Last week major markets were rangebound till later in the week. Stagflation fears rose as the usually cautious ECB pre committed to rate rises in July and September and US CPI hit a 40-year high which triggered a sell off across all risk assets, pushing yields higher and the US Dollar stronger.

The Euro struggled as the ECB once again remained dovish. They held rates which was expected while delivering new economic forecasts with sharply higher inflation and lower growth prospects. While they did pre commit to raising rates the 25bps guidance for a July rate rise disappointed the market.

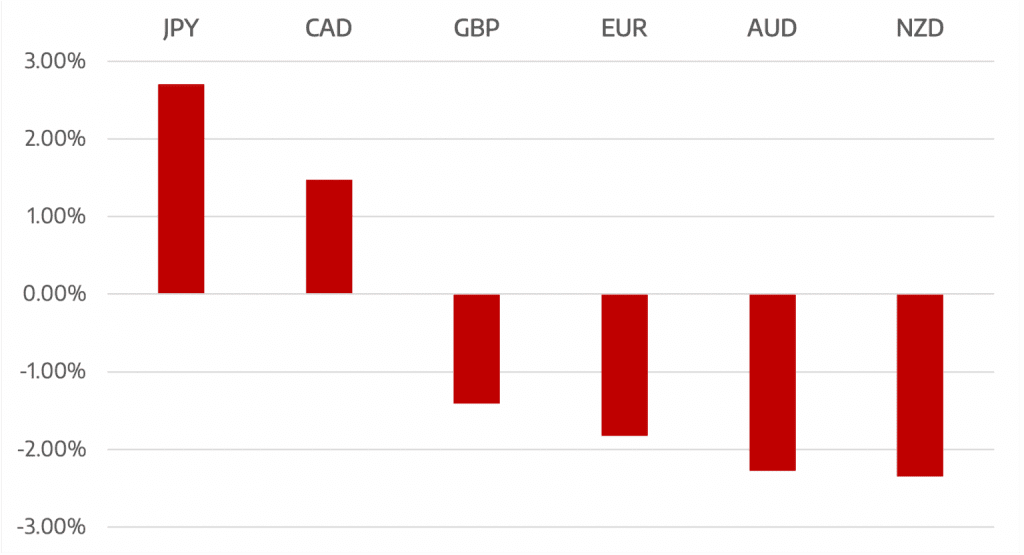

The main trigger for the week was on Friday. The US CPI print sent equities tumbling. This knocked majors and commodity currencies sending them lower. The CAD fell 1.5% while AUD and NZD lost 2.1%. Oil finished the week broadly unchanged with buying dips looking very strong.

Yen fell to the lowest level vs the US Dollar since 2001. The sell off was originally broad based but it did recover a little on Friday mostly due to risk aversion. The widening yields will continue to pressure the Yen with the wider question of will the BoJ intervene.

The week ahead sees the anticipated Fed and BofE interest rate decisions. The Fed is looking to continue with its plan of 50bps hike per meeting through September while the BofE is likely to deliver a 25bps raise. The week ahead should certainly see some volatility.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

Return of The Dollar

appeared first on JP Fund Services.

The post Cromwell FX Market View Return of The Dollar first appeared on trademakers.

The post Cromwell FX Market View Return of The Dollar first appeared on JP Fund Services.

The post Cromwell FX Market View Return of The Dollar appeared first on JP Fund Services.