Last week post-thanksgiving saw Fed Chair Powell speak along with the first Friday payrolls numbers. Powell’s speech admitted that going forward rate hikes will be smaller. Although not new news the reaction was very positive and the end of week payrolls coming in strong didn’t stop the market from going higher.

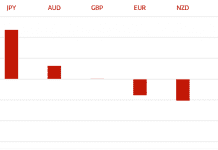

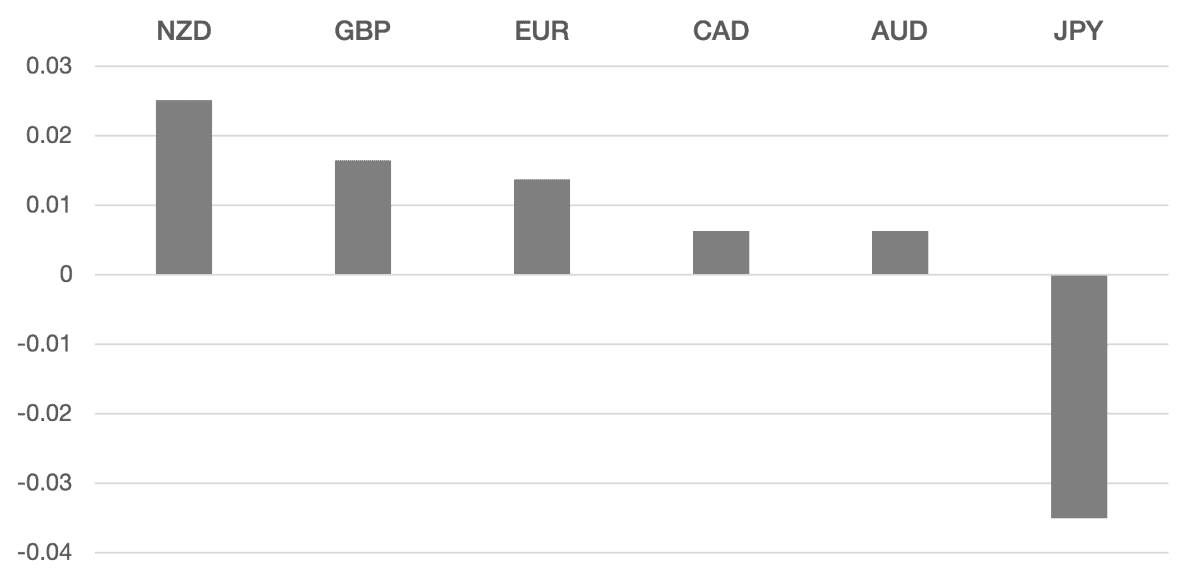

Euro looked to move lower during the week as data disappointed. The CPI came in 0.4% below expectation. However, by the end of the week the EURUSD rose 1.5% due to US Dollar weakness but lost vs other majors.

GBP failed to show much direction. GBPUSD touched 1.23 for the first time in some months and vs the EUR it is now firmly in the middle of a range.

Commodity currencies rose as the weak US Dollar helped. AUD rallied 1% and NZD was firm up around 2.5% while underperformance was in Oil related CAD which fell 0.7%. Oil reversed as it moved into the mid to low $70s but with the G7 price cap along with a potential China reopen oil prices could remain volatile.

The week ahead has the markets looking to digest Powell’s comments and NFP numbers. We are now moving into December and any end of year rally could begin to move markets.

Data we have more PMI and inflation data released as well as GDP from Eurozone Japan and Australia.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

End Of the Year Is Fast Approaching

first appeared on trademakers.

The post Cromwell FX Market View End Of the Year Is Fast Approaching first appeared on JP Fund Services.

The post Cromwell FX Market View End Of the Year Is Fast Approaching appeared first on JP Fund Services.