data led the dollar to lose the ground. The DXY fell marginally to close at 104.83.

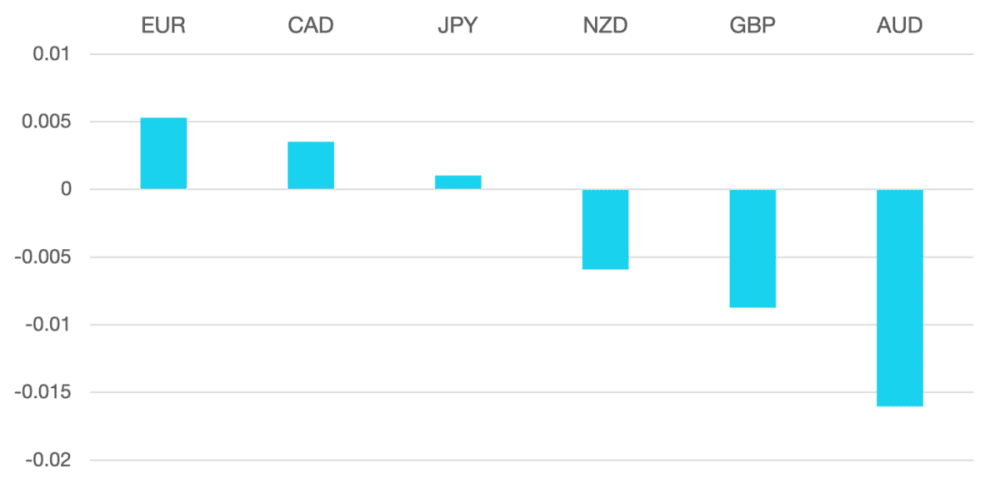

Although reasonably range bound the Euro was the best performer of the week. The hawkish sentiment suggesting several more 50bp hikes are coming. While it remains to be seen if these can be delivered with economic data continue to point to a weaker economy.

GBP lost as the BoE announced a more dovish policy update. Two BoE members voted for no change which was completely unexpected by the market and lead to the Pound losing ground.

Commodity currencies had another mixed week, but the general pressure was from the risk off move NZD and CAD both lost around 0.5% while AUD was the worst performer losing around 1.5%.

Oil finally found a level of support and rallied for the first time in several weeks. WTI rallied 4% to close around $74.50.

The week ahead should be quiet as the market moves into full wind down for Christmas. Data wise we have inflation and GDP announcements.

Cromwell would like to wish everyone a Merry Christmas and a peaceful and prosperous New Year.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Central Banks Round Out 2022

first appeared on trademakers.

The post Cromwell FX Market View Central Banks Round Out 2022 first appeared on JP Fund Services.

The post Cromwell FX Market View Central Banks Round Out 2022 appeared first on JP Fund Services.