Last week saw huge volatility in most markets. Crypto was probably the most wild as some lost their entire value. In the short term we saw some stabilisation towards the end of the week. Yen ended the best performer vs the USD helped by risk aversion and a retracement in treasury yields.

The US Dollar was still the go to currency with he Dollar index rising 0.8% to 104.465. Fed funds are pricing in a 50bps rise in June and a 86% chance of another 50bps taking rates up to 2%.

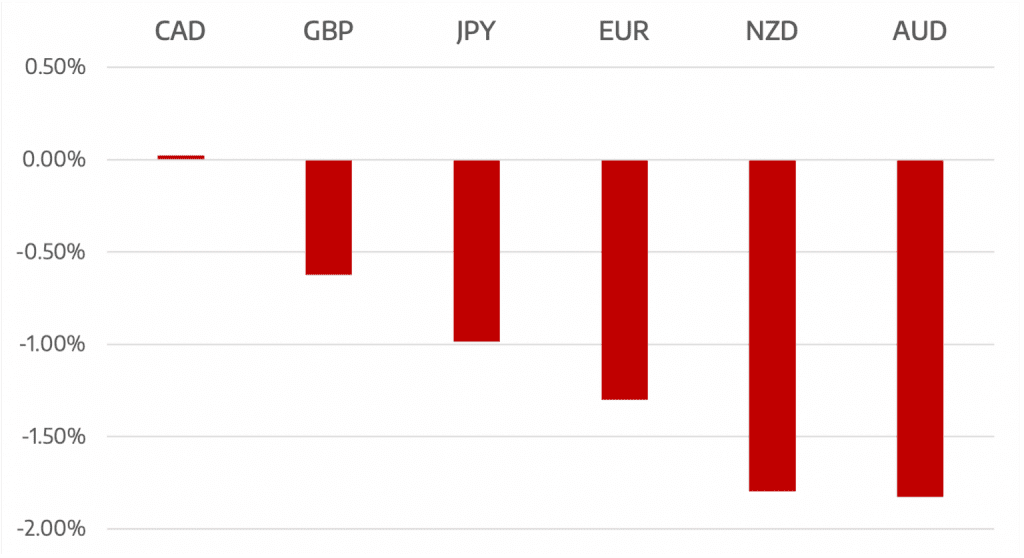

the Euro was the worst performer. A continued dovish tome from the ECB is not helping the single currency coupled with continued weak economic data. The Euro fell 1.3% to 1.0408. GBP is also very vulnerable. UK Data continues to disappoint and Brexit issues are resurfacing. With little good news GBP remains on the back foot.

Commodity currencies also suffered. CAD remained flat against the US as Oil prices rose from the lows of the week to close at $110. AUD and NZD both suffered as risk off in equities led to a sell off in risk currencies.

The week ahead could see a continuation of USD strength. We also have inflation data from UK, EU and Canada.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Dollar Remain Strong; Euro Looks Vulnerable

appeared first on JP Fund Services.

The post Cromwell FX Market View Dollar Remain Strong; Euro Looks Vulnerable first appeared on trademakers.

The post Cromwell FX Market View Dollar Remain Strong; Euro Looks Vulnerable first appeared on JP Fund Services.

The post Cromwell FX Market View Dollar Remain Strong; Euro Looks Vulnerable appeared first on JP Fund Services.