Last week we saw the US Dollar fall once again as short covering fuelled a bounce in risk assets. The Fed is beginning to give a clearer indication as to where it think the Fed funds will be with the risk being that market expectations are disappointed.

The Pound which although gained ground vs the US dollar was still finding it hard to perform given the negativizing within the UK. The UK PMI was weaker than expected indicating the UK economy is already in a downturn. Euro saw continued strength as the CPI remains high. The ECB will eventually have to act and repeated comments from ECB officials affirmed the chance of a July rate hike.

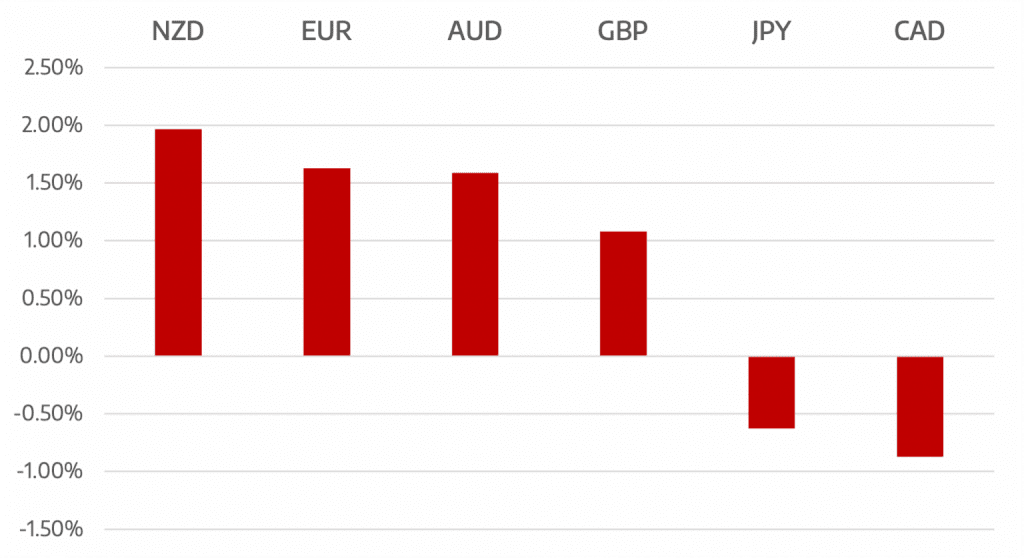

Commodity based currencies performed well as risk assets rallied. Kiwi was the best performer which gained an additional lift by hawkish RBNZ rate hike which indicated interest rates could peak higher than initially projected.

CAD was supported as Oil remained in buy the dip mode. Oil has moved higher over the last few weeks and last week was no exception rallying over 4% to $115.

The week ahead with economic data. GDP numbers from Germany and the US along with PMI readings. there is also much room for stocks to rebound which would give commodity currencies an advantage.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

Cromwell FX Market View

US Dollar To Continue Correction

appeared first on JP Fund Services.

The post Cromwell FX Market View US Dollar To Continue Correction first appeared on trademakers.

The post Cromwell FX Market View US Dollar To Continue Correction first appeared on JP Fund Services.

The post Cromwell FX Market View US Dollar To Continue Correction appeared first on JP Fund Services.