We extend our sincerest condolences to members of the Royal Family and we join the nation in mourning this immeasurable loss.

Last week saw central banks continue their hawkish rate rising. The ECB rose rates by 75bps followed by the RBA and BoC. The market is looking for the inflection point where rates peak and inflation turns lower.

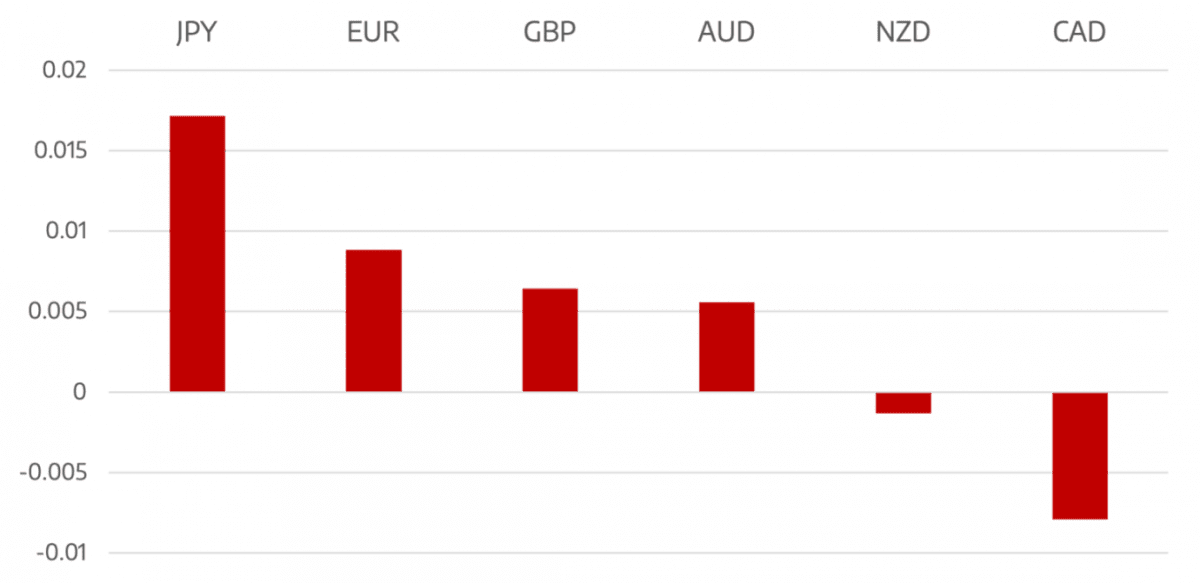

The USDollar has a negative week at last as the market looks at the current tightening cycle could be drawing to a close. Data from the US still remains strong especially the buoyant employment which could lead to a further round of tightening.

Euro reacted well to the hawkish ECB posting a positive week. Europe is still trying to get to grips with the energy situation and any further escalation of this could prove too much for the single currency.

GBP traded well after the new Prime Minister Liz Truss announced her stimulus plan but much like the Euro it is hard to see any continued upside to the GBP

Commodity currencies were helped by general risk sentiment especially the stock market but oil weakness prevented any firm rally.

Oil prices remain under pressure with WTI falling 1% to close around the $86 level.

The week ahead will be looking to see if the equity rally persists. Data wise we have inflation data from the US, UK and Europe along with employment data.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Her Majesty Queen Elizabeth II 1926 – 2022

appeared first on JP Fund Services.